A) $40,900

B) $43,600

C) $900

D) $3,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Power Company sells merchandise with a one year warranty. In 2012, sales consisted of 1,600 units. It is estimated that warranty repairs will average $10 per unit sold, and 30% of the repairs will be made in 2012 and 70% in 2013. In the 2012 income statement, Power should show warranty expense of

A) $4,800

B) $11,200

C) $16,000

D) $0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Notes payable may be issued to creditors to satisfy accounts payable created earlier.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The employee earnings record would contain which column that the payroll register would probably not contain?

A) deductions

B) payment

C) earnings

D) cumulative earnings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $30, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $300; cumulative earnings for year prior to current week, $90,700; social security tax rate, 6.0% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee?

A) $1,032.00

B) $1,143.00

C) $1,053.60

D) $1,166.40

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes only include social security taxes and federal unemployment and state unemployment taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax becomes a liability to the federal government at the time an employee's payroll is prepared.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quick assets include

A) cash; cash equivalents, receivables, prepaid expenses, and inventory

B) cash; cash equivalents, receivables, and prepaid expenses

C) cash; cash equivalents, receivables, and inventory

D) cash; cash equivalents, and receivables

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $110; cumulative earnings for the year prior to this week, $24,500; Social security tax rate, 6% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings; state unemployment compensation tax, 3.4% on the first $7,000; federal unemployment compensation tax, .8% on the first $7,000. What is the net amount to be paid to the employee?

A) $569.87

B) $539.00

C) $625.00

D) $544.88

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, when a $30,000, 90-day, 5% interest-bearing note payable matures, total payment will amount to:

A) $31,500

B) $1,500

C) $30,375

D) $375

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Martin Services Company provides their employees vacation benefits and a defined contribution pension plan. Employees earned vacation pay of $39,500 for the period. The pension plan requires a contribution to the plan administrator equal to 9% of employee salaries. Salaries were $750,000 during the period. Provide the journal entry for (a.) the vacation pay and (b.) the pension benefit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to a summary of the payroll of Scotland Company, $450,000 was subject to the 7.0% social security tax and $500,000 was subject to the 1.5% Medicare tax. Federal income tax withheld was $98,000. Also, $15,000 was subject to state (4.2%) and federal (0.8%) unemployment taxes. The journal entry to record accrued payroll taxes would include:

A) a debit to SUTA Payable of $630

B) a debit to SUTA Payable of $18,900

C) a credit to SUTA Payable of $630

D) a credit to SUTA Payable of $18,900

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Employers are required to compute and report payroll taxes on a calendar-year basis, even if a different fiscal year is used for financial reporting and income tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One of the more popular defined contribution plans is the 401k plan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 8, Alton Co. issued an $80,000, 6%, 120-day note payable to Seller Co. Assume that the fiscal year of Alton Co. ends July 31. Using the 360-day year in your calculations, what is the amount of interest expense recognized by Alton in the current fiscal year?

A) $1,200.00

B) $106.67

C) $306.67

D) $400.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following, assuming a 360-day year is used for interest calculations:

Correct Answer

verified

Correct Answer

verified

True/False

Form W-4 is a form authorizing employers to withhold a portion of employee earnings for payment of an employee's federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment compensation taxes that are collected by the federal government are not paid directly to the unemployed but are allocated among the states for use in state programs.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

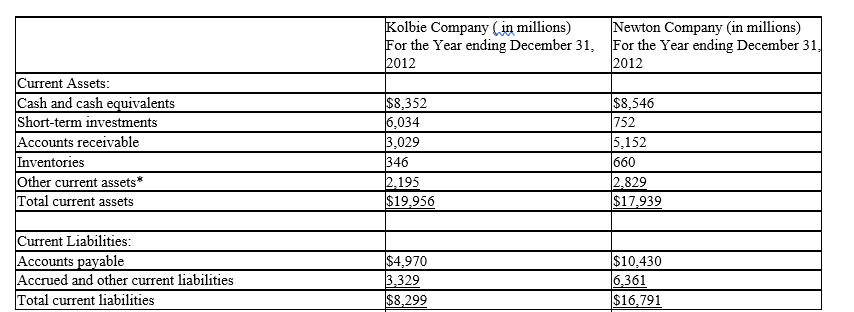

The current assets and current liabilities for Kolbie Company and Newton Company are shown as follows at the end of 2012.

*These represent prepaid expenses and other non-quick current assets.

Required:

(1) Determine the quick ratio for both companies. Round to two decimal places.

(2) Interpret the quick ratio difference between the two companies.

*These represent prepaid expenses and other non-quick current assets.

Required:

(1) Determine the quick ratio for both companies. Round to two decimal places.

(2) Interpret the quick ratio difference between the two companies.

Correct Answer

verified

Correct Answer

verified

True/False

Federal income taxes withheld increase the employer's payroll tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 174

Related Exams