A) Dec. 31 Fees Earned 750 Rent Revenue 175

Income Summary 925

B) Dec. 31 Income Summary 925 Fees Earned 750

Rent Revenue 175

C) Dec. 31 Revenues 575 Income Summary 575

D) Dec. 31 Income Summary 925 Revenues 925

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A fiscal year

A) ordinarily begins on the first day of a month and ends on the last day of the following twelfth month.

B) for a business is determined by the federal government.

C) always begins on January 1 and ends on December 31 of the same year.

D) should end at the height of the business's annual operating cycle.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

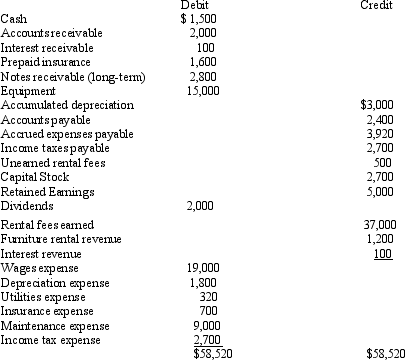

Bob Evans owns a business, Beachside Realty, that rents condominiums and furnishings. Below is the adjusted trial balance at December 31, 2014.  The entry required to close the expense accounts at the end of the period includes a:

The entry required to close the expense accounts at the end of the period includes a:

A) a debit to Income Summary for $35,520

B) a credit to Income Summary for $35,520

C) a debit to Income Summary for $33,520

D) a credit to Income Summary for $33,520

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

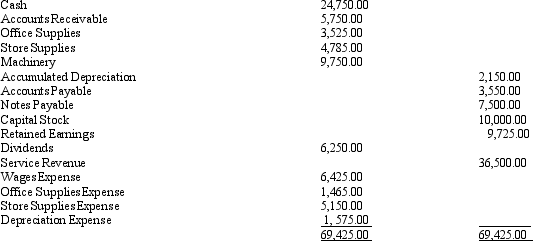

Use the work sheet for Finley Company to answer the questions that follow.  The ending balance in Retained Earnings is

The ending balance in Retained Earnings is

A) $28,000

B) $75,000

C) $25,000

D) $73,000

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which account would not appear in the Balance Sheet columns of the work sheet?

A) Dividends

B) Rent Earned

C) Unearned Revenue

D) Dividends and Unearned Revenue

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Journalizing and posting closing entries must be completed before financial statements can be prepared.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Closing entries

A) need not be journalized if adjusting entries are prepared

B) need not be posted if the financial statements are prepared from the work sheet

C) are not needed if adjusting entries are prepared

D) must be journalized and posted

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net income is shown on the work sheet in the Income Statement Debit column and the Balance Sheet Credit column.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After all of the account balances have been extended to the Income Statement columns of the work sheet, the totals of the debit and credit columns are $77,500 and $83,900, respectively. What is the amount of the net income or net loss for the period?

A) $6,400 net income

B) $6,400 net loss

C) $83,900 net income

D) $77,500 net loss

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After posting the second closing entry to the income summary account, the balance will be equal to

A) zero

B) retained earnings

C) revenues for the period

D) the net income or (loss) for the period

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

After net income or loss is entered on the work sheet, the debit column total must equal the credit column total of the Balance Sheet columns.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Once the adjusting entries are posted, the adjusted trial balance is prepared to

A) verify that the debits and credits are in balance

B) verify that all of the adjustments were posted in the correct accounts

C) verify that the net income (loss) is correct for the period

D) verify the correct flow of accounts into the financial statements

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The following adjusted trial balance is the result of the adjustments made at the end of the month of March for Erik Martin Company. Utilize these adjusted values to prepare the closing entries for Erik Martin Company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the end-of-period processing, which of the following best describes the logical order of steps?

A) preparation of adjustments, adjusted trial balance, financial statements

B) preparation of income statement, adjusted trial balance, balance sheet

C) preparation of adjusted trial balance, cross-referencing, journalizing

D) preparation of adjustments, adjusted trial balance, posting

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of the net income for a period appears on both the income statement and the balance sheet for that period.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Liabilities that will be due within one year or less and that are to be paid out of current assets are called current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fiscal year selected by companies

A) is the same as the calendar year.

B) begins with the first day of the month and ends on the last day of the twelfth month.

C) must always begin on January 1.

D) will change each year.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Real accounts are not permanent accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

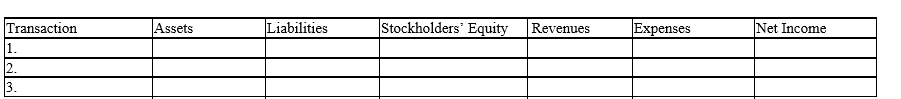

Each of the following transactions for Morrison Company requires an adjusting entry, which if omitted, will overstate or understate assets, liabilities, stockholders' equity, revenues, expenses, or net income. Indicate the amount and direction of the misstatement that would result if the end of period adjusting entry suggested by the transaction was omitted. Place your results in the table following the transactions and use (+) for overstate, (-) for understate, and (NE) for no effect.

1. Morrison purchased supplies on December 1 for $900. On December 31, $350 of supplies were on hand.

2. Prepaid insurance had a debit balance of $5,400 on December 1, which represented a prepayment for 2 years of insurance.

3. The unearned rent revenue account has a credit balance of $390 on December 1, which represents 3 months rent.

Correct Answer

verified

Correct Answer

verified

True/False

After the account balances have been extended from the Adjusted Trial Balance columns on the work sheet, the difference between the initial totals of the Balance Sheet debit and credit columns is net income or net loss.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 198

Related Exams