B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which intangible assets are amortized over their useful life?

A) trademarks

B) goodwill

C) patents

D) all of the above

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The transfer to expense of the cost of intangible assets attributed to the passage of time or decline in usefulness is called amortization.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Standby equipment held for use in the event of a breakdown of regular equipment is reported as property,plant,and equipment on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Machinery was purchased on January 1,2010 for $51,000.The machinery has an estimated life of 7 years and an estimated salvage value of $9,000.Double-declining balance depreciation for 2011 would be

A) $10,929

B) $6,000

C) $10,500

D) $10,408

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Capital expenditures are costs of acquiring,constructing,adding,or replacing property,plant and equipment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A fixed asset's estimated value at the time it is to be retired from service is called

A) book value

B) residual value

C) market value

D) carrying value

F) B) and C)

Correct Answer

verified

Correct Answer

verified

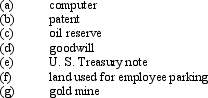

Essay

Identify the following as a Fixed Asset (FA),or Intangible Asset (IA),or Natural Resource (NR),or Neither (N)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31,Strike Company has decided to sell one of its batting cages.The initial cost of the equipment was $310,000 with an accumulated depreciation of $260,000.Depreciation has been taken up to the end of the year.The company found a company that is willing to buy the equipment for $20,000.What is the amount of the gain or loss on this transaction?

A) Gain of $20,000

B) Loss of $30,000

C) No gain or loss

D) Cannot be determined

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets differ from property,plant and equipment assets in that they lack physical substance.

B) False

Correct Answer

verified

Correct Answer

verified

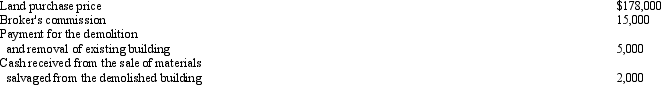

Essay

What is the cost of the land,based upon the following data?

Correct Answer

verified

Correct Answer

verified

True/False

The cost of a patent with a remaining legal life of 10 years and an estimated useful life of 7 years is amortized over 10 years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record the disposal of fixed assets will include a credit to accumulated depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

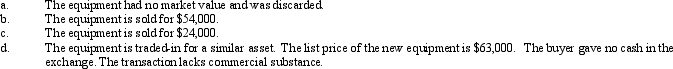

Essay

Equipment acquired at a cost of $126,000 has a book value of $42,000.Journalize the disposal of the equipment under the following independent assumptions.

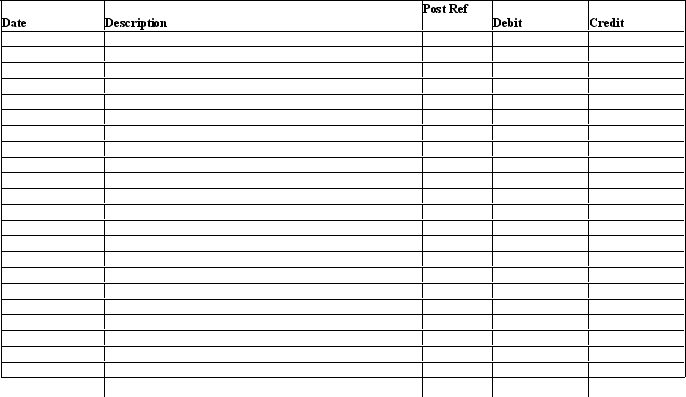

Journal

Journal

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A fixed asset with a cost of $41,000 and accumulated depreciation of $36,500 is traded for a similar asset priced at $60,000.Assuming a trade-in allowance of $3,000,the recognized loss on the trade is

A) $3,000

B) $4,500

C) $ 500

D) $1,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When depreciation estimates are revised,all years of the asset's life are affected.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When land is purchased to construct a new building,the cost of removing any structures on the land should be charged to the building account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of repairing damage to a machine during installation is debited to a fixed asset account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a seller allows a buyer an amount for old equipment that is traded in for new equipment of similar use,this amount is known as boot.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ordinary gains from the sale of fixed assets should be reported in the other income section of the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 174

Related Exams