B) False

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor cost is an example of a controllable cost for the supervisor of a manufacturing department.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For an accounting period during which the quantity of inventory at the end was smaller than the quantity at the beginning,income from operations reported under variable costing will be larger than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis,the unit price or unit cost factor is computed as the difference between actual quantity sold and the planned quantity sold,multiplied by the planned unit sales price or unit cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under absorption costing,the cost of finished goods includes only direct materials,direct labor,and variable factory overhead.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the ability to sell and the amount of production facilities devoted to each of two products is equal,it is profitable to increase the sales of that product with the lowest contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under variable costing,which of the following costs would be included in finished goods inventory?

A) salary of salesperson

B) salary of vice-president of finance

C) wages of carpenters in a furniture factory

D) straight-line depreciation on factory equipment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On the variable costing income statement,all of the fixed costs are deducted from the contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable cost of goods sold totaled $80,000 for the year (16,000 units at $5.00 each) and the planned variable cost of goods sold totaled $86,250 (15,000 units at $5.75 each) ,the effect of the quantity factor on the change in contribution margin is:

A) $5,000 decrease

B) $5,000 increase

C) $5,750 increase

D) $5,750 decrease

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

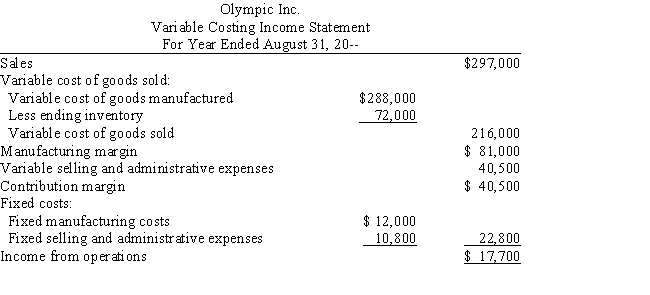

During the first year of operations,18,000 units were manufactured and 13,500 units were sold.On August 31,Olympic Inc.prepared the following income statement based on the variable costing concept:

Determine the unit cost of goods manufactured,based on (a)the variable costing concept and (b)the absorption costing concept.

Determine the unit cost of goods manufactured,based on (a)the variable costing concept and (b)the absorption costing concept.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes the difference between the planned and actual contribution margin?

A) an increase or decrease in the amount of sales

B) an increase in the amount of variable costs and expenses

C) a decrease in the amount of variable costs and expenses

D) all of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The contribution margin ratio is computed as contribution margin divided by sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In contribution margin analysis,the unit price or unit cost factor is computed as:

A) the difference between the actual unit price or unit cost and the planned unit price or cost,multiplied by the planned quantity sold

B) the difference between the actual unit price or unit cost and the planned unit price or cost,multiplied by the actual quantity sold

C) the difference between the actual quantity sold and the planned quantity sold,multiplied by the planned unit sales price or unit cost

D) the difference between the actual quantity sold and the planned quantity sold,multiplied by the actual unit sales price or unit cost

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

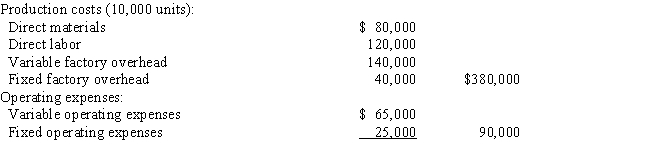

A business operated at 100% of capacity during its first month and incurred the following costs:

If 600 units remain unsold at the end of the month,what is the amount of inventory that would be reported on the absorption costing balance sheet?

If 600 units remain unsold at the end of the month,what is the amount of inventory that would be reported on the absorption costing balance sheet?

A) $24,300

B) $28,200

C) $22,800

D) $34,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales totaled $800,000 for the year (80,000 units at $10.00 each) and the planned sales totaled $799,500 (78,000 units at $10.25 each) ,the effect of the unit price factor on the change in sales is:

A) $19,500 decrease

B) $19,500 increase

C) $20,000 decrease

D) $20,000 increase

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The factory superintendent's salary would be included as part of the cost of products manufactured under the absorption costing concept.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Another name for variable costing is:

A) indirect costing

B) process costing

C) direct costing

D) differential costing

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Service firms can only have one activity base for analyzing changes in costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Variable costing is also known as direct costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For short-run production planning,information in the absorption costing format is more useful to management than is information in the variable costing format.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 151

Related Exams