A) Total costs plus desired profit

B) Desired profit

C) Total selling and administrative expenses plus desired profit

D) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A bottleneck begins when demand for the company's product exceeds the ability to produce the product.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Starling Co. is considering disposing of a machine with a book value of $12,500 and estimated remaining life of five years. The old machine can be sold for $1,500. A new high-speed machine can be purchased at a cost of $25,000. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $26,000 to $23,500 if the new machine is purchased. The total net differential increase or decrease in cost for the new equipment for the entire five years is:

A) decrease of $11,000

B) decrease of $15,000

C) increase of $11,000

D) increase of $15,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

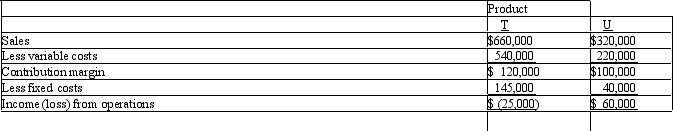

The condensed income statement for a business for the past year is as follows:  Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

Management is considering the discontinuance of the manufacture and sale of Product T at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Product U. What is the amount of change in net income for the current year that will result from the discontinuance of Product T?

A) $120,000 increase

B) $250,000 increase

C) $25,000 decrease

D) $120,000 decrease

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Target costing is arrived at by

A) taking the selling price and subtracting desired profit.

B) taking the selling price and adding desired profit.

C) taking the selling price and subtracting the budget standard cost.

D) taking the budget standard cost and reducing it by 10%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In using the variable cost concept of applying the cost-plus approach to product pricing, fixed manufacturing costs and fixed selling and administrative expenses must be covered by the markup.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discontinuing a product or segment is a huge decision that must be carefully analyzed. Which of the following would be a valid reason not to discontinue an operation?

A) The losses are minimal.

B) The variable costs are less than revenues.

C) The variable costs are more than revenues.

D) The allocated fixed costs are more than revenues.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing provides more accurate and useful cost data than traditional systems.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Swan Company produces their product at a total cost of $43 per unit. Of this amount $8 per unit is selling and administrative costs. The total variable cost is $30 per unit The desired profit is $20 per unit. Determine the mark up percentage on variable cost.

A) 100%

B) 110%

C) 80%

D) 46.5%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

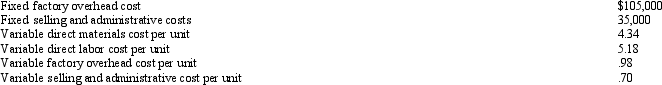

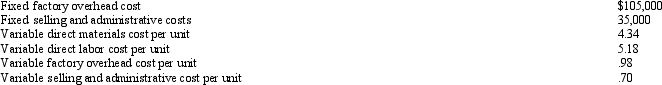

Dotterel Corporation uses the variable cost concept of product pricing. Below is cost information for the production and sale of 35,000 units of its sole product. Dotterel desires a profit equal to a 11.2% rate of return on invested assets of $350,000.  The unit selling price for the company's product is:

The unit selling price for the company's product is:

A) $16.32

B) $13.44

C) $12.10

D) $13.72

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

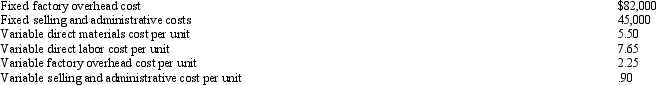

Mallard Corporation uses the product cost concept of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Mallard desires a profit equal to a 12% rate of return on invested assets of $800,000.  The cost per unit for the production of the company's product is:

The cost per unit for the production of the company's product is:

A) $13.15

B) $17.22

C) $15.40

D) $15.75

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dotterel Corporation uses the variable cost concept of product pricing. Below is cost information for the production and sale of 35,000 units of its sole product. Dotterel desires a profit equal to a 11.2% rate of return on invested assets of $350,000.  The dollar amount of desired profit from the production and sale of the company's product is:

The dollar amount of desired profit from the production and sale of the company's product is:

A) $89,600

B) $39,200

C) $70,000

D) $84,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In addition to the differential costs in an equipment replacement decision, the remaining useful life of the old equipment and the estimated life of the new equipment are important considerations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A cost that will not be affected by later decisions is termed a sunk cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Falcon Co. produces a single product. Its normal selling price is $30.00 per unit. The variable costs are $19.00 per unit. Fixed costs are $25,000 for a normal production run of 5,000 units per month. Falcon received a request for a special order that would not interfere with normal sales. The order was for 1,500 units and a special price of $20.00 per unit. Falcon Co. has the capacity to handle the special order and, for this order, a variable selling cost of $1.00 per unit would be eliminated. Should the special order be accepted?

A) Cannot determine from the data given

B) Yes

C) No

D) There would be no difference in accepting or rejecting the special order

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

An unfinished desk is produced for $36.00 and sold for $65.00. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $5.95. Provide a differential analysis for further processing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heston and Burton, CPAs, currently work a five-day week. They estimate that net income for the firm would increase by $75,000 annually if they worked an additional day each month. The cost associated with the decision to continue the practice of a five-day work week is an example of:

A) differential revenue

B) sunk cost

C) differential income

D) opportunity cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The desired selling price for a product will be the same under both variable and total cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is considering a cash outlay of $400,000 for the purchase of land, which it could lease for $40,000 per year. If alternative investments are available which yield a 21% return, the opportunity cost of the purchase of the land is:

A) $84,000

B) $40,000

C) $44,000

D) $ 8,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the product cost concept of applying the cost-plus approach to product pricing, what is included in the markup?

A) Desired profit

B) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

C) Total costs plus desired profit

D) Total selling and administrative expenses plus desired profit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 162

Related Exams