A) $118,000.

B) $110,000.

C) $102,000.

D) $150,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows reports a firm's major sources of cash receipts and major uses of cash payments for a period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchases equipment for $32,000 cash. This transaction should be shown on the statement of cash flows under

A) investing activities

B) financing activities

C) noncash investing and financing activities

D) operating activities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash dividends of $45,000 were declared during the year. Cash dividends payable were $10,000 at the beginning of the year and $15,000 at the end of the year. The amount of cash for the payment of dividends during the year is

A) $50,000

B) $40,000

C) $55,000

D) $35,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be added to net income in calculating net cash flow from operating activities using the indirect method?

A) depreciation expense

B) an increase in inventory

C) a gain on the sale of equipment

D) dividends declared and paid

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

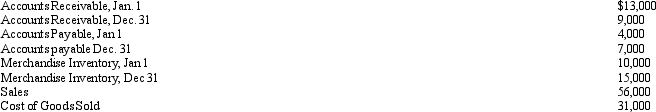

The following selected account balances appeared on the financial statements of the Washington Company:  The Washington Company uses the direct method to calculate net cash flow from operating activities.

Cash collections from customers are

The Washington Company uses the direct method to calculate net cash flow from operating activities.

Cash collections from customers are

A) $56,000

B) $52,000

C) $60,000

D) $45,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the cash flows from financing activities section would include all of the following except

A) receipts from the sale of bonds payable

B) payments for dividends

C) payments for purchase of treasury stock

D) payments of interest on bonds payable

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales for the year were $600,000. Accounts receivable were $100,000 and $80,000 at the beginning and end of the year. Cash received from customers to be reported on the cash flow statement using the direct method is

A) $700,000

B) $600,000

C) $580,000

D) $620,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

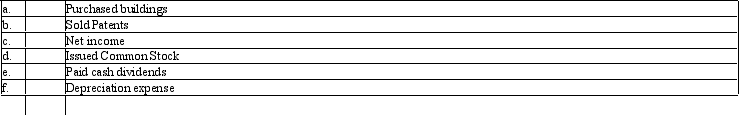

For each of the following, identify whether it would be disclosed as an operating (O), financing (F), or investing (I) activity on the statement of cash flows under the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is cash from operations, less cash for

A) dividends and cash for fixed assets needed to maintain productivity

B) dividends and cash to redeem bonds payable

C) fixed assets needed to maintain productivity

D) fixed assets needed to maintain productivity, and cash to redeem bonds payable

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Durrand Corporation's accumulated depreciation increased by $12,000, while patents decreased by $2,200 between consecutive balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $4,300 from sale of land. Reconcile a net income of $65,000 to net cash flow from operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the four basic financial statements?

A) balance sheet

B) statement of cash flows

C) statement of changes in financial position

D) income statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

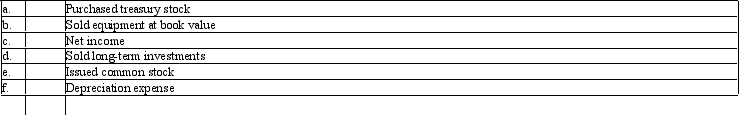

For each of the following, identify whether it would be disclosed as an operating (O), financing (F), or investing (I) activity on the statement of cash flows under the indirect method.

Correct Answer

verified

Correct Answer

verified

True/False

If land costing $145,000 was sold for $205,000, the $60,000 gain on the sale would be added to net income in of the operating activities section of the statement of cash flows (prepared by the indirect method).

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Indicate the section (operating activities, investing activities, financing activities, or none) in which each of the following would be reported on the statement of cash flows prepared by the indirect method:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income tax was $175,000 for the year. Income tax payable was $30,000 and $40,000 at the beginning and end of the year. Cash payments for income tax reported on the cash flow statement using the direct method is

A) $175,000

B) $165,000

C) $205,000

D) $215,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows is an optional financial statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flow per share is

A) required to be reported on the balance sheet

B) required to be reported on the income statement

C) required to be reported on the statement of cash flows

D) not required to be reported on any statement

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct method of reporting cash flows from operations, the major source of cash is cash received from customers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method, expenses that do not affect cash are added to net income in the operating activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 161

Related Exams