A) increase in the total assets of the partnership

B) new capital account added to the ledger for the new partner

C) increase in the total owners' equity of the partnership

D) debit amount to the partner's capital account for the cash received by the current partner

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advantage of the partnership form of business organization is

A) unlimited liability

B) mutual agency

C) ease of formation

D) limited life

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

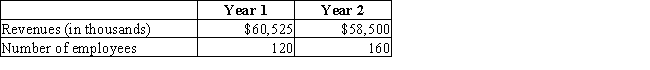

Top Dog,LLC provides repair services for oil rigs.The firm has five members in the LLC,which did not change between the first year and the second year.During Year 2,the business expanded into three new regions of the country.The following revenue and employee information is provided:  Required

(a)For Year 1 and Year 2,determine the revenue per employee

(excluding members).

(b)Interpret the trend between the two years.

Required

(a)For Year 1 and Year 2,determine the revenue per employee

(excluding members).

(b)Interpret the trend between the two years.

Correct Answer

verified

Correct Answer

verified

True/False

Many partnerships provide for the admission of new partners or withdrawals of present partners by amending existing partnership agreements,so that the firm may continue to operate without executing a new agreement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Antonio and Barbara are partners who share income in the ratio of 1:2 and have capital balances of $40,000 and $70,000,respectively,at the time they decide to terminate the partnership.After all noncash assets are sold and all liabilities are paid,there is a cash balance of $80,000.What amount of loss on realization should be allocated to Barbara?

-Antonio and Barbara are partners who share income in the ratio of 1:2 and have capital balances of $40,000 and $70,000,respectively,at the time they decide to terminate the partnership.After all noncash assets are sold and all liabilities are paid,there is a cash balance of $80,000.What amount of loss on realization should be allocated to Barbara?

A) $80,000

B) $10,000

C) $20,000

D) $30,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000,respectively,in a partnership.The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $38,000 and $28,000,respectively; and the remainder to be divided equally.How much of the net income of $77,000 is allocated to Yolanda?

A) $77,000

B) $38,000

C) $36,000

D) $44,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nick is admitted to an existing partnership by investing cash.Nick agrees to pay a bonus for his ownership interest because of the past success of the partnership.When Nick's investment in the partnership is recorded,

A) his capital account will be credited for more than the cash he invested

B) his capital account will be credited for the amount of cash he invested

C) a bonus will be credited for the amount of cash he invested

D) a bonus will be distributed to the old partners' capital accounts

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of a general partnership?

A) The partnership is created by a contract.

B) Mutual agency exists.

C) Partners share equally in net income or net losses unless an agreement states differently.

D) Dissolution occurs only when all partners agree.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The distribution of cash,as the final process in winding up the affairs of a partnership,is based on the income-sharing ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a new partner is admitted by making an investment of assets in the partnership and the new partner has to pay a premium for admission,a bonus is divided among the old partners' capital accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the questions that follow.

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income.

-Based on this information,the statement of partners' equity would show what amount as total capital for the partnership on December 31?

Use the information below to answer the questions that follow.

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income.

-Based on this information,the statement of partners' equity would show what amount as total capital for the partnership on December 31?

A) $384,600

B) $412,600

C) $404,000

D) $414,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Samuel and Darci are partners.The partnership capital for Samuel is $50,000 and that of Darci is $60,000.Josh is admitted as a new partner by investing $50,000 cash.Josh is given a 20% interest in return for his investment.The amount of the bonus to the old partners is

A) $0

B) $18,000

C) $8,000

D) $10,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a partner dies,the capital account balances of the remaining partners

A) will increase

B) will decrease

C) will remain the same

D) may increase, decrease, or remain the same

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jefferson has a capital balance of $65,000 and devotes full time to a partnership.Washington has a capital balance of $45,000 and devotes half time to the partnership.If no other information is available regarding distributions,in what ratio is net income to be divided?

A) 6.5:4.5

B) 1:1

C) 4.5:6.5

D) 1:2

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In admitting a new partner who purchases an interest,the capital interest of the new partner is obtained from the current partners and both the total assets and total capital are increased.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a general partnership,each partner is individually liable to creditors for debts incurred by the partnership,to the extent of the partner's capital balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) . -The final step in the liquidation of a partnership

A) Partnership

B) Partnership agreement

C) Distribution of remaining cash to partners

D) Mutual agency

E) Equally

F) Death of a partner

G) Liquidation

H) Unlimited liability

J) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

X sells to A one-half of a partnership capital interest that totals $70,000 for $40,000.A's capital account in the partnership should be credited for $40,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What amount will be recorded to the building account?

A) $24,000

B) $14,000

C) $40,000

D) $44,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ratio of 4:2:1 is the same as

A) 40%:20%:10%

B) 4/7:2/7:1/7

C) 4/10:2/10:1/20

D) 7/4:7/2:7/1

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 199

Related Exams