A) Assets section of the balance sheet

B) partners' subsidiary ledger

C) statement of cash flows

D) partnership income statement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A disadvantage of partnerships is the mutual agency of all partners.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After all noncash assets have been converted to cash and all liabilities paid,A,B,and C have capital balances of $10,000 (debit),$5,000 (debit),and $25,000 (credit).The cash available for distribution to the partners is $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) : -Business owned by a single individual

A) Deficiency

B) Realization

C) Proprietorship

D) Partnership

E) Mutual agency

F) Liquidation

G) Income-sharing ratio

H) Statement of partnership equity

J) B) and H)

Correct Answer

verified

Correct Answer

verified

True/False

Sarno has a capital balance of $42,000 after adjusting the assets to fair market value.Minton contributes $22,000 to receive a 30% interest in the new partnership.The bonus paid by Minton is $2,800.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The salary allocation to partners used in dividing net income would also appear as salary expense on the partnership income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) . -A voluntary association of two or more persons who co-own a business for profit

A) Partnership

B) Partnership agreement

C) Distribution of remaining cash to partners

D) Mutual agency

E) Equally

F) Death of a partner

G) Liquidation

H) Unlimited liability

J) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

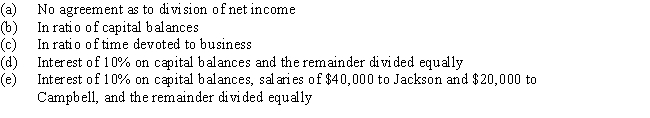

Jackson and Campbell have capital balances of $100,000 and $300,000 respectively.Jackson devotes full time and Campbell one-half time to the business.Determine the division of $120,000 of net income under each of the following assumptions:

Correct Answer

verified

Correct Answer

verified

True/False

If the net income of a partnership is less than the total of the allowances provided by the partnership agreement,the difference must be divided among the partners in the income-sharing ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) . -Every partner can bind the business to a contract within the scope of the partnership's regular business operations

A) Partnership

B) Partnership agreement

C) Distribution of remaining cash to partners

D) Mutual agency

E) Equally

F) Death of a partner

G) Liquidation

H) Unlimited liability

J) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson and Orton are partners who share income in the ratio of 2:3 and have capital balances of $60,000 and $40,000,respectively.Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000.What is Benson's capital balance after admitting Ramsey?

A) $20,000

B) $24,000

C) $48,800

D) $71,200

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Soledad and Winston are partners who share income in the ratio of 1:3 and have capital balances of $100,000 and $140,000,respectively,at the time they decide to terminate the partnership.After all noncash assets are sold and all liabilities are paid,there is a cash balance of $130,000.What amount of loss on realization should be allocated to Soledad?

-Soledad and Winston are partners who share income in the ratio of 1:3 and have capital balances of $100,000 and $140,000,respectively,at the time they decide to terminate the partnership.After all noncash assets are sold and all liabilities are paid,there is a cash balance of $130,000.What amount of loss on realization should be allocated to Soledad?

A) $60,000

B) $27,500

C) $92,500

D) $32,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A partner withdraws from a partnership by selling her interest to another person who currently is not associated with the firm.As a result of this transaction,the capital account balance of the other partners in the partnership

A) will increase

B) will decrease

C) will remain the same

D) may increase, decrease, or remain the same

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What amount will be recorded to Kelsey's capital account?

A) $14,000

B) $24,000

C) $40,000

D) $44,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a limited liability company is formed,

A) the partnership activities are limited

B) all partners have limited liability

C) some of the partners have limited liability

D) none of the partners has limited liability

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Gavin invested $45,000 in the Jason and Kelly Partnership for ownership equity of $45,000.Prior to the investment,land was revalued to a market value of $320,000 from a book value of $200,000.Jason and Kelly share net income in a 1:2 ratio. (a) Provide the journal entry for the revaluation of land. (b) Provide the journal entry to admit Gavin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tanner and Teresa share income and losses in a 2:1 ratio after allowing for salaries of $42,000 to Tanner and $60,000 to Teresa.Net income of the partnership is $132,000.Income should be divided as follows:

A) Tanner, $57,000; Teresa, $75,000

B) Tanner, $58,000; Teresa, $74,000

C) Tanner, $75,000; Teresa, $57,000

D) Tanner, $62,000; Teresa, $70,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the questions that follow.

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income.

-Based on this information,the statement of partners' equity would show what amount as total capital for the partnership on December 31?

Use the information below to answer the questions that follow.

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income.

-Based on this information,the statement of partners' equity would show what amount as total capital for the partnership on December 31?

A) $216,000

B) $164,000

C) $380,000

D) $52,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What amount will be recorded to Sandra's capital account?

A) $18,000

B) $7,500

C) $25,500

D) $10,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alpha and Beta are partners who share income in the ratio of 1:2 and have capital balances of $40,000 and $70,000,respectively,at the time they decide to terminate the partnership.After all noncash assets are sold and all liabilities are paid,there is a cash balance of $50,000.What amount of loss on realization should be allocated to Alpha?

A) $60,000

B) $20,000

C) $30,000

D) $50,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 199

Related Exams