A) net cost of goods sold

B) net income

C) gross profit

D) sales

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

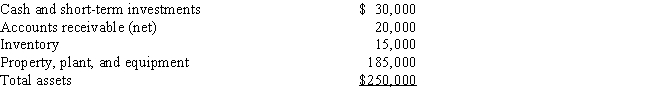

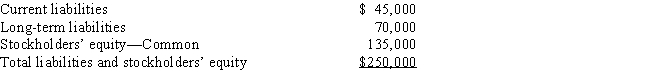

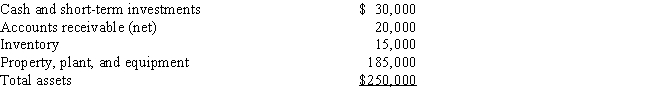

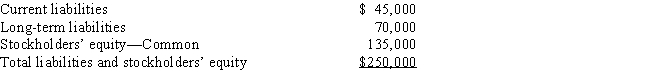

The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Use this information to answer the questions that follow.

Assets

Liabilities and Stockholders' Equity

Liabilities and Stockholders' Equity

Income Statement

Income Statement

-Using the data provided for Diane Company,what is the asset turnover?

-Using the data provided for Diane Company,what is the asset turnover?

A) 1.00

B) 2.94

C) 0.18

D) 0.34

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has a quick ratio of 1,the subsequent payment of an account payable will cause the ratio to increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A loss due to a discontinued operation should be reported on the income statement

A) above income from continuing operations

B) without related tax effect

C) below income from continuing operations

D) as an operating expense

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the accounts receivable turnover may be due to a change in how credit is granted and/or in collection practices.

B) False

Correct Answer

verified

True

Correct Answer

verified

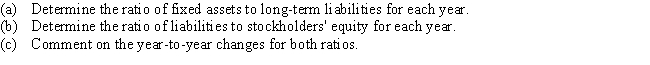

Essay

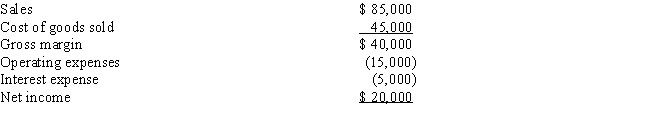

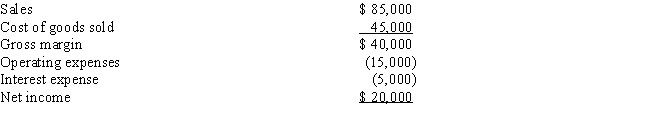

The following information has been condensed from the December 31 balance sheets of Gabriel Co.:

Round your answers to two decimal places.

Round your answers to two decimal places.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The independent auditor's report

A) describes which financial statements are covered by the audit

B) gives the auditor's opinion regarding the fairness of the financial statements

C) summarizes what the auditor did

D) states that the financial statements were presented on time

F) B) and D)

Correct Answer

verified

Correct Answer

verified

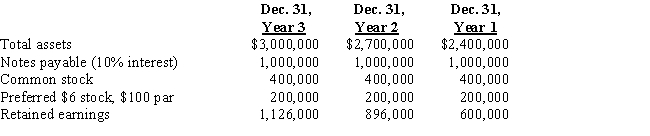

Essay

The following selected data were taken from the financial statements of the Winter Group for the three most recent years of operations:  The Year 3 net income was $242,000,and the Year 2 net income was $308,000.No dividends on common stock were declared during the three years.

The Year 3 net income was $242,000,and the Year 2 net income was $308,000.No dividends on common stock were declared during the three years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available for Jase Company:  Which of the following statements is correct?

Which of the following statements is correct?

A) The price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year.

B) The price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year.

C) The price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

D) The market price per share and the earnings per share are not statistically related to each other.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Gallant Company reported net income of $2,500,000.The income statement included a $200,000 loss on discontinued operations,after applicable income tax.There were 100,000 shares of $10 par common stock and 40,000 shares of 4% preferred stock of $100 par outstanding throughout the current year.Prepare the earnings per share section of Gallant Company's income statement.

Correct Answer

verified

Correct Answer

verified

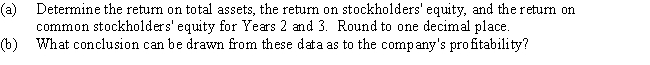

Multiple Choice

What type of analysis is indicated by the following?

A) vertical analysis

B) horizontal analysis

C) liquidity analysis

D) common-size analysis

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Factors that reflect the ability of a business to pay its debts and earn a reasonable amount of income are referred to as solvency,profitability,and liquidity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The auditor's report is where the auditor certifies that the financial statements are correct and accurate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The ratio of the sum of cash,receivables,and marketable securities to current liabilities is referred to as the current ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Use this information to answer the questions that follow.

Assets

Liabilities and Stockholders' Equity

Liabilities and Stockholders' Equity

Income Statement

Income Statement

-Using the data provided for Diane Company,what is the return on common stockholders' equity?

-Using the data provided for Diane Company,what is the return on common stockholders' equity?

A) 6.75%

B) 14.8%

C) 7.4%

D) 13.5%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a vertical analysis,the base for cost of goods sold is

A) total selling expenses

B) sales

C) total expenses

D) gross profit

F) B) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) . Items may be used more than once. -Return on total assets

A) Assess the profitability of the assets

B) Assess how effectively assets are used

C) Indicate the ability to pay current liabilities

D) Indicate how much of the company is financed by debt and equity

E) Indicate instant debt-paying ability

F) Assess the profitability of the investment by common stockholders

G) Indicate future earnings prospects

H) Indicate the extent to which earnings are being distributed to common stockholders

J) A) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an unusual item?

A) a segment of the business being sold

B) corporate income tax being paid

C) a change from one accounting method to another acceptable accounting method

D) closure of all outlet stores

F) B) and D)

Correct Answer

verified

B

Correct Answer

verified

Essay

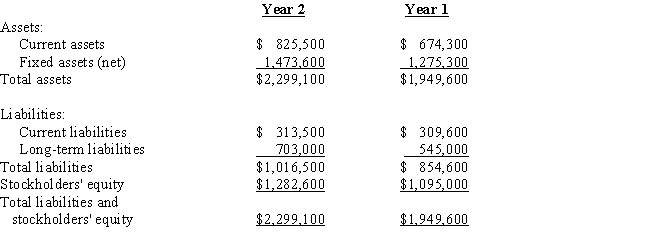

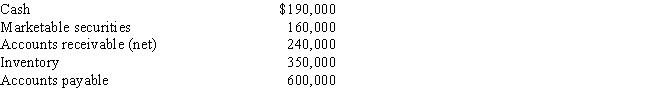

The following items are reported on Denver Company's balance sheet:  Determine the

(a)current ratio and

(b)quick ratio.Round your answers to one decimal place.

Determine the

(a)current ratio and

(b)quick ratio.Round your answers to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percent of fixed assets to total assets is an example of

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 200

Related Exams