B) False

Correct Answer

verified

Correct Answer

verified

Essay

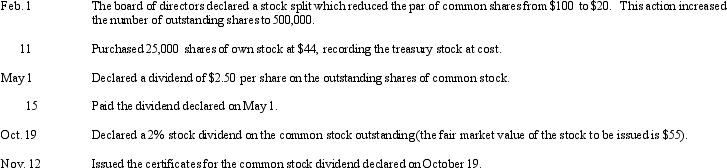

Prepare entries to record the following selected transactions completed during the current fiscal year:

Correct Answer

verified

11ea9439_7175_711a_8ff9_238c36d818a4_TB2013_00_TB2013_00

Correct Answer

verified

Essay

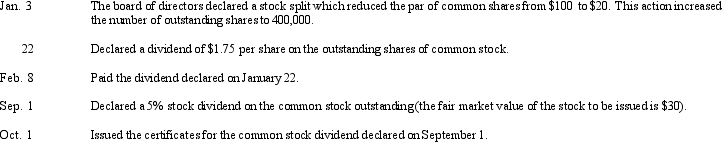

Journalize the following selected transactions completed during the current fiscal year:

Correct Answer

verified

Correct Answer

verified

True/False

While some businesses have been granted charters under state laws, most businesses receive their charters under federal laws.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On May 1, 10,000 shares of $10 par common stock were issued at $30, and on May 7, 5,000 shares of $50 par preferred stock were issued at $111. Journalize the entries for May 1 and May 7.

Correct Answer

verified

Correct Answer

verified

True/False

Cash dividends are normally paid on shares of treasury stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a stock dividend is declared, which of the following accounts is credited?

A) Common Sock

B) Dividend Payable

C) Stock Dividends Distributable

D) Retained Earnings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 60,000 shares of $25 par value stock outstanding that has a current market value of $120. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be:

A) 60,000

B) 10,000

C) 300,000

D) 30,000

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Miriah Inc. has 10,000 shares of 5%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2014. What is the annual dividend on the preferred stock?

A) $50 per share

B) $50,000 in total

C) $10,000 in total

D) $0.50 per share

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On April 1, 10,000 shares of $5 par common stock were issued at $22, and on April 7, 5,000 shares of $50 par preferred stock were issued at $104. Journalize the entries for April 1 and 7.

Correct Answer

verified

Correct Answer

verified

True/False

Under the Internal Revenue Code, corporations are required to pay federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are normally found in a corporation's stockholders' equity section except

A) Common Stock

B) Paid-In Capital in Excess of Par

C) Dividends in Arrears

D) Retained Earnings

F) B) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The excess of sales price of treasury stock over its cost should be credited to

A) Treasury Stock Receivable

B) Premium on Capital Stock

C) Paid-In Capital from Sale of Treasury Stock

D) Income from Sale of Treasury Stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The par value per share of common stock represents

A) the minimum selling price of the stock established by the articles of incorporation.

B) the minimum amount the stockholder will receive when the corporation is liquidated

C) an arbitrary amount established in the articles of incorporation

D) the amount of dividends per share to be received each year

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement below is not a reason for a corporation to buy back its own stock.

A) resale to employees

B) bonus to employees

C) for supporting the market price of the stock

D) to increase the shares outstanding

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nexis Corp. issues 1,000 shares of $15 par value common stock at $22 per share. When the transaction is recorded, credits are made to:

A) Common Stock $15,000 and Paid-in Capital in Excess of Par Value $7,000.

B) Common Stock $22,000 and Retained Earnings $15,000.

C) Common Stock $7,000 and Paid-in Capital in Excess of Stated Value $15,000.

D) Common Stock $22,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under the cost method, when treasury stock is purchased by the corporation, the par value and the price at which the stock was originally issued are important.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If 50,000 shares are authorized, 41,000 shares are issued, and 2,000 shares are reacquired, the number of outstanding shares is 43,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

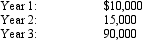

Sabas Company has 20,000 shares of $100 par, 1% non-cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Bayou Corporation was formed on January 1, 20xx, the corporate charter provided for 100,000 share of $10 par value common stock. The following transaction was among those engaged in by the corporation during its first month of operation: The corporation issued 9,000 shares of stock at a price of $23 per share. The entry to record the above transaction would include a

A) debit to Cash for $90,000

B) credit to Common Stock for $207,000

C) credit to Paid in Capital in Excess of Par for $117,000

D) debit to Common Stock for $90,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 165

Related Exams