A) Investors; regulators

B) Hedgers; speculators

C) Speculators; hedgers

D) Regulators; investors

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company that mines bauxite, an aluminum ore, decides to short aluminum futures. This is an example of ________ to limit its risk.

A) cross-hedging

B) long hedging

C) spreading

D) speculating

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank has made long-term fixed-rate mortgages and has financed them with short-term deposits. To hedge out its interest rate risk, the bank could ________.

A) sell T-bond futures

B) buy T-bond futures

C) buy stock-index futures

D) sell stock-index futures

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current level of the S&P 500 is 1,250. The dividend yield on the S&P 500 is 3%. The risk-free interest rate is 6%. The futures price quote for a contract on the S&P 500 due to expire 6 months from now should be ________.

A) 1,274.33

B) 1,286.95

C) 1,268.61

D) 1,291.29

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following provides the profit to a long position at contract maturity?

A) original futures price − Spot price at maturity

B) spot price at maturity − Original futures price

C) zero

D) basis

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor would want to ________ to hedge a long position in Treasury bonds.

A) buy interest rate futures

B) buy Treasury bonds in the spot market

C) sell interest rate futures

D) sell S&P 500 futures

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A hypothetical futures contract on a nondividend-paying stock with a current spot price of $100 has a maturity of 4 years. If the T-bill rate is 7%, what should the futures price be?

A) $76.29

B) $93.46

C) $107

D) $131.08

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are currently long in a futures contract. You instruct a broker to enter the short side of a futures contract to close your position. This is called ________.

A) a cross-hedge

B) a reversing trade

C) a speculation

D) marking to market

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following provides the profit to a short position at contract maturity?

A) original futures price − Spot price at maturity

B) spot price at maturity − Original futures price

C) zero

D) basis

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the perspective of determining profit and loss, the long futures position most closely resembles a levered investment in a ________.

A) long call

B) short call

C) short stock position

D) long stock position

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A speculator will often prefer to buy a futures contract rather than the underlying asset because: I. Gains in futures contracts can be larger due to leverage. II. Transaction costs in futures are typically lower than those in spot markets. III. Futures markets are often more liquid than the markets of the underlying commodities.

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Margin must be posted by ________.

A) buyers of futures contracts only

B) sellers of futures contracts only

C) both buyers and sellers of futures contracts

D) speculators only

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

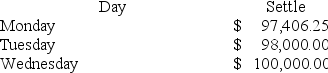

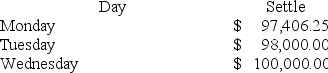

On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer the following questions.

The cumulative rate of return on your investment after Wednesday is a ________.

The cumulative rate of return on your investment after Wednesday is a ________.

A) 79.9% loss

B) 2.6% loss

C) 33% gain

D) 53.9% loss

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only money exchanged by both the long and short at the creation of a futures contract is called the ________.

A) spot price

B) futures price

C) margin

D) collateral

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer the following questions.

At the close of day on Tuesday your cumulative rate of return on your investment is ________.

At the close of day on Tuesday your cumulative rate of return on your investment is ________.

A) 16.2%

B) −5.8%

C) −0.16%

D) −2.2%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the futures market the short position's loss is ________ the long position's gain.

A) greater than

B) less than

C) equal to

D) sometimes less than and sometimes greater than

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CME weather futures contract is an example of ________.

A) a cash-settled contract

B) an agricultural contract

C) a financial future

D) a commodity future

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately ________ of futures contracts result in actual delivery.

A) 0%

B) less than 1% to 3%

C) less than 5% to 15%

D) less than 60% to 80%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today's futures markets are dominated by trading in ________ contracts.

A) metals

B) agriculture

C) financial

D) commodity

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors who take short positions in futures contract agree to ________ delivery of the commodity on the delivery date, and those who take long positions agree to ________ delivery of the commodity.

A) make; make

B) make; take

C) take; make

D) take; take

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams