A) Both costs are constant when considered on a per-unit basis.

B) Both costs are constant when considered on a total basis.

C) Fixed costs are fixed in total,and variable costs are fixed per unit.

D) Variable costs are fixed in total,and fixed costs vary in total.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs are $810,000,the unit selling price is $60,and the unit variable costs are $48,what is the break-even sales (in units) if the variable costs are increased by $2?

A) 16,200 units

B) 57,875 units

C) 81,000 units

D) 67,500 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tucker Co.manufactures office furniture.During the most productive month of the year,3,600 desks were manufactured at a total cost of $192,000.In its slowest month,the company made 1,200 desks at a cost of $72,000.Using the high-low method of cost estimation,total fixed costs per month are

A) $120,000.

B) $12,000.

C) $72,000.

D) $11,600.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Clinton Co.has an operating leverage of 4.Sales are expected to increase by 8% next year.Operating income is

A) unaffected.

B) expected to increase by 2%.

C) expected to increase by 32%.

D) expected to increase by 4 times.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If sales total $2,000,000,fixed costs total $800,000,and variable costs are 60% of sales,the contribution margin ratio is 60%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Snower Corporation sells product G for $150 per unit,the variable cost per unit is $105,the fixed costs are $720,000,and Snower is in the 25% corporate tax bracket.What are the sales (in dollars) required to earn a net income (after tax) of $40,000?

A) $2,577,778

B) $2,533,350

C) $2,566,667

D) $2,400,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following conditions would cause the break-even point to decrease?

A) Total fixed costs increase

B) Unit selling price decreases

C) Unit variable cost decreases

D) Unit variable cost increases

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

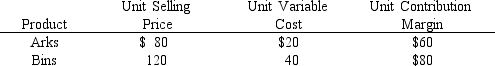

Kennedy Co.sells two products,Arks and Bins.Last year,Kennedy sold 32,000 units of Arks and 18,000 units of Bins.Related data are:

-What was Kennedy Co.'s overall enterprise product's unit contribution margin?

-What was Kennedy Co.'s overall enterprise product's unit contribution margin?

A) $67.20

B) $70.00

C) $30.00

D) $100.00

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs are $450,000,the unit selling price is $75,and the unit variable costs are $50,what are the old and new break-even sales (in units) if the unit selling price increases by $5?

A) 18,000 units and 8,182 units

B) 9,000 units and 8,182 units

C) 18,000 units and 15,000 units

D) 9,000 units and 15,000 units

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Monthly rent on a factory building that does NOT vary with the number of units produced is an example of a fixed cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If sales total $1,000,000,fixed costs total $400,000,and variable costs are 55% of sales,the contribution margin ratio is 45%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If fixed costs are $220,000 and the unit contribution margin is $25,the sales necessary to earn an operating income of $30,000 are 10,000 units.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the unit selling price is $40,the volume of sales is $3,000,000,sales at the break-even point amount to $2,500,000,and the maximum possible sales are $3,300,000,the margin of safety is 7,500 units.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Only a single line,which represents the difference between total sales revenues and total costs,is plotted on the profit-volume chart.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs are $810,000,the unit selling price is $60,and the unit variable costs are $48,what is the break-even sales (in units) if fixed costs are reduced by $50,000?

A) 15,834 units

B) 67,500 units

C) 62,500 units

D) 63,333 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

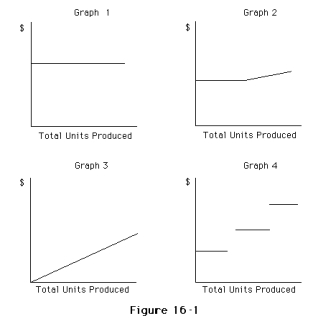

Which of the following graphs illustrates the behavior of a total variable cost?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Winston Co.manufactures office furniture.During the most productive month of the year,3,500 desks were manufactured at a total cost of $84,400.In its slowest month,the company made 1,100 desks at a cost of $46,000.Using the high-low method of cost estimation,total fixed costs are

A) $56,000.

B) $28,400.

C) $17,600.

D) $29,900.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If direct materials cost per unit decreases,the amount of sales necessary to earn a desired amount of profit will decrease.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The point in operations at which revenues and expired costs are exactly equal is called the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 139 of 139

Related Exams