A) 1.17

B) 1.23

C) 1.29

D) 1.36

E) 1.43

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

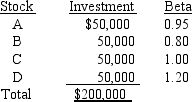

Martin Ortner holds a $200, 000 portfolio consisting of the following stocks:

What is the portfolio's beta?

What is the portfolio's beta?

A) 0.938

B) 0.988

C) 1.037

D) 1.089

E) 1.143

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A portfolio with a large number of randomly selected stocks would have more market risk than a single stock that has a beta of 0.5, assuming that the stock's beta was correctly calculated and is stable.

B) If a stock has a negative beta, its expected return must be negative.

C) A portfolio with a large number of randomly selected stocks would have less market risk than a single stock that has a beta of 0.5.

D) According to the CAPM, stocks with higher standard deviations of returns must also have higher expected returns.

E) If the returns on two stocks are perfectly positively correlated (i.e., the correlation coefficient is +1.0) and these stocks have identical standard deviations, an equally weighted portfolio of the two stocks will have a standard deviation that is less than that of the individual stocks.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain, and most investors are risk averse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.7, whereas Stock B has a beta of 1.3.Portfolio P has 50% invested in both A and B.Which of the following would occur if the market risk premium increased by 1% but the risk-free rate remained constant?

A) The required return on both stocks would increase by 1%.

B) The required return on Portfolio P would remain unchanged.

C) The required return on Stock A would increase by more than 1%, while the return on Stock B would increase by less than 1%.

D) The required return for Stock A would fall, but the required return for Stock B would increase.

E) The required return on Portfolio P would increase by 1%.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate remains constant, but the market risk premium declines.Which of the following is most likely to occur?

A) The required return on a stock with beta > 1.0 will increase.

B) The return on "the market" will remain constant.

C) The return on "the market" will increase.

D) The required return on a stock with beta < 1.0 will decline.

E) The required return on a stock with beta = 1.0 will not change.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A portfolio that consists of 40 stocks that are not highly correlated with "the market" will probably be less risky than a portfolio of 40 stocks that are highly correlated with the market, assuming the stocks all have the same standard deviations.

B) A two-stock portfolio will always have a lower beta than a one-stock portfolio.

C) If portfolios are formed by randomly selecting stocks, a 10-stock portfolio will always have a lower beta than a one-stock portfolio.

D) A stock with an above-average standard deviation must also have an above-average beta.

E) A two-stock portfolio will always have a lower standard deviation than a one-stock portfolio.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Y-axis intercept of the SML represents the required return of a portfolio with a beta of zero, which is the risk-free rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose the returns on two stocks are negatively correlated.One has a beta of 1.2 as determined in a regression analysis using data for the last 5 years, while the other has a beta of -0.6.The returns on the stock with the negative beta must have been negatively correlated with returns on most other stocks during that 5-year period.

B) Suppose you are managing a stock portfolio, and you have information that leads you to believe the stock market is likely to be very strong in the immediate future.That is, you are convinced that the market is about to rise sharply.You should sell your high-beta stocks and buy low-beta stocks in order to take advantage of the expected market move.

C) You think that investor sentiment is about to change, and investors are about to become more risk averse.This suggests that you should re-balance your portfolio to include more high-beta stocks.

D) If the market risk premium remains constant, but the risk-free rate declines, then the required returns on low-beta stocks will rise while those on high-beta stocks will decline.

E) Paid-in-Full Inc.is in the business of collecting past-due accounts for other companies, i.e., it is a collection agency.Paid-in-Full's revenues, profits, and stock price tend to rise during recessions.This suggests that Paid-in-Full Inc.'s beta should be quite high, say 2.0, because it does so much better than most other companies when the economy is weak.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When adding a randomly chosen new stock to an existing portfolio, the higher (or more positive)the degree of correlation between the new stock and stocks already in the portfolio, the less the additional stock will reduce the portfolio's risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Diversifiable risk can be reduced by forming a large portfolio, but normally even highly-diversified portfolios are subject to market (or systematic) risk.

B) A large portfolio of randomly selected stocks will have a standard deviation of returns that is greater than the standard deviation of a 1-stock portfolio if that one stock has a beta less than 1.0.

C) A large portfolio of stocks whose betas are greater than 1.0 will have less market risk than a single stock with a beta = 0.8.

D) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio.

E) A large portfolio of randomly selected stocks will always have a standard deviation of returns that is less than the standard deviation of a portfolio with fewer stocks, regardless of how the stocks in the smaller portfolio are selected.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the market is in equilibrium and that Portfolio AB has 50% invested in Stock A and 50% invested in Stock B.Stock A has an expected return of 10% and a standard deviation of 20%.Stock B has an expected return of 13% and a standard deviation of 30%.The risk-free rate is 5% and the market risk premium, rM - rRF, is 6%.The returns of Stock A and Stock B are independent of one another, i.e., the correlation coefficient between them is zero.Which of the following statements is CORRECT?

A) Since the two stocks have zero correlation, Portfolio AB is riskless.

B) Stock B's beta is 1.0000.

C) Portfolio AB's required return is 11%.

D) Portfolio AB's standard deviation is 25%.

E) Stock A's beta is 0.8333.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you randomly select stocks and add them to your portfolio, which of the following statements best describes what you should expect?

A) Adding more such stocks will increase the portfolio's expected rate of return.

B) Adding more such stocks will reduce the portfolio's beta coefficient and thus its systematic risk.

C) Adding more such stocks will have no effect on the portfolio's risk.

D) Adding more such stocks will reduce the portfolio's market risk but not its unsystematic risk.

E) Adding more such stocks will reduce the portfolio's unsystematic, or diversifiable, risk.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is built on historic conditions, although in most cases we use expected future data in applying it.Because betas used in the CAPM are calculated using expected future data, they are not subject to changes in future volatility.This is one of the strengths of the CAPM.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If investors become less averse to risk, the slope of the Security Market Line (SML)will increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

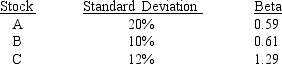

You are considering investing in one of the these three stocks:

If you are a strict risk minimizer, you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio.

If you are a strict risk minimizer, you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio.

A) A; B.

B) B; A.

C) C; A.

D) C; B.

E) A; A.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The realized return on a stock portfolio is the weighted average of the expected returns on the stocks in the portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brodkey Shoes has a beta of 1.30, the T-bill rate is 3.00%, and the T-bond rate is 6.5%.The annual return on the stock market during the past 3 years was 15.00%, but investors expect the annual future stock market return to be 13.00%.Based on the SML, what is the firm's required return?

A) 13.51%

B) 13.86%

C) 14.21%

D) 14.58%

E) 14.95%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

"Risk aversion" implies that investors require higher expected returns on riskier than on less risky securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since the market return represents the expected return on an average stock, the market return reflects a certain amount of risk.As a result, there exists a market risk premium, which is the amount over and above the risk-free rate, that is required to compensate stock investors for assuming an average amount of risk.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 146

Related Exams