B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the term or phrase (a-g) that best describes it. Terms or phrases may be used more than once. -(Cash + Temporary investments + Accounts receivable) /Current liabilities

A) Current ratio

B) Working capital

C) Quick assets

D) Quick ratio

E) Record an accrual and disclose in the notes to the financial statements

F) Disclose only in notes to financial statements

G) No disclosure needed in notes to financial statements

I) A) and F)

Correct Answer

verified

Correct Answer

verified

True/False

Interest expense is reported in the Operating expense section of the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The journal entry to record the cost of warranty repairs that were incurred during the current period,but related to sales made in prior years,includes a debit to Warranty Expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the employer's payroll taxes?

A) SUTA tax

B) FUTA tax

C) social security tax

D) All of these choices

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin Jackson receives an hourly wage rate of $30,with time-and-a-half pay for all hours worked in excess of 40 hours during a week.Payroll data for the current week are as follows: hours worked,46; federal income tax withheld,$350; social security tax rate,6.0%; and Medicare tax rate,1.5%.What is the net amount to be paid to Jackson?

A) $1,470.00

B) $1,009.75

C) $1,097.95

D) $460.25

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The total net pay for a period is determined from the payroll register.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For proper matching of revenues and expenses,the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thomas Martin receives an hourly wage rate of $40,with time-and-a-half pay for all hours worked in excess of 40 hours during a week.Payroll data for the current week are as follows: hours worked,48; federal income tax withheld,$350; social security tax rate,6.0%; and Medicare tax rate,1.5%.What is the gross pay for Martin?

A) $449

B) $1,730

C) $2,080

D) $1,581

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aid in internal control over payrolls that indicates employee attendance is the

A) time card

B) voucher system

C) payroll register

D) employee's earnings record

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most employers are required to withhold federal unemployment taxes from employee earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Excel Products Inc.pays its employees semimonthly.The summary of the payroll for December 31,indicated the following:  For the year ended December 31,$40,000 of the December 31 payroll is subject to social security tax of 6.0%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%.As of January 1,of the following year,all of the $120,000 is subject to all payroll taxes.Prepare the journal entries for payroll tax expense if the employees are paid

(a)December 31 of the current year or

(b)January 2 of the following year.

For the year ended December 31,$40,000 of the December 31 payroll is subject to social security tax of 6.0%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%.As of January 1,of the following year,all of the $120,000 is subject to all payroll taxes.Prepare the journal entries for payroll tax expense if the employees are paid

(a)December 31 of the current year or

(b)January 2 of the following year.

Correct Answer

verified

Correct Answer

verified

True/False

Notes payable may be issued to creditors to satisfy previously created accounts payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the term or phrase (a-g) that best describes it. Terms or phrases may be used more than once. -Reasonably possible likelihood of a liability

A) Current ratio

B) Working capital

C) Quick assets

D) Quick ratio

E) Record an accrual and disclose in the notes to the financial statements

F) Disclose only in notes to financial statements

G) No disclosure needed in notes to financial statements

I) C) and E)

Correct Answer

verified

Correct Answer

verified

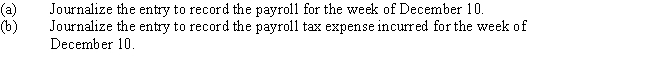

Essay

Townson Company had gross wages of $200,000 during the week ended December 10.The amount of wages subject to social security tax was $180,000,while the amount of wages subject to federal and state unemployment taxes was $24,000.Tax rates are as follows:The total amount withheld from employee wages for federal income taxes was $32,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,the interest charged by the bank,at the rate of 6%,on a 90-day,discounted note payable of $100,000 is

A) $6,000

B) $1,500

C) $500

D) $3,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Notes may be issued

A) when assets are purchased

B) to creditors to temporarily satisfy an account payable created earlier

C) when borrowing money

D) All of these choices

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 197 of 197

Related Exams