A) 1.20

B) 1.00

C) 0.95

D) 0.50

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

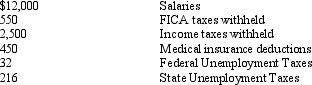

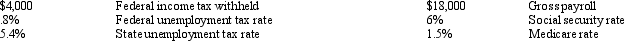

Use the following information to answer the following questions. The following totals for the month of April were taken from the payroll register of Magnum Company.

The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $248

B) credit to FICA Taxes Payable for $1,100

C) credit to Payroll Tax Expense for $248

D) debit to Payroll Tax Expense for $798

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A loan in which the lender deducts interest from the amount borrowed before the money is advanced to the borrower is called an interest bearing note.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The use of a separate payroll bank account is not an advantageous control, because it creates more complexity in reconciliation functions for a company and invites theft.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

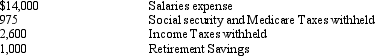

The following totals for the month of June were taken from the payroll register of Arcon Company:  The entry to record the payment of net pay would include a

The entry to record the payment of net pay would include a

A) debit to Salaries Payable for $14,000

B) Debit to Salaries Payable for $9,425

C) Credit to Salaries Expense for $9,425

D) Credit to Salaries Payable for $9,425

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, proceeds of $48,750 were received from discounting a $50,000, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was

A) 6.25%

B) 10.00%

C) 10.26%

D) 9.75%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

During the first year of operations, employees earned vacation pay of $35,000. The vacations will be taken during the second year. The vacation pay expense should be recorded in the second year as the vacations are taken by the employees.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, the interest charged by the bank, at the rate of 9%, on a 90-day, discounted note payable for $100,000 is

A) $9,000

B) $2,250

C) $750

D) $1,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

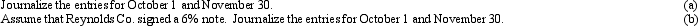

Essay

On October 1, Ramos Co. signed a $90,000, 60-day discounted note at the bank. The discount rate was 6%, and the note was paid on November 30. (Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 30, Seba Salon, Inc. issued a 90-day note with a face amount of $60,000 to Reyes Products, Inc. for merchandise inventory. Determine the proceeds of the note assuming the note is discounted at 8%.

A) $55,200

B) $64,800

C) $58,800

D) $61,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The journal entry to record the cost of warranty repairs that were incurred during the current period, but related to sales made in prior years, includes a debit to Warranty Expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes are based on the employee's net pay.

B) False

Correct Answer

verified

Correct Answer

verified

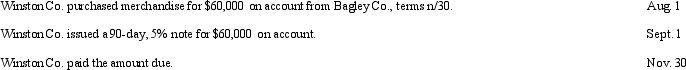

Essay

Journalize the following entries on the books of Winston Co. for August 1, September 1, and November 30. (Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Essay

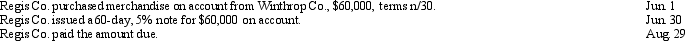

Journalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

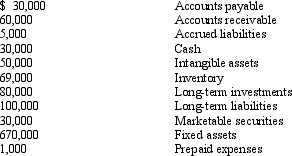

Based on the following data, what is the acid-test ratio, rounded to one decimal point?

A) 3.4

B) 3.0

C) 2.2

D) 1.8

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In a defined benefits plan, the employer bears the investment risks in funding a future retirement income benefit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total earnings of an employee for a payroll period is referred to as

A) take-home pay

B) pay net of taxes

C) net pay

D) gross pay

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

During the first year of operations, a company granted warranties on its products. The estimated cost of the product warranty liability at the end of the year is $8,500. The product warranty expense of $8,500 should be recorded in the years of the expenditures to repair the products covered by the warranty payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming no employees are subject to ceilings for their earnings, Moore Company has the following information for the pay period of December 15 - 31, 20xx.  Salaries Payable would be recorded for

Salaries Payable would be recorded for

A) $18,000

B) $12,950

C) $12,650

D) $11,534

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Depending upon when an unfunded pension liability is to be paid, it will be classified on the balance sheet as either a long-term or a current liability.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 172

Related Exams