A) A conservative financing policy is one where the firm finances part of its fixed assets with short-term capital and all of its net working capital with short-term funds.

B) If a company receives trade credit under terms of 2/10 net 30, this implies that the company has 10 days of free trade credit.

C) One cannot tell if a firm has a conservative, aggressive, or moderate current asset financing policy without an examination of its cash budget.

D) If a firm has a relatively aggressive current asset financing policy vis-á-vis other firms in its industry, then its current ratio will probably be relatively high.

E) Accruals are an expensive but commonly used way to finance working capital.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cash is often referred to as a "non-earning" asset.Thus, one goal of cash management is to minimize the amount of cash necessary for conducting a firm's normal business activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

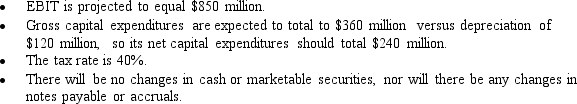

During the coming year, Gold & Gold wants to increase its free cash flow by $180 million, which should result in a higher EVA and stock price.The CFO has made these projections for the upcoming year:

What increase in net working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

What increase in net working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

A) $72

B) $90

C) $108

D) $130

E) $156

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A promissory note is the document signed when a bank loan is executed, and it specifies financial aspects of the loan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freeman Builders, Inc.buys on terms of 2/15, net 30.It does not take discounts, and it typically pays 60 days after the invoice date.Net purchases amount to $720, 000 per year.What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 10.86%

B) 12.07%

C) 13.41%

D) 14.90%

E) 16.55%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive strategy because of the inherent risks associated with using short-term financing.

B) If a company follows a policy of "matching maturities, " this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt.

C) Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased.

D) If a company follows a policy of "matching maturities, " this means that it matches its use of short-term debt with its use of long-term debt.

E) Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm takes actions that reduce its days sales outstanding (DSO), then, other things held constant, this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A revolving credit agreement is a formal line of credit.The firm must generally pay a fee on the unused balance of the committed funds to compensate the bank for the commitment to extend those funds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is

A) used to identify inventory safety stocks.

B) used to slow down the collection of checks our firm writes.

C) used to speed up the collection of checks received.

D) used primarily by firms where currency is used frequently in transactions, such as fast food restaurants, and less frequently by firms that receive payments as checks.

E) used to protect cash, i.e., to keep it from being stolen.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant, if a firm "stretches" (i.e., delays paying)its accounts payable, this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Short-term marketable securities are held for two separate and distinct purposes: (1)to provide liquidity as a substitute for cash and (2)as a non-operating investment.Marketable securities held while awaiting reinvestment are not available for liquidity purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the suppliers of your firm offered you credit terms of 2/10 net 30 days.Your firm is not taking discounts, but is paying after 25 days instead of waiting until Day 30.You point out that the nominal cost of not taking the discount and paying on Day 30 is approximately 37%.But since your firm is neither taking discounts nor paying on the due date, what is the effective annual percentage cost (not the nominal cost) of its costly trade credit, using a 365-day year?

A) 60.3%

B) 63.5%

C) 66.7%

D) 70.0%

E) 73.5%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The aging schedule is a commonly used method for monitoring receivables.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm busy on terms of 2/10 net 30, it should pay as early as possible during the discount period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, which of the following would tend to reduce the cash conversion cycle?

A) Place larger orders for raw materials to take advantage of price breaks.

B) Take all discounts that are offered.

C) Continue to take all discounts that are offered and pay on the net date.

D) Offer longer payment terms to customers.

E) Carry a constant amount of receivables as sales decline.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "spontaneous, " but unfortunately, due to law and economic forces, firms have little control over the level of these accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A conservative current operating asset financing approach will result in permanent current assets and some seasonal current assets being financed using long-term securities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regular monthly cash budget will be misleading.The problem can be corrected by using a daily cash budget.

B) Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales.

C) If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60.

D) If a firm sells on terms of net 90, and if its sales are highly seasonal, with 80% of its sales in September, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August.

E) Depreciation is included in the estimate of cash flows (Cash flow = Net income = Depreciation) ; hence depreciation is set forth on a separate line in the cash budget.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has set up a revolving credit agreement with a bank, the risk to the firm of being unable to obtain funds when needed is lower than if it had an informal line of credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 21.1.If the firm adopts a restricted policy, how much lower would its interest expense be than under the relaxed policy?

A) $8, 418

B) $8, 861

C) $9, 327

D) $9, 818

E) $10, 309

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 138

Related Exams