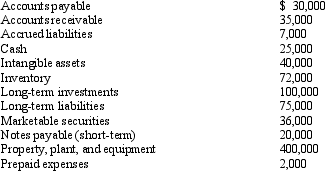

A) total property, plant and equipment.

B) total current assets.

C) total liabilities.

D) total assets.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A balance sheet shows cash, $75,000; marketable securities, $115,000; receivables, $150,000 and $222,500 of inventories. Current liabilities are $225,000. The current ratio is 2.5 to 1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the above data, what is the amount of quick assets?

Based on the above data, what is the amount of quick assets?

A) $168,000

B) $96,000

C) $60,000

D) $61,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An extraordinary item results from

A) a segment of the business being sold.

B) corporate income tax being paid.

C) a change from one accounting method to another acceptable accounting method.

D) a transaction or event that is unusual and occurs infrequently.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The numerator of the rate earned on total assets ratio is equal to

A) net income

B) net income plus tax expense

C) net income plus interest expense

D) net income minus preferred dividends

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common measure of liquidity is

A) ratio of net sales to assets.

B) dividends per share of common stock.

C) receivable turnover.

D) profit margin.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If two companies have the same current ratio, their ability to pay short-term debt is the same.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a common-sized income statement, each item is expressed as a percentage of net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The ratio of fixed assets to long-term liabilities provides a measure of a firm's ability to pay dividends.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The number of days' sales in inventory is one means of expressing the relationship between the cost of goods sold and inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis is a technique for evaluating financial statement data

A) for one period of time.

B) over a period of time.

C) on a certain date.

D) as it may appear in the future.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In performing a vertical analysis, the base for cost of goods sold is

A) total selling expenses.

B) net sales.

C) total expenses.

D) gross profit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

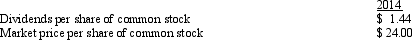

The following information is available for Dorman Company:  Which of the following statements is correct?

Which of the following statements is correct?

A) The dividend yield is 6.0%, which is of interest to investors seeking an increase in market price of their stocks.

B) The dividend yield is 6.0%, which is of special interest to investors seeking to earn revenue on their investments.

C) The dividend yield is 16.7%, which is of interest to bondholders.

D) The dividend yield is 16.7% which is an important measure of solvency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Using measures to assess a business's ability to pay its current liabilities is called current position analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company changes from one acceptable accounting method to another, the change is reported

A) in the statement of retained earnings, as a correction to the beginning balance.

B) in the income statement, below income from continuing operations.

C) in the income statement, above income from continuing operations

D) through a retroactive restatement of prior period earnings.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each item with its definition. -Common-sized financial statements

A) Useful for comparing one company to another or a company with industry averages

B) Focuses on a company’s ability to generate net income

C) The percentage analysis of the relationship of each component in a financial statement to a total within the statement.

D) An analysis of a company’s ability to pay its current liabilities.

E) Occurs when a company abandons a segment.

F) A percentage analysis of increases and decreases in related items in comparative financial statements.

G) Something that is both unusual and infrequent.

H) This requires a restatement of prior period financial statements.

J) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

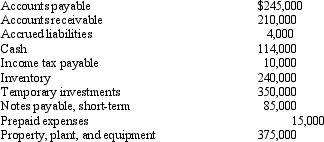

The following data are taken from the balance sheet at the end of the current year. Determine the (a) working capital, (b) current ratio, and (c) quick ratio. Present figures used in your computations. Round ratios to the nearest tenth.

Correct Answer

verified

Correct Answer

verified

Essay

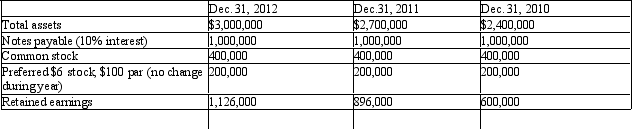

The following selected data were taken from the financial statements of the Berrol Group for December 31, 2012, 2011, and 2010:

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has a quick ratio of 1, the subsequent payment of an account payable will cause the ratio to increase.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Gallant Company reported net income of $2,500,000. The income statement included one extraordinary item: a $500,000 gain from condemnation of land and a $200,000 loss on discontinued operations, both after applicable income tax. There were 100,000 shares of $10 par common stock and 40,000 shares 4% preferred stock of $100 par outstanding throughout the current year. Required: Prepare the earnings per share section of Gallant Company's income statement.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 193

Related Exams