A) The price of stock one day is about what it was on the previous day.

B) Changes in stock prices cannot be predicted from available information.

C) Stock prices are not determined by market fundamentals such as supply and demand.

D) Prices of stocks of different firms in the same industry show no or little tendency to move together.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the number of corporations in a portfolio from 110 to 120 reduces

A) market risk by more than an increase from 1 to 10.

B) market risk by less than an increase from 1 to 10.

C) firm-specific risk by more than an increase from 1 to 10.

D) firm-specific risk by less than an increase from 1 to 10.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

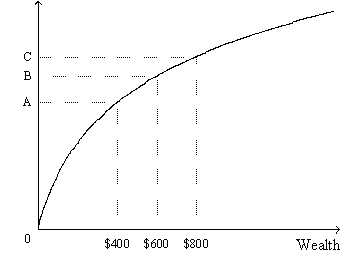

Figure 9-3. The figure shows a utility function for Rob.

-Refer to Figure 9-3. If most people's utility functions look like Rob's utility function, then it is easy to explain why

-Refer to Figure 9-3. If most people's utility functions look like Rob's utility function, then it is easy to explain why

A) people buy various types of insurance.

B) we observe a trade-off between risk and return.

C) most people prefer to hold diversified portfolios of assets to undiversified portfolios of assets.

D) None of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the economist's view of finance and the financial system?

A) The financial system is very important to the functioning of the economy, and the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

B) The financial system, while interesting, is not very important to the functioning of the economy; however, the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

C) The financial system is very important to the functioning of the economy; however, the tools of finance are not particularly helpful to us as individuals since we seldom make decisions for which those tools are useful.

D) The field of finance is intimately concerned with the financial system and the tools of finance, and financial economists see great importance in them; however, the "mainstream" economist sees little value in studying financial markets or the tools of finance.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are better off choosing $400 in 4 years rather than $300 today if the interest rate is

A) lower than about 5.5 percent.

B) higher than about 5.5 percent.

C) lower than about 7.5 percent.

D) higher than about 7.5 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the price of an asset rises above what appears to be its fundamental value, the market is said to be experiencing a speculative bubble.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Braden says that $400 saved for one year at 4 percent interest has a smaller future value than $400 saved for two years at 2 percent interest. Lefty says that the present value of $400 to be received one year from today if the interest rate is 4 percent exceeds the present value of $400 to be received two years from today if the interest rate is 2 percent.

A) Braden and Lefty are both correct.

B) Braden and Lefty are both incorrect.

C) Only Braden is correct.

D) Only Lefty is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dakota rearranges her portfolio so that it has a higher average return. In doing this rearranging, she

A) raised both firm-specific risk and market risk.

B) raised firm-specific risk, but not market risk.

C) raised market risk, but not firm-specific risk.

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Moral hazard is illustrated by people who take greater risks after they purchase insurance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you win a small lottery and you are given the following choice: You can receive (1) an immediate payment of $5,000 or (2) two annual payments, each in the amount of $2,700, with the first payment coming one year from now, and the second payment coming two years from now. You would choose to take the two annual payments if the interest rate is

A) 2 percent, but not if the interest rate is 3 percent.

B) 3 percent, but not if the interest rate is 4 percent.

C) 4 percent, but not if the interest rate is 5 percent.

D) 5 percent, but not if the interest rate is 6 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

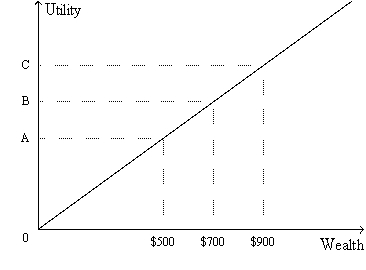

Figure 9-1. The figure shows a utility function.

-Refer to Figure 9-1. The properties exhibited by this utility function help to explain various things we observe in the economy, including

-Refer to Figure 9-1. The properties exhibited by this utility function help to explain various things we observe in the economy, including

A) the risk-return tradeoff.

B) insurance.

C) diversification.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a payment of $500 to be made two years from today is greater if the interest rate is 7% than if it is 6%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If you believe the stock market is informationally efficient, then it is a waste of time to engage in fundamental analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The market for insurance is one example of reducing risk by using diversification.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The future value of $500 saved for two years at an interest rate of 5% is

A) $550.25.

B) $550.00.

C) $551.25.

D) None of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $2,000 to be received two years from today if the interest rate is 5%?

A) $2205

B) $2200

C) $1818.18

D) $1814.06

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $185.71 three years from today equal to $175 today?

A) 2 percent

B) 4 percent

C) 6 percent

D) 8 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cleo promises to pay Jacques $1,000 in two years. If the interest rate is 6 percent, how much is this future payment worth today?

A) $883.60

B) $887.97

C) $890.00

D) None of the above are correct to the nearest cent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A risk-averse person

A) has a utility curve where the slope increases with wealth, and might take a bet with a 70 percent chance of wining $400 and a 30 per chance of losing $400.

B) has a utility curve where the slope increases with wealth, and would never take a bet with a 70 percent chance of wining $400 and a 30 per cent chance of losing $400.

C) has a utility curve where the slope decreases with wealth, and might take a bet with a 70 percent chance of wining $400 and a 30 per chance of losing $400.

D) has a utility curve where the slope decreases with wealth, and would never take a bet with a 70 percent chance of wining $400 and a 30 per cent chance of losing $400.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you put $350 into a bank account today. Interest is paid annually and the annual interest rate is 6 percent. The future value of the $350 after 4 years is

A) $414.09.

B) $434.00.

C) $441.87.

D) $481.24.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 381 - 400 of 419

Related Exams