A) Interest Expense for $2,500

B) Premium on Bonds Payable for $2,500

C) Interest Expense for $5,000

D) Premium on Bonds Payable for $5,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The times interest earned ratio is calculated by dividing Bonds Payable by Interest Expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If bonds of $1,000,000 with unamortized discount of $10,000 are redeemed at 98,the gain on redemption of bonds is $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate and the market rate are the same is to

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

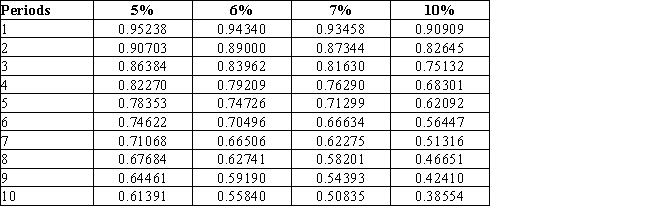

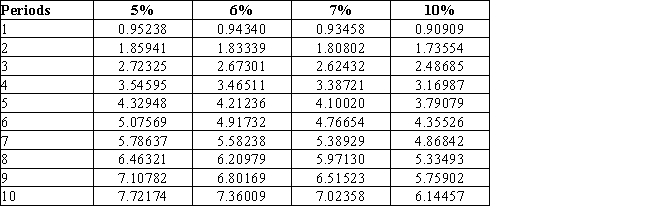

Use the following tables to calculate the present value of a $25,000,7%,five-year bond that pays $1,750

($25,000 × 7%)interest annually,if the market rate of interest is 7%Present Value of $1 at Compound Interest  Present Value of Annuity of $1 at Compound Interest

Present Value of Annuity of $1 at Compound Interest

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1 of the current year,Barton Corporation issued 10% bonds with a face value of $200,000.The bonds are sold for $191,000.The bonds pay interest semiannually on June 30 and December 31,and the maturity date is December 31,five years from now.Barton records straight-line amortization of the bond discount.The bond interest expense for the year ended December 31 is

A) $10,900

B) $18,200

C) $21,800

D) $29,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total premium related to the bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a portion of a bond issue is redeemed,a related proportion of the unamortized premium or discount must be written off.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Interest payments on 12% bonds with a face value of $20,000 and interest paid semiannually would be $2,400 every six months.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Elias Corporation issued 10% bonds with a face value of $50,000.The bonds are sold for $46,000.The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31,10 years from now.Elias records straight-line amortization of the bond discount.The bond interest expense for the year ended December 31 of the first year is

A) $5,000

B) $5,200

C) $5,800

D) $5,400

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds payable are not callable,the issuing corporation

A) can exchange them for common stock

B) can repurchase them in the open market

C) must get special permission from the SEC to repurchase them

D) is more likely to repurchase them if the interest rates increase

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The balance in a bond discount account should be reported on the balance sheet as a deduction from the related bonds payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds are issued at a discount,it means that the

A) bondholder will receive effectively less interest than the contractual rate of interest

B) market interest rate is lower than the contractual interest rate

C) market interest rate is higher than the contractual interest rate

D) financial strength of the issuer is suspect

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Franklin Corporation issues $50,000,10%,five-year bonds on January 1 for $52,100.Interest is paid semiannually on January 1 and July 1.If Franklin uses the straight-line method of amortization of bond premium,the amount of bond interest expense to be recognized on July 1 is

A) $10,290

B) $2,710

C) $2,500

D) $2,290

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -If the contract rate is less than the effective rate

A) Contract rate

B) Effective rate

C) Bond discount

D) Bond premium

E) Bond

F) Bond indenture

G) Principal

I) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses on the redemption of bonds are reported as Other income or Other expense on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year,a company issues an $800,000,6%,five-year bond that pays semiannual interest of $24,000 ($800,000 × 6% × 1/2),receiving cash of $690,960.Journalize the entry to record the first interest payment and the amortization of the related bond discount using the straight-line method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the corporation issuing the bonds has the right to redeem the bonds prior to maturity,the bonds are

A) convertible bonds

B) unsecured bonds

C) debenture bonds

D) callable bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The value of a bond stated on the bond certificate

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) All of the above

Correct Answer

verified

Correct Answer

verified

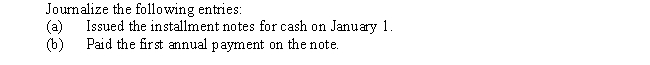

Essay

On January 1,Yeargan Company obtained a $125,000,seven-year 5% installment note from Farmers Bank.The note requires annual payments of $21,602,with the first payment occurring on the last day of the fiscal year.The first payment consists of $6,250 interest and principal repayment of $15,352.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 177

Related Exams