A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor is bearish on a particular stock and decided to buy a put with a strike price of $25. Ignoring commissions, if the option was purchased for a price of $.85, what is the break-even point for the investor?

A) $24.15

B) $25

C) $25.87

D) $27.86

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why is the holder of an option not required to post margin under the Option Clearing Corporation rules?

A) Once an option is purchased, no further money is at risk.

B) The seller pays all costs.

C) The credit worthiness of the holder covers all potential losses.

D) The holder must post securities instead of margin.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else the same, an American-style option will be ________ valuable than a ________ style option.

A) more; European-

B) less; European-

C) more; Canadian-

D) less; Canadian-

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase one MBI July 125 call contract (equaling 100 shares) for a premium of $5. You hold the option until the expiration date, when MBI stock sells for $123 per share. You will realize a ________ on the investment.

A) $200 profit

B) $200 loss

C) $500 profit

D) $500 loss

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A writer of a call option will want the value of the underlying asset to ________, and a buyer of a put option will want the value of the underlying asset to ________.

A) decrease; decrease

B) decrease; increase

C) increase; decrease

D) increase; increase

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4. Selling a straddle would generate total premium income of ________.

A) $300

B) $400

C) $500

D) $700

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An Asian put option gives its holder the right to ________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

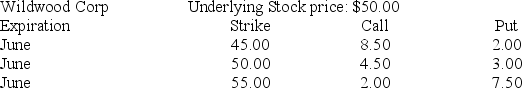

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with calls, you would ________.

To establish a bull money spread with calls, you would ________.

A) buy the 55 call and sell the 45 call

B) buy the 45 call and buy the 55 call

C) buy the 45 call and sell the 55 call

D) sell the 45 call and sell the 55 call

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase one MBI July 90 call contract for a premium of $4. The stock has a 2-for-1 split prior to the expiration date. You hold the option until the expiration date, when MBI stock sells for $48 per share. You will realize a ________ on the investment.

A) $300 profit

B) $100 loss

C) $400 loss

D) $200 profit

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximum loss a buyer of a stock call option can suffer is the ________.

A) call premium

B) stock price

C) stock price minus the value of the call

D) strike price minus the stock price

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Each listed stock option contract gives the holder the right to buy or sell ________ shares of stock.

A) 1

B) 10

C) 100

D) 1,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following strategies makes a profit when the stock price declines and loses money when the stock price increases?

A) long call and short put

B) long call and long put

C) short call and short put

D) short call and long put

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bill Jones inherited 5,000 shares of stock priced at $45 per share. He does not want to sell the stock this year due to tax reasons, but he is concerned that the stock will drop in value before year-end. Bill wants to use a collar to ensure that he minimizes his risk and doesn't incur too much cost in deferring the gain. January call options with a strike of $50 are quoted at a cost of $2, and January puts with a $40 exercise price are quoted at a cost of $3. If Bill establishes the collar and the stock price winds up at $35 in January, Bill's net position value including the option profit or loss and the stock is ________.

A) $195,000

B) $220,000

C) $175,000

D) $215,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the ticker symbol for the CBOE option contract on the S&P 100 Index?

A) SPX

B) DJX

C) CME

D) OEX

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A call option on Brocklehurst Corp. has an exercise price of $30. The current stock price of Brocklehurst Corp. is $32. The call option is ________.

A) at the money

B) in the money

C) out of the money

D) knocked in

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a call option and a put option on General Electric. Both the call option and the put option have the same exercise price and expiration date. This strategy is called a ________.

A) time spread

B) long straddle

C) short straddle

D) money spread

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

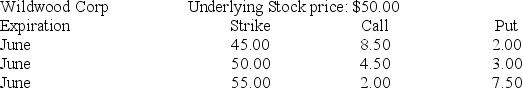

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

A) $1,050

B) $650

C) $400

D) $400 income rather than cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

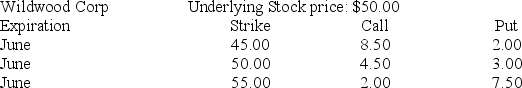

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

If in June the stock price is $53, your net profit on the bull money spread (buy the 45 call and sell the 55 call) would be ________.

If in June the stock price is $53, your net profit on the bull money spread (buy the 45 call and sell the 55 call) would be ________.

A) $300

B) −$400

C) $150

D) $50

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a stock portfolio worth $50,000. You are worried that stock prices may take a dip before you are ready to sell, so you are considering purchasing either at-the-money or out-of-the-money puts. If you decide to purchase the out-of-the-money puts, your maximum loss is ________ than if you buy at-the-money puts and your maximum gain is ________.

A) greater; lower

B) greater; greater

C) lower; greater

D) lower; lower

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 91

Related Exams