A) convertible bonds

B) unsecured bonds

C) debenture bonds

D) callable bonds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $1,000,000, 7%, 5 year bond that pays semi-annual interest of $35,000 ($1,000,000 ´ 7% ´ 1/2), receiving cash of $884,171. Journalize the entry to record the issuance of the bonds.

Correct Answer

verified

Correct Answer

verified

True/False

The issue price of zero-coupon bonds is the present value of their face amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An installment note payable for a principal amount of $94,000 at 6% interest requires Lawson Company to repay the principal and interest in equal annual payments of $22,315 beginning December 31, 2014, for each of the next five years. After the final payment, the carrying amount on the note will be

A) $ 1,263

B) $21,053

C) $22,315

D) $ 0

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Interest payments on 12% bonds with a face value of $20,000 and interest paid semiannually would be $2,400 every 6 months.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $1,000,000, 7%, 5 year bond that pays semi-annual interest of $35,000 ($1,000,000 ´ 7% ´ 1/2), receiving cash of $884,171. Journalize the first interest payment and the amortization of the related bond discount using the straight-line method. Round answer to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the amortization of a premium on bonds payable on an interest payment date includes:

A) debit Premium on Bonds Payable, credit Interest Revenue

B) debit Interest Expense, credit Premium on Bond Payable

C) debit Interest Expense, debit Premium on Bonds Payable, credit Cash

D) debit Bonds Payable, credit Interest Expense

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A secured bond is called a debenture bond and is backed only by the general creditworthiness of the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $500,000, 8%, 10 year bond that pays semi-annual interest of $20,000 ($500,000 ´ 8% ´ 1/2), receiving cash of $520,000. Journalize the entry to record the first interest payment and amortization of premium using the straight-line method.

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $800,000, 6%, 5 year bond that pays semi-annual interest of $24,000 ($800,000 ´ 6% ´ 1/2), receiving cash of $690,960. Journalize the entry to record the first interest payment and the amortization of the related bond discount using the straight-line method.

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a bond premium on an issued 11%, 4-year, $100,000 bond is $12,928, the annual interest expense is $5,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the payment of interest, interest expense, and amortization of bond discount is

A) debit Interest Expense, credit Cash and Discount on Bonds Payable

B) debit Interest Expense, credit Cash

C) debit Interest Expense and Discount on Bonds Payable, credit Cash

D) debit Interest Expense, credit Interest Payable and Discount on Bonds Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $900,000 and Premium on Bonds Payable has a balance of $10,000. If the issuing corporation redeems the bonds at 103, what is the amount of gain or loss on redemption?

A) $1,200 loss

B) $1,200 gain

C) $17,000 loss

D) $17,000 gain

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

A $500,000 bond issue on which there is an unamortized discount of $20,000 is redeemed for $475,000. Journalize the redemption of the bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the first day of the fiscal year, Lisbon Co. issued $1,000,000 of 10-year, 7% bonds for $1,050,000, with interest payable semiannually. Orange Inc. purchased the bonds on the issue date for the issue price. The journal entry to record the amortization of the premium (by the straight line method) for the year by Lisbon Co. includes a debit to:

A) Interest Expense for $2,500

B) Premium on Bonds Payable for $2,500

C) Interest Expense for $5,000

D) Premium on Bonds Payable for $5,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If sinking fund cash is used to purchase investments, those investments are reported on the balance sheet as marketable securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If bonds are sold for a discount, the carrying value of the bonds is equal to the face value less the unamortized discount.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To determine the six month interest payment amount on a bond, you would take one-half of the market rate times the face value of the bond.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

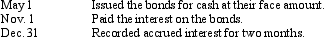

Brubeck Co. issued $10,000,000 of 30-year, 8% bonds on May 1 of the current year, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions for the current year:

Correct Answer

verified

Correct Answer

verified

True/False

Zero-coupon bonds do not provide for interest payments.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 186

Related Exams