B) False

Correct Answer

verified

Correct Answer

verified

True/False

Multinational financial management requires that financial analysts consider the effects of changing currency values.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose in the spot market 1 U.S.dollar equals 1.3750 Canadian dollars.6-month Canadian securities have an annualized return of 6% (and thus a 6-month periodic return of 3%) .6-month U.S.securities have an annualized return of 6.5% and a periodic return of 3.25%.If interest rate parity holds,what is the U.S.dollar-Canadian dollar exchange rate in the 180-day forward market? In other words,how many Canadian dollars are required to purchase one U.S.dollar in the 180-day forward market? Do not round the intermediate calculations and round the final answer to four decimal places.

A) 1.1660

B) 1.1385

C) 1.4540

D) 1.3717

E) 1.2345

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose one year ago,Hein Company had inventory in Britain valued at 240,000 pounds.The exchange rate for dollars to pounds was 1£ = 2 U.S.dollars.This year the exchange rate is 1£ = 1.82 U.S.dollars.The inventory in Britain is still valued at 240,000 pounds.What is the U.S.dollar gain or loss in inventory value as a result of the change in exchange rates?

A) -$43,200.00

B) -$48,816.00

C) -$36,288.00

D) -$50,544.00

E) -$32,400.00

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One year ago,a U.S.investor converted dollars to yen and purchased 100 shares of stock in a Japanese company at a price of 3,150 yen per share.The stock's total purchase cost was 315,000 yen.At the time of purchase,in the currency market 1 yen equaled $0.00952.Today,the stock is selling at a price of 3,465 yen per share,and in the currency market $1 equals 145 yen.The stock does not pay a dividend.If the investor were to sell the stock today and convert the proceeds back to dollars,what would be his realized return on his initial dollar investment from holding the stock?

A) -22.14%

B) -20.31%

C) -18.08%

D) -23.77%

E) -22.55%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If one U.S.dollar buys 1.59 Canadian dollars,how many U.S.dollars can you purchase for one Canadian dollar?

A) 0.6667

B) 0.7547

C) 0.5786

D) 0.5346

E) 0.6289

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A currency trader observes the following quotes in the spot market: 1 U.S.dollar =1.34 Japanese yen 1 British pound = 2.25 Swiss francs 1 British pound = 1.65 U.S.dollars Given this information,how many yen can be purchased for 1 Swiss franc? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) 0.8156

B) 1.1301

C) 0.7370

D) 0.8844

E) 0.9827

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Multinational financial management requires that

A) the effects of changing currency values be included in financial analyses.

B) legal and economic differences need not be considered in financial decisions because these differences are insignificant.

C) political risk should be excluded from multinational corporate financial analyses.

D) traditional U.S.and European financial models incorporating the existence of a competitive marketplace not be recast when analyzing projects in other parts of the world.

E) cultural differences need not be accounted for when considering firm goals and employee management.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A box of candy costs 28.80 Swiss francs in Switzerland and $21.80 in the United States.Assuming that purchasing power parity (PPP) holds,how many Swiss francs are required to purchase one U.S.dollar? Do not round the intermediate calculations and round the final answer to four decimal places.

A) 1.0701

B) 1.1097

C) 1.3211

D) 1.6382

E) 1.2286

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stover Corporation,a U.S.based importer,makes a purchase of crystal glassware from a firm in Switzerland for 39,960 Swiss francs,or $24,000,at the spot rate of 1.665 Swiss francs per dollar.The terms of the purchase are net 90 days,and the U.S.firm wants to cover this trade payable with a forward market hedge to eliminate its exchange rate risk.Suppose the firm completes a forward hedge at the 90-day forward rate of 1.682 Swiss francs.If the spot rate in 90 days is actually 1.615 Swiss francs,how much in U.S.dollars will the U.S.firm have saved or lost by hedging its exchange rate exposure? Do not round the intermediate calculations and round the final answer to the nearest cent.

A) $1,212.29

B) $926.47

C) $985.60

D) $965.89

E) $916.61

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1985,a given Japanese imported automobile sold for 1,476,000 yen,or $8,200.If the car still sold for the same amount of yen today but the current exchange rate is 141 yen per dollar,what would the car be selling for today in U.S.dollars?

A) $10,259

B) $12,980

C) $12,562

D) $10,468

E) $11,515

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose 6 months ago a Swiss investor bought a 6-month U.S.Treasury bill at a price of $9,708.74,with a maturity value of $10,000.The exchange rate at that time was 1.441 Swiss francs per dollar.Today,at maturity,the exchange rate is 1.324 Swiss francs per dollar.What is the annualized rate of return to the Swiss investor? Do not round the intermediate calculations and round the final answer to two decimal places.

A) -11.26%

B) -10.73%

C) -9.98%

D) -9.76%

E) -10.83%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Individuals and corporations can buy or sell forward currencies to hedge their exchange rate exposure.Essentially,the process involves simultaneously selling the currency expected to appreciate in value and buying the currency expected to depreciate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that currently,1 British pound equals 1.98 U.S.dollars and 1 U.S.dollar equals 1.25 Swiss francs.How many Swiss francs are needed to purchase 1 pound?

A) 2.1285

B) 2.3760

C) 1.9058

D) 2.5988

E) 2.4750

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

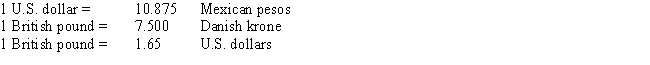

A currency trader observes the following quotes in the spot market:  Given this information,how many Mexican pesos can be purchased for 1 Danish krone?

Given this information,how many Mexican pesos can be purchased for 1 Danish krone?

A) 2.3446

B) 2.0097

C) 2.9188

D) 2.0815

E) 2.3925

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a foreign investor who holds tax-exempt Eurobonds paying 10.50% is considering investing in an equivalent-risk domestic bond in a country with a 28% withholding tax on interest paid to foreigners.If 10.50% after-tax is the investor's required return,what before-tax rate would the domestic bond need to pay to provide the required after-tax return?

A) 15.46%

B) 16.33%

C) 16.92%

D) 12.83%

E) 14.58%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the exchange rate between U.S.dollars and Swiss francs is SF 1.41 = $1.00,and the exchange rate between the U.S.dollar and the euro is $1.00 = 0.70 euro.What is the cross rate of Swiss francs to euros? (In other words,how many Swiss francs are needed to purchase one euro?) Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) 2.2963

B) 2.5179

C) 2.0143

D) 2.0949

E) 1.6316

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If one Swiss franc can purchase $0.85 U.S.dollars,how many Swiss francs can one U.S.dollar buy?

A) 1.0471

B) 1.1765

C) 1.0706

D) 1.3294

E) 1.2706

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Any bond sold outside the country of the borrower is called an international bond.

B) Foreign bonds and Eurobonds are two important types of international bonds.

C) Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold.

D) The term Eurobond applies only to foreign bonds denominated in U.S.currency.

E) A Eurodollar is a U.S.dollar deposited in a bank outside the U.S.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When considering the risk of a foreign investment,a higher risk might arise from exchange rate risk and political risk while lower risk might result from international diversification.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 50

Related Exams