A) nontrade receivables

B) trade receivables

C) merchandise receivables

D) sales receivables

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable turnover measures the length of time in days it takes to collect a receivable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When companies sell their receivables to other companies,the transaction is called factoring.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record a note received from a customer to replace an account is

A) debit Notes Receivable; credit Accounts Receivable

B) debit Accounts Receivable; credit Notes Receivable

C) debit Cash; credit Notes Receivable

D) debit Notes Receivable; credit Notes Payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the current year,Accounts Receivable has a balance of $550,000; Allowance for Doubtful Accounts has a credit balance of $5,500; and sales for the year total $2,500,000.An analysis of receivables estimates uncollectible receivables as $25,000. Determine the amount of the adjusting entry for bad debt expense and the adjusted balance of Allowance for Doubtful Accounts,respectively.

A) $19,500 and $25,000

B) $30,500 and $525,000

C) $19,500 and $525,000

D) $30,500 and $25,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Other receivables include nontrade receivables such as loans to company officers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "receivables" includes all

A) money claims against other entities

B) merchandise to be collected from individuals or companies

C) cash to be paid to creditors

D) cash to be paid to debtors

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paper Company receives a $6,000,3-month,6% promissory note from Dame Company in settlement of an open accounts receivable.What entry will Paper Company make upon receiving the note?

A) Notes Receivable-Dame Company 6,000

Accounts Receivable-Dame Company 6,000

B) Notes Receivable-Dame Company 6,090

Accounts Receivable-Dame Company 6,090

C) Notes Receivable-Dame Company 6,090

Accounts Receivable-Dame Company 6,000

Interest Revenue 90

D) Notes Receivable-Dame Company 6,000

Interest Revenue 90

Accounts Receivable-Dame Company 6,000

Interest Receivable 90

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Trade receivables occur when two companies trade or exchange notes receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the direct write-off method of accounting for uncollectible receivables is used,what general ledger account is credited to write off a customer's account as uncollectible?

A) Bad Debt Expense

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) Interest Expense

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a note is received from a customer on account,it is recorded by debiting Notes Receivable and crediting Accounts Receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts has a credit balance of $500 at the end of the year (before adjustment) ,and bad debt expense is estimated at 3% of credit sales.If credit sales are $300,000,the amount of the adjusting entry to record the estimated uncollectible accounts receivable is

A) $8,500

B) $9,500

C) $9,000

D) Cannot be determined

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On August 1,Kim Company accepted a 90-day note receivable as payment for services provided to Hsu Company.The terms of the note were $20,000 face value and 6% interest.On October 30,the journal entry to record the collection of the note should include a

A) credit to Notes Receivable for $20,300

B) debit to Interest Receivable for $300

C) credit to Interest Revenue for $300

D) debit to Notes Receivable for $20,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have just received notice that a customer of yours with an Account Receivable balance of $100 has gone bankrupt and will not make any future payments.Assuming you use the allowance method,the entry you make is to

A) debit Bad Debt Expense and credit Allowance for Doubtful Accounts

B) debit Bad Debt Expense and credit Accounts Receivable

C) debit Allowance for Doubtful Accounts and credit Accounts Receivable

D) debit Allowance for Doubtful Accounts and credit Bad Debt Expense

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The difference between the balance in Accounts Receivable and the balance in the Allowance for Doubtful Accounts is called the net realizable value of the receivables.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The interest on a 6%,60-day note for $5,000 is $300.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A primary difference between the direct write-off and allowance method is whether or not bad debts is based on a percentage of sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To record estimated uncollectible receivables using the allowance method,the adjusting entry would be a

A) debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts

B) debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts

C) debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable

D) debit to Loss on Credit Sales and a credit to Accounts Receivable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

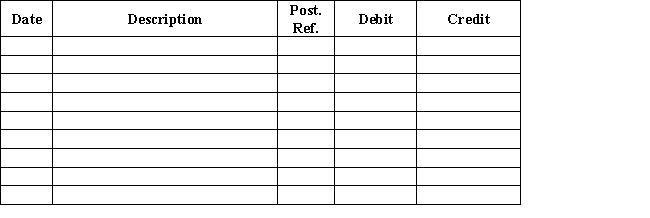

Essay

Journalize the following transactions for Lucite Company.

November 14 Received a $4,800.00,90-day,9% note from Alan Albertson in payment of his account.

December 31 Accrued interest on the Albertson note.

February 12 Received the amount due from Albertson on his note.

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable turnover ratio is computed by dividing total gross sales by the average net receivables during the year.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 163

Related Exams