A) Land improvements

B) Buildings

C) Land

D) Machinery and equipment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a plant asset is traded for another similar asset,losses on the asset traded are not recognized.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of computer equipment does not include the consultant's fee to supervise installation of the equipment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The double-declining-balance method of depreciation uses a declining percentage rate in determining the depreciation amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each of the following as: -Resurfacing a pool in an apartment building

A) Ordinary maintenance and repairs

B) Asset improvements

C) Extraordinary repairs

E) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a company records depreciation expense for a period of time,cash is accumulated to replace fixed assets as they wear out.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Residual value is also known as all of the following except

A) scrap value

B) trade-in value

C) salvage value

D) net book value

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

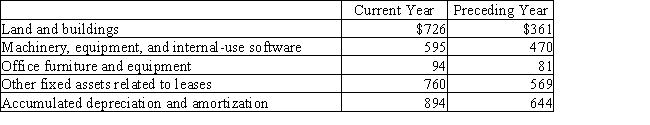

The following information was taken from a recent annual report of Harrison Company

(in millions):  Required

Required

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The method of determining depreciation that yields successive reductions in the periodic depreciation charge over the estimated life of the asset is the

A) units-of-production method

B) double-declining-balance method

C) straight-line method

D) time-valuation method

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record the disposal of fixed assets will include a credit to Accumulated Depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An exchange is said to have commercial substance if future cash flows remain the same as a result of the exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Company has sales of $2,025,000 for the current year.The book value of its fixed assets at the beginning of the year was $550,000 and at the end of the year was $800,000.The fixed asset turnover ratio for Newport is

A) 3.0

B) 3.6

C) 3.7

D) 2.5

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each of the following costs associated with long-lived assets as one of the following: -Sales taxes paid on new factory equipment

A) Buildings

B) Machinery and equipment

C) Land

D) Land improvements

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each account name to the financial statement section (a-i) in which it would appear. -Amortization Expense

A) Current assets

B) Fixed assets

C) Intangible assets

D) Current liability

E) Long-term liability

F) Owner's equity

G) Revenues

H) Operating expenses

I) Other revenue and expense

K) A) and I)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company discards machinery that is fully depreciated,this transaction would be recorded as a

A) debit to Accumulated Depreciation and credit to Machinery

B) debit to Machinery and a credit to Accumulated Depreciation

C) debit to Cash and a credit to Accumulated Depreciation

D) debit to Depreciation Expense and a credit Accumulated Depreciation

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

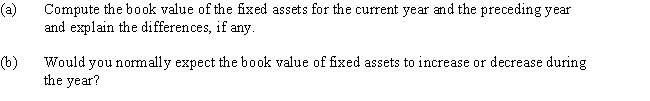

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000

(including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the intangible assets described with their proper classification (a-d) . -iTunes music

A) Patent

B) Copyright

C) Trademark

D) Goodwill

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sands Company purchased mining rights for $500,000.It expects to harvest 1 million tons of ore over the next five years.During the current year,Sands mined 350,000 tons of ore.The entry to record the depletion would include a

A) debit to Depletion Expense for $175,000

B) credit to Depletion Expense for $350,000

C) debit to Accumulated Depletion for $175,000

D) credit to Accumulated Depletion for $350,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the intangible assets described with their proper classification (a-d) . -Location of a company

A) Patent

B) Copyright

C) Trademark

D) Goodwill

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The cost of new equipment is called a revenue expenditure because it will help generate revenues in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 219

Related Exams