A) Freight

B) Delivery Expense

C) Merchandise Inventory

D) Sales discount

E) Purchases Returns and Allowances

F) Debit memo

G) Purchase discount

H) Trade discount

J) D) and F)

Correct Answer

verified

Correct Answer

verified

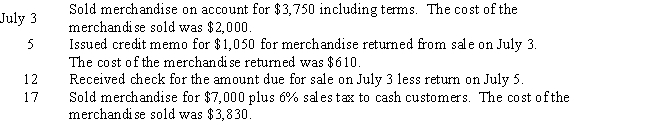

Essay

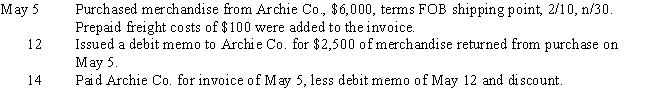

Journalize the following transactions assuming the perpetual inventory system:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the major difference between a periodic and a perpetual inventory system?

A) Under the periodic inventory system, the purchase of inventory will be debited to the purchases account.

B) Under the periodic inventory system, no journal entry is recorded at the time of the sale of inventory for the cost of the inventory.

C) Under the periodic inventory system, all adjustments such as purchases returns and allowances and discounts are reconciled at the end of the month.

D) All of these choices are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A sale of $750 on account subject to a sales tax of 6% would be recorded as an account receivable of $750.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a perpetual inventory system,merchandise returned to vendors reduces the merchandise inventory account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On March 25,Osgood Company sold merchandise on account,$10,000,terms n/30.The applicable sales tax percentage is 7.5%.Record the transaction.

Correct Answer

verified

Correct Answer

verified

Essay

Madison Company's perpetual inventory records indicate that $875,300 of merchandise should be on hand on October 31.The physical inventory indicates that $781,900 is actually on hand.Journalize the adjusting entry for the inventory shrinkage for Madison Company for the year ended October 31.

Correct Answer

verified

Correct Answer

verified

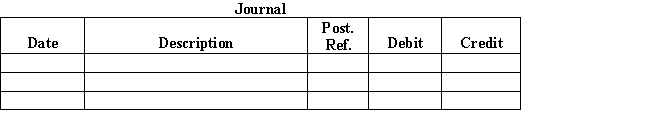

Essay

Gadget Palace is a retailer selling unique hardware.Gadget Palace uses a perpetual inventory system.Journalize the following transactions:

Correct Answer

verified

Correct Answer

verified

True/False

The cost of merchandise inventory is limited to the purchase price less any purchase discounts.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

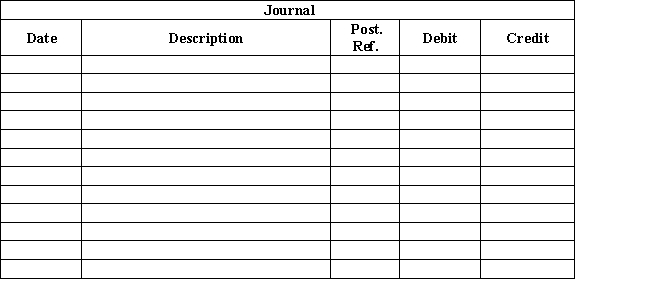

Journalize the following transactions assuming a perpetual inventory system:

Correct Answer

verified

Correct Answer

verified

True/False

The single-step income statement is easier to prepare,but a criticism of this format is that gross profit and income from operations are not readily available.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the perpetual inventory system,all purchases of merchandise are debited to the account

A) Merchandise Inventory

B) Cost of Merchandise Sold

C) Cost of Merchandise Available for Sale

D) Purchases

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following transactions for Evans Company.Assume the company uses a perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matching Match each of the following items (a-h) with the appropriate definition below. -The cost associated with delivery of merchandise to the customer.

A) Freight

B) Delivery Expense

C) Merchandise Inventory

D) Sales discount

E) Purchases Returns and Allowances

F) Debit memo

G) Purchase discount

H) Trade discount

J) A) and G)

Correct Answer

verified

Correct Answer

verified

True/False

There is no difference between the recording of cash sales and the recording of MasterCard or VISA sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A sales invoice included the following information: merchandise price,$12,000; terms 1/10,n/eom,FOB shipping point with prepaid freight of $900 added to the invoice.Assuming that a credit for merchandise returned of $500 is granted prior to payment and the invoice is paid within the discount period,what is the amount of cash that should be received by the seller?

A) $12,285

B) $11,500

C) $10,480

D) $11,385

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Cost of merchandise sold is the amount that the merchandising company pays for the merchandise it intends to sell.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using a perpetual inventory system,the entry to record the return from a customer of merchandise sold on account includes a

A) credit to Customer Refunds Payable

B) debit to Merchandise Inventory

C) credit to Merchandise Inventory

D) debit to Cash

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

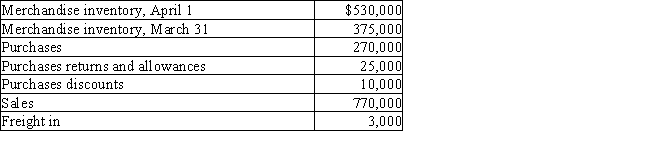

The following data were extracted from the accounting records of Dana Designs for the year ended March 31.  Prepare the cost of merchandise sold section of the income statement for the year ended March 31,using the periodic method.

Prepare the cost of merchandise sold section of the income statement for the year ended March 31,using the periodic method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the return of merchandise from a customer would include a

A) debit to Sales

B) credit to Sales

C) debit to Customer Refunds Payable

D) debit to Estimated Returns Inventory

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 232

Related Exams