B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the appropriate term (a-h) . -Document that formally creates a corporation

A) Articles of incorporation

B) Limited liability

C) Bylaws

D) Corporation

E) Public corporation

F) Board of directors

G) Private corporation

H) Dividends

J) C) and H)

Correct Answer

verified

Correct Answer

verified

Essay

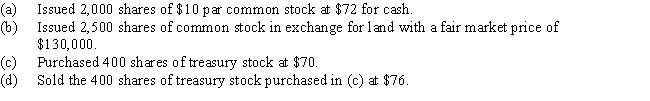

Prepare entries to record the following transactions for Maine Corp.:

Correct Answer

verified

Correct Answer

verified

Essay

Wonder Sales is authorized to issue 100,000 shares of 2%,$100 par preferred stock and 1,000,000 shares of $10 par common stock.Journalize the following transactions: (a)On January 2,Wonder Sales issues 5,000 shares of preferred stock for $110 per share and 65,000 shares of common stock at $10 per share. (b)On January 25,Wonder Sales issues 250 shares of preferred stock to Morton Law Firm for settlement of a $36,000 invoice for incorporation services. (c)On January 31,Wonder Sales issues 500 shares of common stock to Setup Inc.for fixtures that have a fair market value of $8,500.

Correct Answer

verified

Correct Answer

verified

True/False

A large public corporation normally uses registrars and transfer agents to maintain the records of stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The liability for a dividend is recorded on which of the following dates?

A) date of record

B) date of payment

C) last day of the fiscal year

D) date of declaration

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a cash dividend decreases a corporation's stockholders equity and decreases its assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the current year ended, ABC had the following transactions: Issued 10,000 shares of $2 par common stock for $12 per share.Issued 3,000 shares of $50 par, 6% preferred stock for $70 per share.Purchased 1,000 shares of previously issued common stock for $15 per share.Reported net income of $200,000. Declared and paid a total dividend of $40,000. Assume that retained earnings had a beginning balance of $75,000. Match the following amounts to the appropriate term (a-h) . -$330,000

A) Treasury stock

B) Retained earnings

C) Preferred stock

D) Excess of issue price over par (preferred)

E) Common stock

F) Total paid-in capital

G) Excess of issue price over par (common)

H) Total stockholders' equity

J) B) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with 100,000 authorized shares of $4 par common stock issued 50,000 shares at $9.Subsequently,the company declared a 2% stock dividend on a date when the market price was $10 per share.The effect of the declaration and issuance of the stock dividend is to

A) decrease retained earnings, increase common stock, and increase paid-in capital

B) increase retained earnings, decrease common stock, and decrease paid-in capital

C) increase retained earnings, decrease common stock, and increase paid-in capital

D) decrease retained earnings, increase common stock, and decrease paid-in capital

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders' equity

A) is usually equal to cash on hand

B) includes paid-in capital and liabilities

C) includes retained earnings and paid-in capital

D) is shown on the income statement

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a stock dividend decreases a corporation's stockholders' equity and increases its liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess of issue price over par of common stock is termed a (n)

A) discount

B) income

C) deficit

D) premium

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

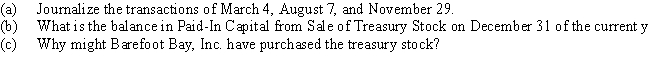

On March 4 of the current year,Barefoot Bay,Inc.reacquired 5,000 shares of its common stock at $89 per share.On August 7,Barefoot Bay sold 3,500 of the reacquired shares at $100 per share.The remaining 1,500 shares were sold at $88 per share on November 29.Required

Correct Answer

verified

Correct Answer

verified

True/False

If the dividend amount of preferred stock,$50 par value,is quoted as 8%,then the dividends per share would be $4.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Sabas Company has 20,000 shares of $100 par,1% noncumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

True/False

The initial owners of stock of a newly formed corporation are called directors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If common stock is issued for an amount greater than par value,the excess should be credited to

A) Retained Earnings

B) Cash

C) Legal Capital

D) Paid-In Capital in Excess of Par

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cumulative effect of the declaration and payment of a cash dividend on a company's financial statements is to

A) decrease total liabilities and stockholders' equity

B) increase total expenses and total liabilities

C) increase total assets and stockholders' equity

D) decrease total assets and stockholders' equity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the appropriate term (a-h) . -The date when dividends are actually distributed to stockholders

A) Cash dividend

B) Date of record

C) Stock Dividends Distributable

D) Date of declaration

E) Treasury stock

F) Preferred stock

G) Date of payment

H) Paid-In Capital in Excess of Par

J) D) and H)

Correct Answer

verified

Correct Answer

verified

Essay

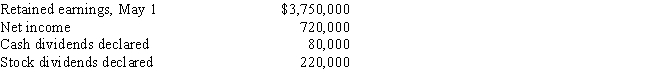

Big Bluestem Inc.reported the following results for the year ending April 30:  Prepare a retained earnings statement for the fiscal year ended April 30.

Prepare a retained earnings statement for the fiscal year ended April 30.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 215

Related Exams