A) an increase in inventory

B) a decrease in accounts payable

C) preferred dividends declared and paid

D) a decrease in accounts receivable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,the cash flows from financing activities section would include

A) receipts from the sale of investments

B) payments for the acquisition of investments

C) receipts from a note receivable

D) receipts from the issuance of capital stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows is not useful for

A) planning future investing and financing activities

B) determining a company's ability to pay its debts

C) determining a company's ability to pay dividends

D) calculating the net worth of a company

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Net income for the year was $29,500.Accounts receivable increased $2,500,and accounts payable increased $5,400.There were no other changes in noncash current assets and liabilities.Under the indirect method,the cash flow from operations is $32,400.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

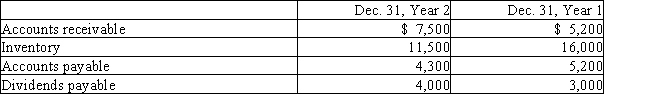

The net income reported on the income statement for the current year was $250,000.Depreciation recorded on fixed assets and amortization of patents for the year were $40,000,and $9,000,respectively.Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

A) $271,000

B) $279,000

C) $327,000

D) $256,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Dividends received on investment

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Fortune Corporation's comparative balance sheet for current assets and liabilities was as follows:

Adjust Year 2 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Adjust Year 2 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Correct Answer

verified

Correct Answer

verified

Essay

Indicate the section (operating activities,investing activities,financing activities,or none)in which each of the following would be reported on the statement of cash flows prepared by the indirect method:

Correct Answer

verified

Correct Answer

verified

Essay

Samuel Company's accumulated depreciation-equipment increased by $6,000,while patents decreased by $2,200 between balance sheet dates.There were no purchases or sales of depreciable or intangible assets during the year.In addition,the income statement showed a loss of $3,200 from the sale of investments.Assume no changes in noncash current assets and liabilities. Reconcile a net income of $92,000 to net cash flow from operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the four basic financial statements?

A) balance sheet

B) statement of cash flows

C) statement of changes in financial position

D) income statement

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash paid for equipment would be reported on the statement of cash flows in

A) the cash flows from operating activities section

B) the cash flows from financing activities section

C) the cash flows from investing activities section

D) a separate schedule

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,the cash flows from operating activities section would include

A) receipts from the issuance of capital stock

B) receipts from the sale of investments

C) payments for the acquisition of investments

D) cash receipts from sales activities

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be found in a schedule of noncash investing and financing activities,reported at the end of a statement of cash flows?

A) equipment acquired in exchange for a note payable

B) bonds payable exchanged for capital stock

C) purchase of treasury stock

D) capital stock issued to acquire fixed assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Cost of goods sold reported on the income statement was $155,000.The accounts payable balance increased $8,000,and the inventory balance increased by $21,000 over the year.Determine the amount of cash paid for merchandise.

Correct Answer

verified

Correct Answer

verified

True/False

The main disadvantage of the direct method of reporting cash flows from operating activities is that the necessary data are often costly to accumulate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash payments for merchandise were

A) $39,000

B) $33,000

C) $29,000

D) $23,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities,as part of the statement of cash flows,would include any receipts from the issuance of bonds payable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities,as part of the statement of cash flows,include payments for the acquisition of fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The acquisition of land in exchange for common stock is an example of noncash investing and financing activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the statement of cash flows,the correct order of reporting cash activities is financing,operating,and investing.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 175

Related Exams