A) Retained Earnings

B) Paid-in Capital in Excess of Par Value

C) Treasury Stock

D) Appropriated Retained Earnings

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Lack of ease in transferability of ownership is one of the disadvantages of the corporate form of business organization.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

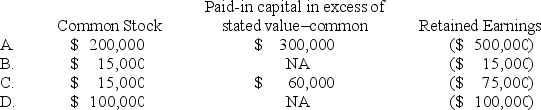

Rocco Corporation decides to issue a 7.5% stock dividend on 20,000 outstanding shares of $10 stated value common stock.The distribution is made at the time the market value of the stock is $50 a share.How will the entry to record this transaction affect the company's stockholders' equity accounts?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Montana Company was authorized to issue 200,000 shares of common stock.The company had issued 50,000 shares of stock when it purchased 10,000 shares of treasury stock.After the purchase of treasury stock,the number of outstanding shares of common stock was which of the following?

A) 190,000

B) 60,000

C) 40,000

D) 50,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is the most common explanation as to why a company might have a negative amount of total stockholders' equity on its balance sheet?

A) Its total assets exceed its total liabilities.

B) Its total revenues are less than its total expenses in the current period.

C) Its cash is segregated in a separate bank account designated for emergency uses.

D) It has a negative balance in its Retained Earnings account.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 10,Year 1,Burton Builders,Inc. ,a publicly traded company,announced that it had been awarded a contract to build a football stadium at a contract price of $500 million.This contract would increase its projected revenues by 20% over the next three years.Which of the following statements is correct with regard to this announcement?

A) The market price of Burton's stock will probably be higher on June 11,Year 1 than on June 10th.

B) Burton's net cash flow from operations will increase by 20% over the next three years.

C) Burton's assets should be increased by $500 million on June 10,Year 1 to recognize this contract.

D) Burton's net income will increase by 20% over the next three years.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Franklin Corporation reported net income of $75,000 in Year 1.The company had 100,000 shares of $12 par value common stock outstanding and a market price of $18 per share.What is Franklin's price-earnings ratio?

A) 2.4

B) 24

C) 16.6

D) 1.5

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The number of shares of stock outstanding generally is greater than the number of shares of stock issued.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An advantage of the corporate form of business organization is that corporations are free from double taxation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

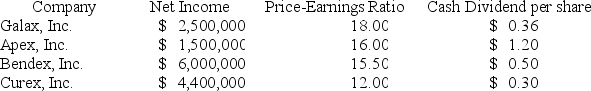

Ben Weaver is planning to invest in one of the following companies based on their average performance over the past five years,summarized below.

If Ben is looking for a company that is likely to achieve rapid growth in revenues and profitability,which one should he choose?

If Ben is looking for a company that is likely to achieve rapid growth in revenues and profitability,which one should he choose?

A) Galax,Inc.

B) Apex,Inc.

C) Bendex,Inc.

D) Curex,Inc.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ogilvie Corp.issued 12,000 shares of no-par stock for $40 per share.Ogilvie was authorized to issue 35,000 shares.What effect will this event have on the elements of the company's financial statements?

A) Increase assets and increase stockholders' equity by $1,400,000.

B) Increase assets and increase stockholders' equity by $480,000.

C) Increase cash inflows from investing activities by $480,000.

D) None of these answer choices are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fixit Corporation issued 20,000 shares of $20 par value common stock at its current market price of $32.How does this event affect total stockholders' equity?

A) It increases by $640,000.

B) It is unaffected.

C) It increases by $240,000.

D) It increases by $400,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All corporations are subject to extensive government regulation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes,in part,how the declaration of a stock dividend affects the elements of the financial statements?

A) Decreases total assets

B) Increases total stockholders' equity

C) Decreases paid-in capital in excess of par value-common

D) No effect on total stockholders' equity

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Curtain Co.paid dividends of $6,000,$12,000,and $20,000 during Year 1,Year 2,and Year 3,respectively.The company had 1,000 shares of 5%,$200 par value preferred stock outstanding that paid a cumulative dividend.What is the total amount of dividends paid to common shareholders during Year 3?

A) $4,000

B) $6,000

C) $8,000

D) $10,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the payment of a previously declared cash dividend affect the elements of the financial statements?

A) Decreases assets and stockholders' equity

B) Increases liabilities and decreases stockholders' equity

C) Decreases liabilities and increases stockholders' equity

D) None of these answer choices are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Napoli Industries had net income for Year 2 of $650,000.Napoli had an average number of shares outstanding at the end of the year of 500,000 shares.On January 1,Year 2,the market price of Napoli's stock was $20 per share.On December 31,Year 2,the market price was $22 per share.What is the price-earnings ratio for Napoli at the end of Year 2?

A) 16.9

B) 16.2

C) 15.4

D) None of these answer choices is correct

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is meant by the term "double taxation?"

A) Corporations must pay income taxes on their net income,and their stockholders must pay income taxes on their dividends.

B) In a partnership,both partners are required to claim their share of net income on their tax returns.

C) A sole proprietorship must pay income taxes on its net income and the owner is also required to pay income taxes on withdrawals.

D) A sole proprietorship must pay income taxes to both the state government and the federal government.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

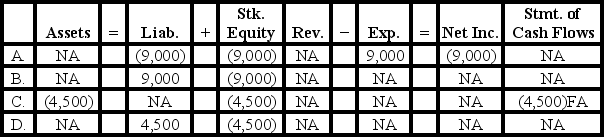

On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.

-How will the entry to record the declaration of the dividend on March 1 affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation records a stock dividend,it debits Retained Earnings for the par value of the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 92

Related Exams