A) $4.50 and $0.25

B) $3.25 and $0.25

C) $4.50 and $0.90

D) $2.00 and $0.25

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Sabas Company has 40,000 shares of $100 par,1% preferred stock and 100,000 shares of $50 par common stock issued and outstanding.The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

Essay

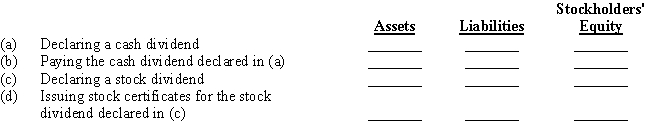

Indicate whether the following actions would (+)increase,(-)decrease,or (0)not affect a company's total assets,liabilities,and stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the most appropriate term (a-h) . -A class of stock that provides no preference rights to shareholders

A) authorized shares

B) issued shares

C) outstanding shares

D) par value

E) common stock

F) preferred stock

G) Paid-In Capital in Excess of Par

H) transfer agent

J) A) and H)

Correct Answer

verified

Correct Answer

verified

True/False

Cash dividends are normally paid on shares of treasury stock.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

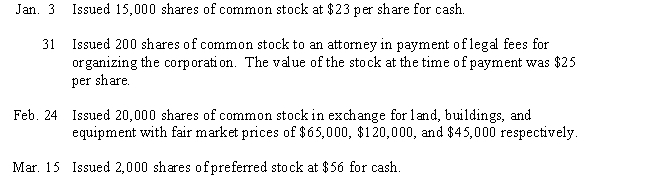

A corporation was organized on January 1 of the current year,with an authorization of 20,000 shares of 4%,$12 par preferred stock,and 100,000 shares of $3 par common stock.

The following selected transactions were completed during the first year of operations:

Journalize the transactions.

Journalize the transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Texas Inc.has 10,000 shares of 6%,$125 par value cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31.What is the annual dividend on the preferred stock?

A) $60 per share

B) $75,000 in total

C) $10,000 in total

D) $0.75 per share

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 50,000 shares of $25 par stock outstanding that has a current market value of $120.If the corporation issues a 5-for-1 stock split,the par value of the stock after the split will be

A) $5

B) $60

C) $25

D) $24

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock that was purchased for $3,000 is sold for $3,500.As a result of these two transactions combined

A) income will be increased by $500

B) stockholders' equity will be increased by $3,500

C) stockholders' equity will be increased by $500

D) stockholders' equity will not change

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders' equity

A) is usually equal to cash on hand

B) includes paid-in capital and liabilities

C) includes retained earnings and paid-in capital

D) is shown on the income statement

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a cash dividend decreases a corporation's stockholders' equity and decreases its assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock that had been purchased for $5,600 last month was reissued this month for $8,500.The journal entry to record the reissuance would include a credit to

A) Treasury Stock for $8,500

B) Paid-In Capital from Sale of Treasury Stock for $8,500

C) Paid-In Capital in Excess of Par-Common Stock for $2,900

D) Paid-In Capital from Sale of Treasury Stock for $2,900

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 12,000 shares of $20 par stock outstanding that has a current market value of $150.If the corporation issues a 4-for-1 stock split,the market value of the stock will fall to approximately $50.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 193 of 193

Related Exams