Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 92

True/False

Under the Internal Revenue Code,corporations are required to pay federal income taxes.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 93

True/False

Before a stock dividend can be declared or paid,there must be sufficient cash.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 94

True/False

A large retained earnings account means that there is cash available to pay dividends.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 95

Multiple Choice

A corporation issues 2,500 shares of common stock for $ 45,000.The stock has a stated value of $10 per share.The journal entry to record the stock issuance would include a credit to Common Stock for

A) $25,000

B) $45,000

C) $20,000

D) $ 5,000

E) A) and C)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 96

Multiple Choice

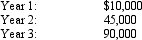

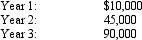

Sabas Company has 20,000 shares of $100 par,2% cumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for the third year.

Determine the dividends per share for preferred and common stock for the third year.

A) $4.50 and $0.25

B) $3.25 and $0.25

C) $4.50 and $0.90

D) $2.00 and $0.25

E) None of the above

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 97

True/False

A large public corporation normally uses registrars and transfer agents to maintain records of the stockholders.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 98

True/False

One of the prerequisites to paying a cash dividend is sufficient retained earnings.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 99

Multiple Choice

Sabas Company has 20,000 shares of $100 par,2% cumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for the second year.

Determine the dividends per share for preferred and common stock for the second year.

A) $2.25 and $0.00

B) $2.25 and $0.45

C) $0.00 and $0.45

D) $2.00 and $0.45

E) B) and C)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 169 of 169

Related Exams