Correct Answer

verified

Correct Answer

verified

True/False

In order to be a recorded contingent liability,the liability must be possible and easily estimated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Zero Company obtained a $52,000,4-year,6.5% installment note from Regional Bank.The note requires annual payments consisting of principal and interest of $15,179,beginning on December 31 of the current year.The December 31,Year 1 carrying amount in the allocation of periodic payments table for this installment note will be equal to:

A) $27,635

B) $40,201

C) $36,821

D) $39,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

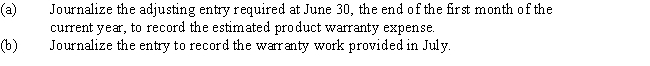

Essay

Lamar Industries warrants its products for one year.The estimated product warranty expense is 3% of sales.Sales for June were $190,000.In July,a customer received warranty repairs requiring $185 of parts and $50 of labor.

Correct Answer

verified

Correct Answer

verified

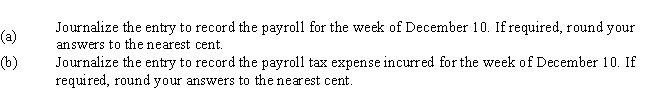

Essay

Townson Company had gross wages of $180,000 during the week ended December 10.All earnings are subject to social security tax,while the amount of wages subject to federal and state unemployment taxes was $24,000.Tax rates are as follows:

The total amount withheld from employee wages for federal income taxes was $32,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record fully funded pension rights for its salaried employees at the end of the year is

A) debit Salary Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record the conversion of a $6,300 accounts payable to a note payable would be

A) Cash 6,300

Notes Payable 6,300

B) Notes Receivable 6,300

Notes Payable 6,300

C) Notes Payable 6,300

Cash 6,300

D) Accounts Payable 6,300

Notes Payable 6,300

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The proceeds from discounting a $20,000,60-day,note payable at 6% is $20,200.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Gemstone Company obtained a $165,000,10-year,7% installment note from Guarantee Bank.The note requires annual payments of $23,492,with the first payment occurring on the last day of the fiscal year.The first payment consists of interest of $11,550 and principal repayment of $11,942.The journal entry to record the payment of the first annual amount due on the note would include a

A) debit to cash for $11,942

B) credit to interest payable for $11,550

C) debit to notes payable for $11,942

D) debit to interest expense for $23,492

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that all wages are subject to federal and state unemployment taxes,the employer's payroll tax expense would be

A) $1,370

B) $750

C) $620

D) $2,870

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martinez Co.borrowed $50,000 on March 1 of the current year by signing a 60-day,9%,interest-bearing note.Assuming a 360-day year,when the note is paid on April 30,the entry to record the payment should include a

A) debit to Interest Payable for $750

B) debit to Interest Expense for $750

C) credit to Cash for $50,000

D) credit to Cash for $54,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Co.issued a $50,000,120-day,discounted note to Guarantee Bank.The discount rate is 6%.Assuming a 360-day year,the cash proceeds to Chang Co.are

A) $49,750

B) $47,000

C) $49,000

D) $51,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes only include social security taxes and federal unemployment and state unemployment taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment taxes are paid by the employer and the employee.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is probable and amount is estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

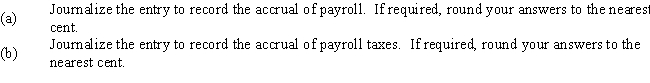

Essay

According to a summary of the payroll of Scotland Company,salaries for the period were $500,000.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%)and federal (0.8%)unemployment taxes.All earnings are subject to social security tax of 6.0% and Medicare tax of 1.5%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 8,Jones Inc.issued an $80,000,6%,120-day note payable to Miller Company.Assume that the fiscal year of Jones ends July 31.Using a 360-day year,what is the amount of interest expense recognized by Jones in the current fiscal year? When required,round your answer to the nearest dollar.

A) $700

B) $4,200

C) $307

D) $1,400

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following totals for the month of April were taken from the payroll register of Magnum Company:

The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $1,170

B) debit to FICA Taxes Payable for $1,500

C) credit to Payroll Tax Expense for $420

D) debit to Payroll Tax Expense for $1,620

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The amount borrowed is equal to the face amount of the note on an interest-bearing note payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is remote and amount is estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 188

Related Exams