B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any unamortized premium should be reported on the balance sheet of the issuing corporation as

A) a direct deduction from the face amount of the bonds in the Liabilities section

B) paid-in capital

C) a direct deduction from retained earnings

D) an addition to the face amount of the bonds in the Liabilities section

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

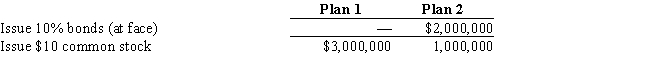

Jenson Co.is considering the following alternative plans for financing the company:  Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans,assuming income before bond interest and income tax is $1,000,000.

Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans,assuming income before bond interest and income tax is $1,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $1,000,000 of 10%,20-year bonds,interest payable annually,at a time when the market rate of interest is 12%.The straight-line method is adopted for the amortization of bond discount or premium.Which of the following statements is true?

A) The amount of annual interest expense is computed at 10% of the bond carrying amount at the beginning of the year.

B) The amount of annual interest expense gradually decreases over the life of the bonds.

C) The amount of unamortized discount decreases from its balance at issuance date to a zero balance at maturity.

D) The bonds will be issued at a premium.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Discount on Bonds Payable is a contra liability account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

A $500,000 bond issue on which there is an unamortized discount of $20,000 is redeemed for $475,000.Journalize the redemption of the bonds.

Correct Answer

verified

Correct Answer

verified

True/False

The carrying amount of the bonds is defined as the face value of the bonds plus any unamortized discount or less any unamortized premium.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Discount on Bonds Payable has a balance of $10,000.If the issuing corporation redeems the bonds at 97.5,what is the amount of gain or loss on redemption?

A) $10,000 loss

B) $25,000 loss

C) $25,000 gain

D) $15,000 gain

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation often issues callable bonds to protect itself against significant declines in future interest rates.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The balance in Premium on Bonds Payable should be reported as a deduction from Bonds Payable on the balance sheet.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

The effective interest rate method of amortizing a bond discount or premium is the preferred method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the effective interest rate method of amortization is used,the amount of interest expense for a given period is calculated by multiplying the face rate of interest by the bond's carrying value at the beginning of the given period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -A measure of income earned by each share of common stock

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) C) and F)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Dylan Corporation issues for cash $2,000,000 of 8%,15-year bonds,interest payable annually,at a time when the market rate of interest is 9%.The straight-line method is adopted for the amortization of bond discount or premium.Which of the following statements is true?

A) The amount of annual interest paid to bondholders remains the same over the life of the bonds.

B) The amount of annual interest expense decreases as the bonds approach maturity.

C) The amount of annual interest paid to bondholders increases over the 15-year life of the bonds.

D) The carrying amount decreases from its amount at issuance date to $2,000,000 at maturity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Designer Company issued 10-year bonds on January 1.The 6% bonds have a face value of $800,000 and pay interest every January 1 and July 1.The bonds were sold for $690,960 based on the market interest rate of 8%.Designer uses the effective interest method to amortize bond discounts and premiums.On July 1 of the first year,Designer should record an interest expense (round to the nearest dollar) of

A) $27,638

B) $24,000

C) $48,000

D) $55,277

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Selling the bonds at a premium has the effect of

A) raising the effective interest rate above the stated interest rate

B) attracting investors that are willing to pay a lower rate of interest than on similar bonds

C) causing the interest expense to be higher than the bond interest paid

D) causing the interest expense to be lower than the bond interest paid

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Premium on Bonds Payable

A) should be reported on the balance sheet as a deduction from the related bonds payable

B) should be allocated to the remaining periods for the life of the bonds by the straight-line method, if the results obtained by that method materially differ from the results that would be obtained by the effective interest rate method

C) would be added to the related bonds payable on the balance sheet

D) should be reported in the Paid-in capital section of the balance sheet

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Callable bonds can be redeemed by the issuing corporation at the fair market price of the bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year,a company issues a $500,000,8%,10-year bond that pays semiannual interest of $20,000 ($500,000 × 8% × 1/2),receiving cash of $437,740.Journalize the entry to record the issuance of the bonds.

Correct Answer

verified

11ea8d32_28a7_8623_b445_b7009e56e650_TB6239_00

Correct Answer

verified

Essay

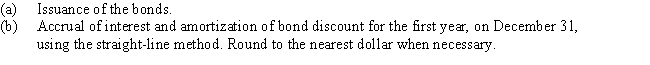

On August 1,Clayton Co.issued $1,300,000 of 20-year,9% bonds,dated August 1,for $1,225,000.Interest is payable semiannually on February 1 and August 1.Present the entries to record the following transactions for the current year:

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 177

Related Exams