B) False

Correct Answer

verified

Correct Answer

verified

True/False

The issuance of common stock affects both paid-in capital and retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market interest rate related to a bond is also called the

A) stated interest rate.

B) effective interest rate.

C) contract interest rate.

D) straight-line rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Bonds are sold at face value when the contract rate is equal to the market rate of interest.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

For accounting purposes,stated value is treated the same way as par value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 50,000 shares of $100 par value stock outstanding that has a current market value of $180.If the corporation issues a 4-for-1 stock split,the market value of the stock will fall to approximately

A) $30.

B) $36.

C) $45.

D) $50.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities that are due and payable beyond one year or paid out of noncurrent assets are termed long-term liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 10,000 shares of $100 par value stock outstanding.If the corporation issues a 5-for-1 stock split,the number of shares outstanding after the split will be 2,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A 10% stock dividend will increase the number of shares outstanding and the book value per share.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a cash dividend decreases a corporation's stockholders' equity and decreases its assets.

B) False

Correct Answer

verified

Correct Answer

verified

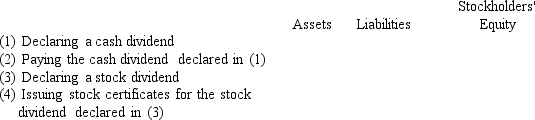

Essay

Indicate whether the following actions would (+)increase, (-)decrease,or (0)not affect

a company's total assets,liabilities,and stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is greater than the contractual rate of interest,bonds will sell

A) at a premium.

B) at face value.

C) at a discount.

D) only after the stated rate of interest is increased.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

True/False

The declaration of a cash dividend decreases a corporation's stockholders' equity and increases its liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bonds payable due in 2020 are reported on the balance sheet as long-term liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which section of the balance sheet would treasury stock be reported?

A) Fixed assets

B) Long-term liabilities

C) Stockholders' equity

D) Intangible assets

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For proper matching of revenues and expenses,the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment compensation tax becomes an employer's liability at the time the employee is paid.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The total earnings of an employee for a payroll period is referred to as gross pay.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond indenture is

A) a contract between the corporation issuing the bonds and the underwriters selling the bonds.

B) the amount due at the maturity date of the bonds.

C) a contract between the corporation issuing the bonds and the bondholders.

D) the amount for which the corporation can buy back the bonds prior to the maturity date.

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

A bond is simply a form of an interest-bearing note.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 132

Related Exams