A) both firm-specific risks and market risk fall.

B) firm-specific risks fall; market risk does not.

C) market risk falls; firm-specific risks do not.

D) neither firm-specific risks nor market risk falls.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions best illustrates adverse selection?

A) A person adds risky stock to his portfolio.

B) A person who has narrowly avoided many accidents applies for automobile insurance.

C) A person is unwilling to buy a stock when she believes its price has an equal chance of rising or falling $10.

D) A person purchases homeowners insurance and then checks his smoke detector batteries less frequently.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following changes would decrease the present value of a future payment?

A) an increase in the size of the payment

B) an increase in the time until the payment is made

C) a decrease in the interest rate

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following pairs of portfolios exemplifies the risk-return tradeoff?

A) For Portfolio A, the average return is 6 percent and the standard deviation is 15 percent; for Portfolio B, the average return is 6 percent and the standard deviation is 25 percent.

B) For Portfolio A, the average return is 5 percent and the standard deviation is 15 percent; for Portfolio B, the average return is 8 percent and the standard deviation is 15 percent.

C) For Portfolio A, the average return is 5 percent and the standard deviation is 25 percent; for Portfolio B, the average return is 8 percent and the standard deviation is 15 percent.

D) For Portfolio A, the average return is 5 percent and the standard deviation is 15 percent; for Portfolio B, the average return is 8 percent and the standard deviation is 25 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient markets hypothesis says that beating the market consistently is

A) impossible. Many studies find that beating the market is, at best, extremely difficult.

B) impossible. Many studies find that beating the market is relatively easy.

C) relatively easy. Many studies find that beating the market is, at best, extremely difficult.

D) relatively easy. Many studies find that beating the market is relatively easy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

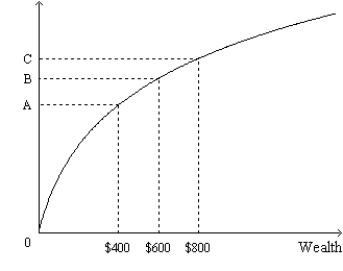

Figure 27-1. The figure shows a utility function.  -Refer to Figure 27-1. The properties exhibited by this utility function help to explain various things we observe in the economy, including

-Refer to Figure 27-1. The properties exhibited by this utility function help to explain various things we observe in the economy, including

A) the risk-return tradeoff.

B) insurance.

C) diversification.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms is used to describe a situation in which the price of an asset rises above what appears to be its fundamental value?

A) "random walk"

B) "random bubble"

C) "speculative bubble"

D) "speculative hedge"

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the interest rate is 4 percent. Which of the following has the greatest present value?

A) $100 today plus $190 one year from today

B) $150 today plus $140 one year from today

C) $200 today plus $90 one year from today

D) $250 today plus $40 one year from today

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is 7.5 percent, then what is the present value of $4,000 to be received in 6 years?

A) $2,420.68

B) $2,591.85

C) $2,996.33

D) $3,040.63

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An asset market is said to experience a speculative bubble when

A) the price of the asset rises above what appears to be its fundamental value.

B) the price of the asset appears to follow a random walk.

C) the market cannot establish an equilibrium price for the asset.

D) the asset is a natural resource and its supply is manipulated by foreign nations and foreign firms.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You could borrow $1,000 today from Bank A and repay the loan, with interest, by paying Bank A $1,060 one year from today. Or, you could borrow $1,500 today from Bank B and repay the loan, with interest, by paying Bank B $1,600 one year from today. Which of the following statements is correct?

A) The interest rate on the loan from Bank A is higher than the interest rate on the loan from Bank B.

B) The interest rate on the loan from Bank A is lower than the interest rate on the loan from Bank B.

C) The interest rates on the two loans are the same.

D) There is not enough information to determine which loan has the higher interest rate.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of $100 to be paid in two years is less than the present value of $100 to be paid in three years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Al, Ralph, and Stan are all intending to retire. Each currently has $1 million in assets. Al will earn 16% interest and retire in two years. Ralph will earn 8% interest and retire in four years. Stan will earn 4% interest and retire in eight years. Who will have the largest sum when he retires?

A) Al

B) Ralph

C) Stan

D) They all retire with the same amount.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a savings account pays 5 percent annual interest, then the rule of 70 tells us that the account value will double in approximately 14 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A measure of the volatility of a variable is its

A) present value.

B) future value.

C) return.

D) standard deviation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The value of a stock depends on the ability of the company to generate dividends and the expected price of the stock when the stockholder sells her shares.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the economist's view of finance and the financial system?

A) The financial system is very important to the functioning of the economy, and the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

B) The financial system, while interesting, is not very important to the functioning of the economy; however, the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

C) The financial system is very important to the functioning of the economy; however, the tools of finance are not particularly helpful to us as individuals since we seldom make decisions for which those tools are useful.

D) The field of finance is intimately concerned with the financial system and the tools of finance, and financial economists see great importance in them; however, the "mainstream" economist sees little value in studying financial markets or the tools of finance.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversifying

A) increases the standard deviation of the value of a portfolio indicating its risk has increased.

B) increases the standard deviation of the value of a portfolio indicating its risk has decreased.

C) decreases the standard deviation of the value of a portfolio indicating its risk has increased.

D) decreases the standard deviation of the value of a portfolio indicating its risk has decreased.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you put $500 into a bank account today. Interest is paid annually and the annual interest rate is 3%. The future value of the $500 in 5 years to the nearest cent is

A) $575.00

B) $578.81

C) $579.64

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three years ago Dawn put $1,200 into an account paying 2 percent interest. How much is Dawn's account worth today?

A) $1,225.38

B) $1,248.48

C) $1,264.72

D) $1,273.45

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 513

Related Exams