Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs are $250,000, the unit selling price is $125, and the unit variable costs are $73, what is the break-even sales (units) ?

A) 3,425 units

B) 2,381 units

C) 2,000 units

D) 4,808 units

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following activity bases would be the most appropriate for gasoline costs of a delivery service, such as United Postal Service?

A) Number of trucks employed

B) Number of miles driven

C) Number of trucks in service

D) Number of packages delivered

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs are $561,000 and the unit contribution margin is $8.00, what is the break-even point in units if variable costs are decreased by $.50 a unit?

A) 66,000

B) 70,125

C) 74,800

D) 60,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

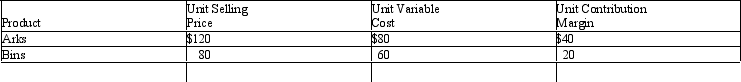

Carter Co. sells two products, Arks and Bins. Last year Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are:  What was Carter Co.'s weighted average variable cost?

What was Carter Co.'s weighted average variable cost?

A) $140

B) $ 70

C) $ 64

D) $ 60

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

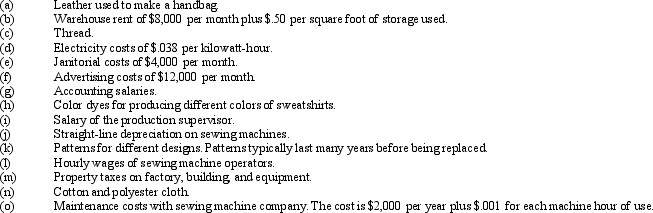

The following is a list of various costs of producing sweatshirts. Classify each cost as either a variable, fixed, or mixed cost for units produced and sold.

Correct Answer

verified

Correct Answer

verified

True/False

The point in operations at which revenues and expired costs are exactly equal is called the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Variable costs are costs that vary on a per-unit basis with changes in the activity level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs increased and variable costs per unit decreased, the break-even point would:

A) increase

B) decrease

C) remain the same

D) cannot be determined from the data provided

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

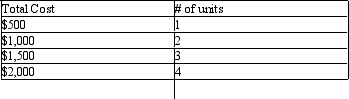

Given the following cost data, what type of cost is shown?

A) mixed cost

B) variable cost

C) fixed cost

D) none of the above

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales are $525,000, variable costs are 53% of sales, and operating income is $50,000, what is the contribution margin ratio?

A) 47%

B) 26.5%

C) 9.5%

D) 53%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Matching

Match the following terms with their definitions.

Correct Answer

Multiple Choice

If fixed costs are $46,800, the unit selling price is $42, and the unit variable costs are $24, what is the break-even sales (units) ?

A) 2,400

B) 1,950

C) 1,114

D) 2,600

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Total variable costs change as the level of activity changes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that vary in total in direct proportion to changes in an activity level are called:

A) fixed costs

B) sunk costs

C) variable costs

D) differential costs

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

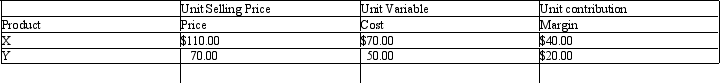

Rusty Co. sells two products, X and Y. Last year Rusty sold 5,000 units of X's and 35,000 units of Y's. Related data are:  What was Rusty Co.'s weighted average unit contribution margin?

What was Rusty Co.'s weighted average unit contribution margin?

A) $60.00

B) $20.00

C) $40.00

D) $22.50

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zeke Company sells 25,000 units at $21 per unit. Variable costs are $10 per unit, and fixed costs are $75,000. The contribution margin ratio and the unit contribution margin are:

A) 47% and $11 per unit

B) 53% and $7 per unit

C) 47% and $8 per unit

D) 52% and $11 per unit

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The Waterfall Company sells a product for $150 per unit. The variable cost is $80 per unit, and fixed costs are $270,000. Determine the (a) break-even point in sales units, and (b) break-even points in sales units if the company desires a target profit of $36,000. Round your answer to the nearest whole number.

Correct Answer

verified

a. SP $150 - VC $80 = CM $70

$...View Answer

Show Answer

Correct Answer

verified

$...

View Answer

Multiple Choice

The systematic examination of the relationships among selling prices, volume of sales and production, costs, and profits is termed:

A) contribution margin analysis

B) cost-volume-profit analysis

C) budgetary analysis

D) gross profit analysis

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

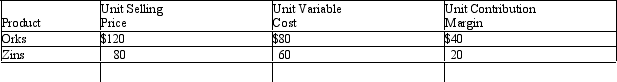

Safari Co. sells two products, Orks and Zins. Last year Safari sold 21,000 units of Orks and 14,000 units of Zins. Related data are:

Correct Answer

verified

Calculate the following:

a. Safari Co.'s...View Answer

Show Answer

Correct Answer

verified

a. Safari Co.'s...

View Answer

Showing 21 - 40 of 217

Related Exams