A) expected returns to fall; risk premiums to fall

B) expected returns to rise; risk premiums to fall

C) expected returns to rise; risk premiums to rise

D) expected returns to fall; risk premiums to rise

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a well-diversified portfolio, ________ risk is negligible.

A) nondiversifiable

B) market

C) systematic

D) unsystematic

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beta is a measure of ________.

A) total risk

B) relative systematic risk

C) relative nonsystematic risk

D) relative business risk

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research has identified two systematic factors that affect U.S. stock returns. The factors are growth in industrial production and changes in long-term interest rates. Industrial production growth is expected to be 3%, and long-term interest rates are expected to increase by 1%. You are analyzing a stock that has a beta of 1.2 on the industrial production factor and .5 on the interest rate factor. It currently has an expected return of 12%. However, if industrial production actually grows 5% and interest rates drop 2%, what is your best guess of the stock's return?

A) 15.9%

B) 12.9%

C) 13.2%

D) 12%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity is a risk factor that ________.

A) has yet to be accurately measured and incorporated into portfolio management

B) is unaffected by trading mechanisms on various stock exchanges

C) has no effect on the market value of an asset

D) affects bond prices but not stock prices

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most significant conceptual difference between the arbitrage pricing theory (APT) and the capital asset pricing model (CAPM) is that the CAPM ________.

A) places less emphasis on market risk

B) recognizes multiple unsystematic risk factors

C) recognizes only one systematic risk factor

D) recognizes multiple systematic risk factors

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the one-factor APT. The standard deviation of return on a well-diversified portfolio is 20%. The standard deviation on the factor portfolio is 12%. The beta of the well-diversified portfolio is approximately ________.

A) .60

B) 1

C) 1.67

D) 3.20

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

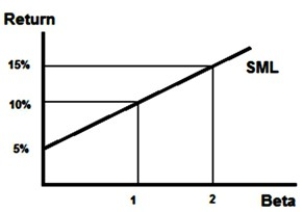

According to the CAPM, the risk premium an investor expects to receive on any stock or portfolio is ________.

A) directly related to the risk aversion of the particular investor

B) inversely related to the risk aversion of the particular investor

C) directly related to the beta of the stock

D) inversely related to the alpha of the stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the CAPM, what is the expected market return given an expected return on a security of 15.8%, a stock beta of 1.2, and a risk-free interest rate of 5%?

A) 5%

B) 9%

C) 13%

D) 14%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the expected return on a stock with a beta of .8, given a risk-free rate of 3.5% and an expected market return of 15.5%?

A) 3.8%

B) 13.1%

C) 15.6%

D) 19.1%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

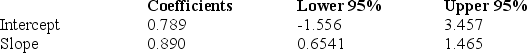

You run a regression of a stock's returns versus a market index and find the following:

Based on the data, you know that the stock ________.

Based on the data, you know that the stock ________.

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to .890

C) has a beta that is likely to be anything between .6541 and 1.465 inclusive

D) has no systematic risk

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compensation of money managers is ________ based on alpha or other appropriate risk-adjusted measures.

A) never

B) rarely

C) almost always

D) always

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The measure of unsystematic risk can be found from an index model as ________.

A) residual standard deviation

B) R-square

C) degrees of freedom

D) sum of squares of the regression

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fama and French claim that after controlling for firm size and the ratio of the firm's book value to market value, beta is: I. Highly significant in predicting future stock returns II. Relatively useless in predicting future stock returns III. A good predictor of the firm's specific risk

A) I only

B) II only

C) I and III only

D) I, II, and III

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk premium for exposure to aluminum commodity prices is 4%, and the firm has a beta relative to aluminum commodity prices of .6. The risk premium for exposure to GDP changes is 6%, and the firm has a beta relative to GDP of 1.2. If the risk-free rate is 4%, what is the expected return on this stock?

A) 10%

B) 11.5%

C) 13.6%

D) 14%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One extensive study found that about ________ of financial managers use CAPM to estimate cost of capital.

A) one-third

B) one-half

C) three quarters

D) ninety percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two-factor model on a stock provides a risk premium for exposure to market risk of 12%, a risk premium for exposure to silver commodity prices of 3.5%, and a risk-free rate of 4%. The beta for exposure to market risk is 1, and the beta for exposure to commodity prices is also 1. What is the expected return on the stock?

A) 11.6%

B) 13%

C) 15.3%

D) 19.5%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When all investors analyze securities in the same way and share the same economic view of the world, we say they have ________.

A) heterogeneous expectations

B) equal risk aversion

C) asymmetric information

D) homogeneous expectations

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the alpha of a portfolio with a beta of 2 and actual return of 15%?

What is the alpha of a portfolio with a beta of 2 and actual return of 15%?

A) 0%

B) 13%

C) 15%

D) 17%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the capital asset pricing model, a security with a ________.

A) negative alpha is considered a good buy

B) positive alpha is considered overpriced

C) positive alpha is considered underpriced

D) zero alpha is considered a good buy

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 89

Related Exams