Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tomas and Saturn are partners who share income in the ratio of 3:1.Their capital balances are $80,000 and $120,000,respectively.The partnership generated net income of $30,000.What is Saturn's capital balance after closing the revenue and expense accounts to the capital accounts?

A) $102,500

B) $120,000

C) $112,500

D) $127,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bobbi and Stuart are partners.The partnership capital of Bobbi is $40,000 and that of Stuart is $70,000.Bobbi sells his interest in the partnership to John for $50,000.The journal entry to record the admission of John as a new partner would include a credit to

A) John's capital account for $40,000

B) Stuart's capital account for $10,000

C) John's capital account for $50,000

D) John's capital account for $40,000 and a credit to Stuart's capital account for $10,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the share of losses on realization of the sale of noncash assets exceed the balance in a partner's capital account,the resulting balance is called a deficiency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an additional partner is admitted to a partnership by contribution of assets to the partnership,

A) the total assets of the partnership do not change

B) no liabilities can be contributed at the same time

C) the amount of the cash contribution is the same as the amount of the debit to the new partner's capital account

D) the total of the owners' equity accounts increases

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A partnership requires only an agreement between two or more persons to organize.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) . -Without an agreement,the law will stipulate this method of sharing profits and losses

A) Partnership

B) Partnership agreement

C) Distribution of remaining cash to partners

D) Mutual agency

E) Equally

F) Death of a partner

G) Liquidation

H) Unlimited liability

J) A) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Immediately prior to the admission of Allen,the Sanson-Jeremy Partnership assets had been adjusted to current market prices and the capital balances of Sanson and Jeremy were $80,000 and $120,000,respectively.If the parties agree that the business is worth $240,000,what is the amount of bonus that should be recognized in the accounts at the admission of Allen?

A) $60,000

B) $80,000

C) $40,000

D) $100,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

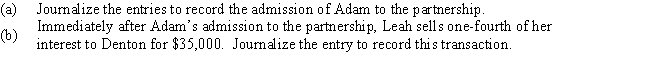

Kala and Leah,partners in Best Designs,have capital balances of $40,000 and $60,000,respectively.Adam joins the partnership by buying one-half of Kala's interest for $30,000.In addition,because of Adam's outstanding sales skills,the partners agree to increase his interest to 40% if he invests another $10,000.The income-sharing ratio of Kala,Leah,and Adam is 4:3:1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) : -Each partner may act on behalf of the entire partnership so that the liabilities created by one partner become the liabilities of all partners

A) Deficiency

B) Realization

C) Proprietorship

D) Partnership

E) Mutual agency

F) Liquidation

G) Income-sharing ratio

H) Statement of partnership equity

J) A) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson and Campbell have capital balances of $100,000 and $300,000,respectively.Jackson devotes full time and Campbell devotes one-half time to the business.Determine the division of $150,000 of net income when there is no reference to division in the partnership agreement.

A) $75,000 and $75,000

B) $37,500 and $112,500

C) $100,000 and $50,000

D) $112,500 and $37,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the questions that follow.

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income.

-Based on this information,the statement of partners' equity would show what amount in the capital account for Hawk on December 31?

Use the information below to answer the questions that follow.

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income.

-Based on this information,the statement of partners' equity would show what amount in the capital account for Hawk on December 31?

A) $211,600

B) $213,000

C) $201,000

D) $203,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A new partner contributes accounts receivable to a partnership,which appears in the ledger of his sole proprietorship at $20,500,and there was an allowance for doubtful accounts of $750.If $600 of the accounts receivable are completely worthless,the partnership Accounts Receivable should be debited for $19,900.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the liquidating process,any uncollected cash becomes a loss to the partnership and is divided among the remaining partners' capital balances based on their income-sharing ratio.

B) False

Correct Answer

verified

Correct Answer

verified

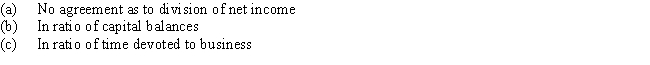

Essay

Jackson and Campbell have capital balances of $100,000 and $300,000 respectively.Jackson devotes full time and Campbell one-half time to the business.Determine the division of $150,000 of net income under each of the following assumptions:

Correct Answer

verified

Correct Answer

verified

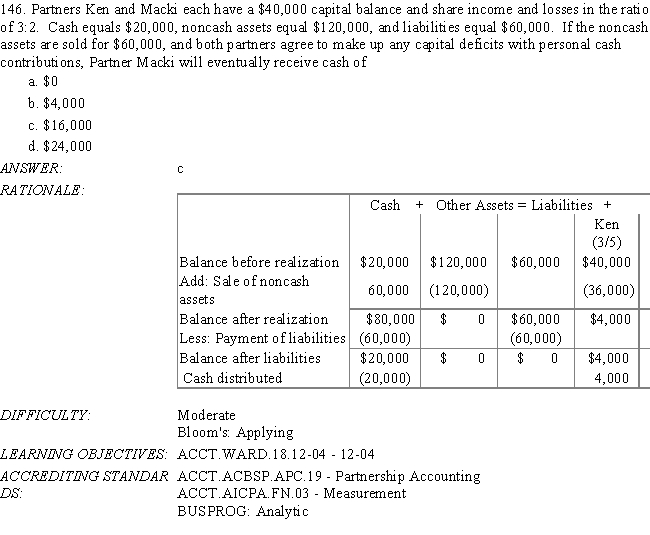

Multiple Choice

Tomas and Saturn are partners who share income in the ratio of 3:1.Their capital balances are $80,000 and $120,000,respectively.The partnership generated net income of $30,000.What is Tomas's capital balance after closing the revenue and expense accounts to the capital accounts?

A) $102,500

B) $22,500

C) $57,500

D) $127,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000,respectively,in a partnership.The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $34,000 and $26,000,respectively; and the remainder to be divided equally.How much of the net income of $120,000 is allocated to Xavier?

A) $59,000

B) $61,000

C) $49,000

D) $44,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000,respectively,in a partnership.The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $34,000 and $26,000,respectively; and the remainder to be divided equally.How much of the net income of $120,000 is allocated to Yolanda?

A) $46,000

B) $61,000

C) $60,000

D) $66,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A partnership's asset accounts should be changed from cost to fair market value when a new partner is admitted to a firm or an existing partner withdraws or dies.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 199 of 199

Related Exams