A) $1,370

B) $750

C) $620

D) $2,870

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

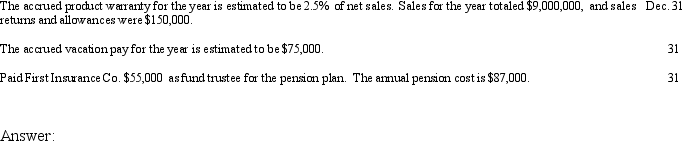

Journalize the following transactions for Riley Corporation:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Co. issued a $50,000, 120-day, discounted note to Guarantee Bank. The discount rate is 6%. Assuming a 360-day year, the cash proceeds to Chang Co. are

A) $49,750

B) $47,000

C) $49,000

D) $51,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During its first year of operations, a company granted employees vacation privileges and pension rights estimated at a cost of $21,500 and $15,000. The vacations are expected to be taken in the next year and the pension rights are expected to be paid in the future 5-30 years. What is the total cost of vacation pay and pension rights to be recognized in the first year?

A) $15,000

B) $36,500

C) $6,500

D) $21,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a product warranty should be included as an expense in the

A) period the cash is collected for a product sold on account

B) future period when the cost of repairing the product is paid

C) period of the sale of the product

D) future period when the product is repaired or replaced

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Internal controls for cash payments also apply to payrolls.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Form W-4 is a form authorizing employers to withhold a portion of employee earnings for payment of an employee's federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The detailed record indicating the data for each employee for each payroll period and the cumulative total earnings for each employee is called the

A) payroll register

B) payroll check

C) employee's earnings record

D) employer's earnings record

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

While separation of duties may play a strong role in the internal control of inventory, it is significant in controlling payroll.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For proper matching of revenues and expenses, the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension plan which requires the employer to make annual pension contributions, with no promise to employees regarding future pension payments, is termed

A) funded

B) unfunded

C) defined benefit

D) defined contribution

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Like many taxes deducted from employee earnings, federal income taxes are subject to a maximum amount per employee per year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record the issuance of a note for the purpose of converting an existing account payable would be

A) debit Cash; credit Accounts Payable

B) debit Accounts, Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Notes Payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment taxes are paid by the employer and the employee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For an interest bearing note payable, the amount borrowed is equal to the face amount of the note.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record pension rights that have not been funded for its salaried employees, at the end of the year is

A) debit Salary Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Dixon Sales has five sales employees which receive weekly paychecks. Each earns $10.25 per hour and each has worked 40 hours in the pay period. Each employee pays 12% of gross in Federal Income Tax, 3% in State Income Tax, 6% of gross in Social Security Tax, 1.5% of gross in Medicare Tax, and 1/2% in State Disability Insurance. Journalize the recognition of the pay period ending January 19th which will be paid to the employees January 26th. (Keep in mind that none of the employees is subject to a ceiling amount for social security.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) all of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The payroll register is a multicolumn form used to assemble the data related for all employees.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record fully funded pension rights for its salaried employees at the end of the year is

A) debit Salary Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 172

Related Exams