A) If a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will decrease.

B) A reduction in inventories held would have no effect on the current ratio.

C) An increase in inventories would have no effect on the current ratio.

D) If a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will increase.

E) A reduction in the inventory turnover ratio will generally lead to an increase in the ROE.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm has the highest price/earnings ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

B) If a firm has the highest market/book ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

C) Other things held constant, the higher a firm's expected future growth rate, the lower its P/E ratio is likely to be.

D) The higher the market/book ratio, then, other things held constant, the higher one would expect to find the Market Value Added (MVA) .

E) If a firm has a history of high Economic Value Added (EVA) numbers each year, and if investors expect this situation to continue, then its market/book ratio and MVA are both likely to be below average.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

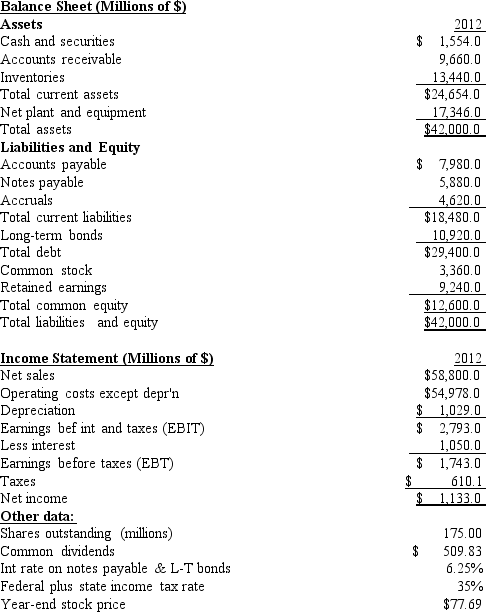

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc.Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's TIE?

-Refer to Exhibit 3.1.What is the firm's TIE?

A) 1.94

B) 2.15

C) 2.39

D) 2.66

E) 2.93

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emerson Inc.'s would like to undertake a policy of paying out 45% of its income.Its latest net income was $1, 250, 000, and it had 225, 000 shares outstanding.What dividend per share should it declare?

A) $2.14

B) $2.26

C) $2.38

D) $2.50

E) $2.63

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heidee Corp.and Leaudy Corp.have identical assets, sales, interest rates paid on their debt, tax rates, and EBIT.However, Heidee uses more debt than Leaudy.Which of the following statements is CORRECT?

A) Heidee would have the higher net income as shown on the income statement.

B) Without more information, we cannot tell if Heidee or Leaudy would have a higher or lower net income.

C) Heidee would have the lower equity multiplier for use in the DuPont equation.

D) Heidee would have to pay more in income taxes.

E) Heidee would have the lower net income as shown on the income statement.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lincoln Industries' current ratio is 0.5.Considered alone, which of the following actions would increase the company's current ratio?

A) Use cash to reduce long-term bonds outstanding.

B) Borrow using short-term notes payable and use the cash to increase inventories.

C) Use cash to reduce accruals.

D) Use cash to reduce accounts payable.

E) Use cash to reduce short-term notes payable.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its quick ratio?

A) Issue new common stock and use the proceeds to acquire additional fixed assets.

B) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

C) Issue new common stock and use the proceeds to increase inventories.

D) Speed up the collection of receivables and use the cash generated to increase inventories.

E) Use some of its cash to purchase additional inventories.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average, but its profit margin and debt ratio are both below the industry average.Which of the following statements is CORRECT?

A) Its total assets turnover must equal the industry average.

B) Its total assets turnover must be above the industry average.

C) Its return on assets must equal the industry average.

D) Its TIE ratio must be below the industry average.

E) Its total assets turnover must be below the industry average.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lindley Corp.'s stock price at the end of last year was $33.50, and its book value per share was $25.00.What was its market/book ratio?

A) 1.34

B) 1.41

C) 1.48

D) 1.55

E) 1.63

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

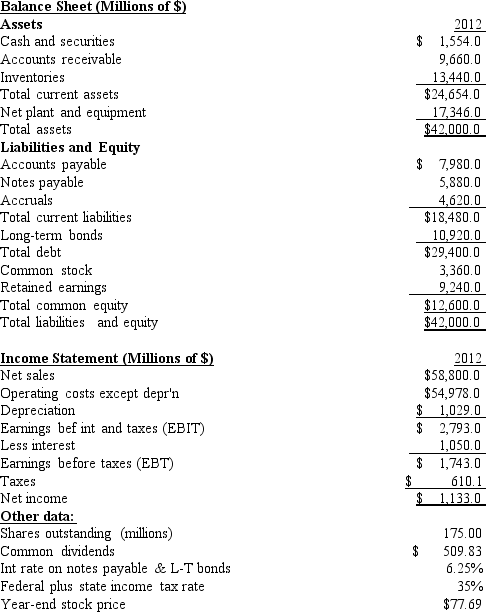

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc.Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's quick ratio?

-Refer to Exhibit 3.1.What is the firm's quick ratio?

A) 0.49

B) 0.61

C) 0.73

D) 0.87

E) 1.05

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's new president wants to strengthen the company's financial position.Which of the following actions would make it financially stronger?

A) Increase inventories while holding sales and cost of goods sold constant.

B) Increase accounts receivable while holding sales constant.

C) Increase EBIT while holding sales constant.

D) Increase accounts payable while holding sales constant.

E) Increase notes payable while holding sales constant.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rappaport Corp.'s sales last year were $320, 000, and its net income after taxes was $23, 000.What was its profit margin on sales?

A) 6.49%

B) 6.83%

C) 7.19%

D) 7.55%

E) 7.92%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%.Under these conditions, the ROE will decrease.

B) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%.Under these conditions, the ROE will increase.

C) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%.Without additional information, we cannot tell what will happen to the ROE.

D) The modified DuPont equation provides information about how operations affect the ROE, but the equation does not include the effects of debt on the ROE.

E) Other things held constant, an increase in the debt ratio will result in an increase in the profit margin on sales.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arshadi Corp.'s sales last year were $52, 000, and its total assets were $22, 000.What was its total assets turnover ratio (TATO) ?

A) 2.03

B) 2.13

C) 2.25

D) 2.36

E) 2.48

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the CEO of a large, diversified, firm were filling out a fitness report on a division manager (i.e., "grading" the manager) , which of the following situations would be likely to cause the manager to receive a better grade? In all cases, assume that other things are held constant.

A) The division's DSO (days' sales outstanding) is 40, whereas the average for its competitors is 30.

B) The division's basic earning power ratio is above the average of other firms in its industry.

C) The division's total assets turnover ratio is below the average for other firms in its industry.

D) The division's debt ratio is above the average for other firms in the industry.

E) The division's inventory turnover is 6, whereas the average for its competitors is 8.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding will decline.

B) If a security analyst saw that a firm's days' sales outstanding (DSO) was higher than the industry average and was also increasing and trending still higher, this would be interpreted as a sign of strength.

C) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding (DSO) will increase.

D) There is no relationship between the days' sales outstanding (DSO) and the average collection period (ACP) .These ratios measure entirely different things.

E) A reduction in accounts receivable would have no effect on the current ratio, but it would lead to an increase in the quick ratio.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal, increasing the debt ratio will increase the ROA.

B) The use of debt financing will tend to lower the basic earning power ratio, other things held constant.

C) A firm that employs financial leverage will have a higher equity multiplier than an otherwise identical firm that has no debt in its capital structure.

D) If two firms have identical sales, interest rates paid, operating costs, and assets, but differ in the way they are financed, the firm with less debt will generally have the higher expected ROE.

E) Holding bonds is better than holding stock for investors because income from bonds is taxed on a more favorable basis than income from stock.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

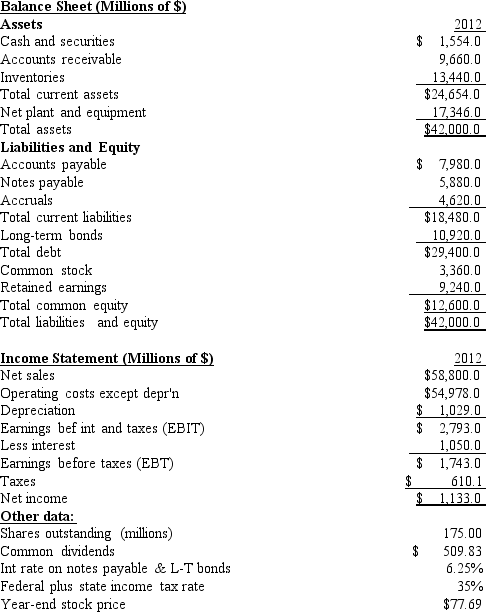

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc.Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's BEP?

-Refer to Exhibit 3.1.What is the firm's BEP?

A) 6.00%

B) 6.32%

C) 6.65%

D) 6.98%

E) 7.33%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy are virtually identical in that they are both profitable, and they have the same total assets (TA) , Sales (S) , return on assets (ROA) , and profit margin (PM) .However, Company Heidee has the higher debt ratio.Which of the following statements is CORRECT?

A) Company Heidee has a lower operating income (EBIT) than Company LD.

B) Company Heidee has a lower total assets turnover than Company Leaudy.

C) Company Heidee has a lower equity multiplier than Company Leaudy.

D) Company Heidee has a higher fixed assets turnover than Company Leaudy.

E) Company Heidee has a higher ROE than Company Leaudy.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 104

Related Exams