A) that local currency may weaken to the dollar causing adverse effects on the investment's return.

B) that the dollar may weaken to the local currency causing adverse effects on the investment's return.

C) that local currency may be difficult to exchange into dollars causing problems in receiving a return on the investment.

D) that dollars may be difficult to exchange into local currency causing problems in receiving any return on investment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

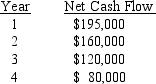

Heedy Inc.is considering a capital investment proposal that costs $460,000 and has an estimated life of four years and no residual value.The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 10%.The present value of $1 at compound interest rates of 10% for 1,2,3,and 4 years is .909,.826,.751,and .683,respectively.Determine the net present value.

The minimum desired rate of return for net present value analysis is 10%.The present value of $1 at compound interest rates of 10% for 1,2,3,and 4 years is .909,.826,.751,and .683,respectively.Determine the net present value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An analysis of a proposal by the net present value method indicated that the present value exceeded the amount to be invested.Which of the following statements best describes the results of this analysis?

A) The proposal is desirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

B) The proposal is desirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

C) The proposal is undesirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

D) The proposal is undesirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When evaluating a proposal by use of the net present value method,if there is an excess of the present value of future cash inflows over the amount to be invested,the rate of return on the proposal exceeds the rate used in the analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

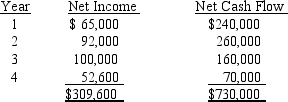

June Co.is evaluating a project requiring a capital expenditure of $619,200.The project has an estimated life of four years and no salvage value.The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is .893,.797,.712,and .636,respectively.

Determine: (a)the average rate of return on investment,giving effect to depreciation on the investment,and (b)the net present value.

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is .893,.797,.712,and .636,respectively.

Determine: (a)the average rate of return on investment,giving effect to depreciation on the investment,and (b)the net present value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mars Corp.is choosing between two different capital investment proposals.Machine A has a useful life of 4 years,and Machine B has a useful life of 6 years.Each proposal requires an initial investment of $200,000,and the company desires a rate of return of 10%.Although Machine B has a useful life of 6 years,it could be sold at the end of 4 years for $35,000.

Machine A will generate net cash flow of $70,000 in each of the four years.Machine B will generate $80,000 in year 1,$70,000 in year 2,$60,000 in year 3,and $40,000 per year for the remaining 3 years of its useful life.

Which of the following statements portrays the most accurate analysis between the two proposals?

Machine A will generate net cash flow of $70,000 in each of the four years.Machine B will generate $80,000 in year 1,$70,000 in year 2,$60,000 in year 3,and $40,000 per year for the remaining 3 years of its useful life.

Which of the following statements portrays the most accurate analysis between the two proposals?

A) Mars should invest in Machine A because the net present value of Machine A after 4 years is higher than the net present value of Machine B after 4 years.

B) Mars should invest in Machine B because the net present value of Machine A after 4 years is lower and the net present value of Machine B after 6 years.

C) Mars should invest in Machine B because the net present value of Machine A after 4 years is lower than the net present value of Machine B after 4 years.

D) Mars should invest in Machine A because the net present value of Machine A after 4 years is higher than the net present value of Machine B after 6 years.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A series of equal cash flows at fixed intervals is termed a(n)

A) present value index.

B) price-level index.

C) net cash flow.

D) annuity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When evaluating two competing proposals with unequal lives,management should give greater consideration to the investment with the longer life because the asset will be useful to the company for a longer period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following provisions of the Internal Revenue Code can be used to reduce the amount of the income tax expense arising from capital investment projects?

A) Interest deduction

B) Depreciation deduction

C) Minimum tax provision

D) Charitable contributions

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value index for this investment is

A) .88.

B) 1.45.

C) 1.14.

D) .70.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Internal rate of return is often called the payback rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of the average investment for a proposed investment of $70,000 in a fixed asset,with a useful life of four years,straight-line depreciation,no residual value,and an expected total net income of $21,600 for the 4 years,is

A) $10,800.

B) $21,600.

C) $35,000.

D) $30,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The process by which management allocates available investment funds among competing capital investment proposals is termed capital rationing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a proposed expenditure of $400,000 for a fixed asset with a 4-year life has an annual expected net cash flow and net income of $160,000 and $60,000,respectively,the cash payback period is 2.5 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value for this investment is

A) positive $39,750.

B) positive $118,145.

C) negative $118,145.

D) negative $39,750.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as (1)average rate of return and (2)cash payback methods.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In net present value analysis for a proposed capital investment,the expected future net cash flows are reduced to their present values.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The computations involved in the net present value method of analyzing capital investment proposals are more involved than those for the average rate of return method.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

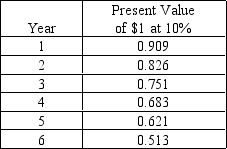

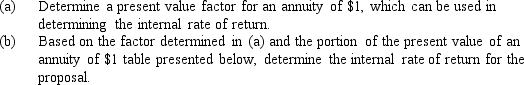

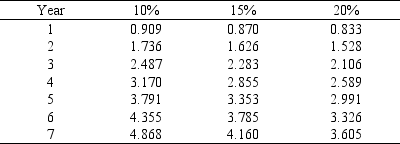

The internal rate of return method is used to analyze a $831,500 capital investment proposal with annual net cash flows of $250,000 for each of the six years of its useful life.

Correct Answer

verified

Correct Answer

verified

True/False

The process by which management plans,evaluates,and controls long- term investment decisions involving fixed assets is called cost-volume-profit analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 103

Related Exams