A) debit to Interest Expense for $11,550

B) credit to Interest Payable for $11,550

C) credit to Notes Payable for $165,000

D) debit to Notes Payable for $165,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Bonds payable should be reported on the balance sheet at face value plus or minus any unamortized premium or discount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal document that indicates the name of the issuer,the face value of the bond and such other data is called

A) trading on the equity

B) a convertible bond

C) a bond debenture

D) a bond indenture

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is greater than the contractual rate of interest,bonds will sell

A) at a premium

B) at face value

C) at a discount

D) only after the stated rate of interest is increased

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds that are subject to retirement prior to maturity at the option of the issuer are called

A) debentures

B) callable bonds

C) early retirement bonds

D) options

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The legal contract between issuer and bondholder

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

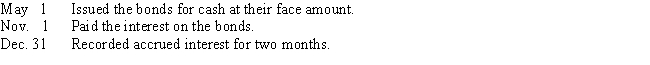

Brubeck Co.issued $10,000,000 of 30-year,8% bonds on May 1 of the current year,with interest payable on May 1 and November 1.The fiscal year of the company is the calendar year.Journalize the entries to record the following selected transactions for the current year:

Correct Answer

verified

Correct Answer

verified

True/False

The market rate of interest is affected by a variety of factors,including investors' assessment of current economic conditions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $2,000,000 of 10% bonds are issued at 97,the amount of cash received from the sale is

A) $2,060,000

B) $2,000,000

C) $2,100,000

D) $1,940,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the straight-line method of amortization of bond premium or discount is used,which of the following statements is true?

A) Annual interest expense will increase over the life of the bonds with the amortization of bond premium.

B) Annual interest expense will remain the same over the life of the bonds with the amortization of bond discount.

C) Annual interest expense will decrease over the life of the bonds with the amortization of bond discount.

D) Annual interest expense will increase over the life of the bonds with the amortization of bond discount.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of $5,000 to be received in four years at a market rate of interest of 6% compounded annually is $3,636.30.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

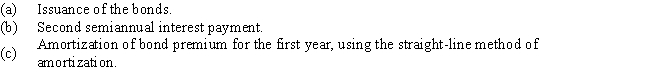

On the first day of the fiscal year,Lisbon Co.issued $1,000,000 of 10-year,7% bonds for $1,050,000,with interest payable semiannually.Orange Inc.purchased the bonds on the issue date for the issue price.Prepare entries to record the following transactions for the current fiscal year:

Correct Answer

verified

Correct Answer

verified

True/False

Both callable and noncallable bonds can be purchased by the issuing corporation in the open market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Premium on Bonds Payable has a balance of $7,000.If the issuing corporation redeems the bonds at 101,what is the amount of gain or loss on redemption?

A) $3,000 loss

B) $3,000 gain

C) $7,000 loss

D) $7,000 gain

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

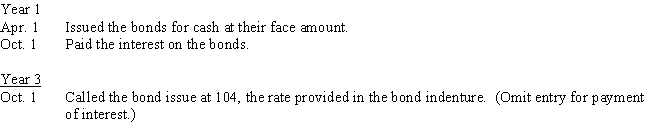

A company issued $1,000,000 of 30-year,8% callable bonds on April 1,with interest payable on April 1 and October 1.The fiscal year of the company is the calendar year.Journalize the entries to record the following selected transactions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-If the market rate of interest is 10%,a $10,000,12%,10-year bond that pays interest semiannually would sell at an amount

A) less than face value

B) equal to the face value

C) greater than face value

D) The answer cannot be determined from the information given.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -If the contract rate exceeds the effective rate

A) Contract rate

B) Effective rate

C) Bond discount

D) Bond premium

E) Bond

F) Bond indenture

G) Principal

I) B) and F)

Correct Answer

verified

Correct Answer

verified

True/False

Only callable bonds can be purchased by the issuing corporation before maturity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $900,000,and Premium on Bonds Payable has a balance of $10,000.If the issuing corporation redeems the bonds at 103,what is the amount of gain or loss on redemption?

A) $1,200 loss

B) $1,200 gain

C) $17,000 loss

D) $17,000 gain

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The entire principal of the bond is paid back on maturity date

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 177

Related Exams