A) FICA tax

B) FICA tax, state and federal unemployment compensation tax

C) only state unemployment compensation tax

D) only federal unemployment compensation tax

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For a current liability to exist, the following two tests must be met. The liability must be due usually within a year and must be paid out of current assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are

A) due, but not receivable for more than one year

B) due, but not payable for more than one year

C) due and receivable within one year

D) due and payable within one year

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an internal control procedure for payroll?

A) employees observed clocking in and out

B) payroll depends on a fired employee's supervisor to notify them when an employee has been fired

C) payroll requires employees to show identification when picking up their paychecks

D) changes in pay rates on a computerized system must be tested by someone independent of payroll

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a variable component of a payroll system?

A) hours worked

B) medicare tax rate

C) rate of pay

D) social security number

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will have no effect on an employee's take-home pay?

A) Social security tax

B) Unemployment tax

C) Marital status

D) Number of exemptions claimed

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement below is not a determinate in calculating the amount of federal income taxes withheld from an individuals pay?

A) filing status

B) types of earnings

C) gross pay

D) number of exemptions

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One of the more popular defined contribution plans is the 401k plan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

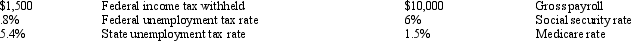

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx.

Salaries Payable would be recorded in the amount of:

Salaries Payable would be recorded in the amount of:

A) $8,500

B) $7,130

C) $7,670

D) $7,750

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Carmen Flores' weekly gross earnings for the week ending Dec. 7th were $2,500, and her federal income tax withholding was $525. Prior to this week Flores had earned $99,000 for the year. Assuming the social security rate is 6% on the first $100,000 of annual earnings and Medicare is 1.5% of all earnings, what is Flores' net pay?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8, Alton Co. issued an $80,000, 6%, 120-day note payable to Seller Co. What is the due date of the note?

A) October 8

B) October 7

C) October 6

D) October 5

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, when a $30,000, 90-day, 5% interest-bearing note payable matures, total payment will amount to:

A) $31,500

B) $1,500

C) $30,375

D) $375

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a borrower receives the face amount of a discounted note less interest, this amount is known as:

A) the note proceeds

B) the note discount

C) the note deferred interest

D) the note principal

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Generally, all deductions made from an employee's gross pay are required by law.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $40, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $350; cumulative earnings for year prior to current week, $99,700; social security tax rate, 6.0% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings. What is the gross pay for the employee?

A) $775.00

B) $1,840.00

C) $1,960.00

D) $1,562.60

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $110; cumulative earnings for the year prior to this week, $24,500; Social security tax rate, 6% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings; state unemployment compensation tax, 3.4% on the first $7,000; federal unemployment compensation tax, .8% on the first $7,000. What is the net amount to be paid the employee?

A) $569.87

B) $539.00

C) $625.00

D) $544.88

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll entries are made with data from the

A) wage and tax statement

B) employee's earning record

C) employer's quarterly federal tax return

D) payroll register

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most desirable quick ratio?

A) 2.20

B) 1.80

C) 1.95

D) 1.50

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mobile Co. issued a $45,000, 60-day, discounted note to Guarantee Bank. The discount rate is 6%. At maturity, assuming a 360-day year, the borrower will pay:

A) $45,450

B) $42,300

C) $45,000

D) $44,550

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A defined contribution plan promises employees a fixed annual pension benefit.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 172

Related Exams