Correct Answer

verified

_TB2085_00...

_TB2085_00...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

A corporation has 50,000 shares of $25 par value stock outstanding that has a current market value of $150. If the corporation issues a 5-for-1 stock split, the market value of the stock after the split will be approximately:

A) $25

B) $150

C) $5

D) $30

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 45,000 shares were originally issued and 5,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared?

A) $80,000

B) $10,000

C) $90,000

D) $100,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Matching

Match the following stockholder's equity concepts to the best answer.

Correct Answer

True/False

The declaration of a stock dividend decreases a corporation's stockholders' equity and increases its liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Before a stock dividend can be declared or paid, there must be sufficient cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues 2,500 shares of common stock for $ 45,000. The stock has a stated value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for

A) $25,000

B) $45,000

C) $20,000

D) $ 5,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the issuance of common stock at a price above par includes a debit to

A) Organizational Expenses

B) Common Stock

C) Cash

D) Paid-In Capital in Excess of Par-Common Stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If common stock is issued for an amount greater than par value, the excess should be credited to

A) Retained Earnings.

B) Cash.

C) Legal Capital.

D) Paid-in Capital in Excess of Par Value.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of treasury stock is deducted from total paid-in capital and retained earnings in determining total stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The authorized stock of a corporation

A) must be recorded in a formal accounting entry.

B) only reflects the initial capital needs of the company.

C) is indicated in its by-laws.

D) is indicated in its charter.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If 50,000 shares are authorized, 41,000 shares are issued, and 2,000 shares are reacquired, the number of outstanding shares is 43,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The stock dividends distributable account is listed in the current liability section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

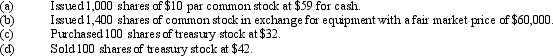

Essay

Prepare entries to record the following:

Correct Answer

verified

(a)

_TB2085_00_TB2085_00 (b)

_TB2085_00_TB2085_00 (b)

...View Answer

Show Answer

Correct Answer

verified

...

View Answer

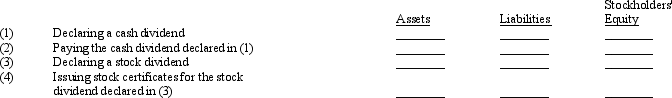

Essay

Indicate whether the following actions would (+) increase, (-) decrease, or (0) not affect a company's total assets, liabilities, and stockholders' equity.

Correct Answer

verified

_TB2085_00...

_TB2085_00...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

The balance in Retained Earnings at the end of the period is created by closing entries.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A large public corporation normally uses registrars and transfer agents to maintain records of the stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The retained earnings statement may be combined with the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the main disadvantages of the corporate form is the

A) professional management

B) double taxation of dividends

C) charter

D) corporation must issue stock

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The state charter allows a corporation to issue only a certain number of shares of each class of stock. This amount of stock is called

A) treasury stock

B) issued stock

C) outstanding stock

D) authorized stock

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 171

Related Exams