A) -$14,820

B) -$23,180

C) -$19,000

D) -$21,280

E) -$20,520

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Perhaps the most important step when developing forecasted financial statements is to determine the breakdown of common equity between common stock and retained earnings.

B) The first,and perhaps the most critical,step in forecasting financial requirements is to forecast future sales.

C) Forecasted financial statements,as discussed in the text,are used primarily as a part of the managerial compensation program,where management's historical performance is evaluated.

D) The capital intensity ratio gives us an idea of the physical condition of the firm's fixed assets.

E) The AFN equation produces more accurate forecasts than the forecasted financial statement method,especially if fixed assets are lumpy and economies of scale exist.

G) C) and E)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

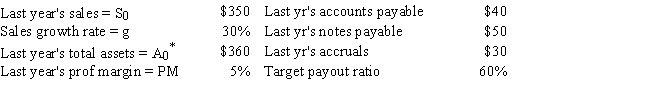

Clayton Industries is planning its operations for next year.Ronnie Clayton,the CEO,wants you to forecast the firm's additional funds needed (AFN) .Data for use in your forecast are shown below.Based on the AFN equation,what is the AFN for the coming year? Dollars are in millions.

A) $67.0

B) $78.7

C) $63.9

D) $77.9

E) $91.1

G) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The term "additional funds needed (AFN) " is generally defined as follows:

A) Funds that are obtained automatically from routine business transactions.

B) Funds that a firm must raise externally from non-spontaneous sources,i.e. ,by borrowing or by selling new stock,to support operations.

C) The amount of assets required per dollar of sales.

D) The amount of internally generated cash in a given year minus the amount of cash needed to acquire the new assets needed to support growth.

E) A forecasting approach in which the forecasted percentage of sales for each balance sheet account is held constant.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a firm's sales grow,its current assets also tend to increase.For instance,as sales increase,the firm's inventories generally increase,and purchases of inventories result in more accounts payable.Thus,spontaneously generated funds arise from transactions brought on by sales increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The sustainable growth rate is the maximum achievable growth rate without the firm having to raise external funds.In other words,it is the growth rate at which the firm's AFN equals zero.

B) If a firm's assets are growing at a positive rate,but its retained earnings are not increasing,then it would be impossible for the firm's AFN to be negative.

C) If a firm increases its dividend payout ratio in anticipation of higher earnings,but sales and earnings actually decrease,then the firm's actual AFN must,mathematically,exceed the previously calculated AFN.

D) Higher sales usually require higher asset levels,and this leads to what we call AFN.However,the AFN will be zero if the firm chooses to retain all of its profits,i.e. ,to have a zero dividend payout ratio.

E) Dividend policy does not affect the requirement for external funds based on the AFN equation.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Errors in the sales forecast can be offset by similar errors in costs and income forecasts.Thus,as long as the errors are not large,sales forecast accuracy is not critical to the firm.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Godinho Corp.had $420 million of sales,and it had $75 million of fixed assets that were being operated at 80% of capacity.In millions,how large could sales have been if the company had operated at full capacity?

A) $551.3

B) $462.0

C) $509.3

D) $656.3

E) $525.0

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When we use the AFN equation,we assume that the ratios of assets and liabilities to sales (A0*/S0 and L0*/S0) vary from year to year in a stable,predictable manner.

B) When fixed assets are added in large,discrete units as a company grows,the assumption of constant ratios is more appropriate than if assets are relatively small and can be added in small increments as sales grow.

C) Firms whose fixed assets are "lumpy" frequently have excess capacity,and this should be accounted for in the financial forecasting process.

D) For a firm that uses lumpy assets,it is impossible to have small increases in sales without expanding fixed assets.

E) Regression techniques cannot be used in situations where excess capacity or economies of scale exist.

G) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Kamath-Meier Corporation's CFO uses this equation,which was developed by regressing inventories on sales over the past 5 years,to forecast inventory requirements: Inventories = $22.0 + 0.125(Sales) .The company expects sales of $275.0 million during the current year,and it expects sales to grow by 30% next year.What is the inventory forecast for next year? All dollars are in millions.

A) $59.4

B) $60.0

C) $54.7

D) $66.7

E) $82.0

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Howton & Howton Worldwide (HHW) is planning its operations for the coming year,and the CEO wants you to forecast the firm's additional funds needed (AFN) .Data for use in the forecast are shown below.However,the CEO is concerned about the impact of a change in the payout ratio from the 10% that was used in the past to 50%,which the firm's investment bankers have recommended.Based on the AFN equation,by how much would the AFN for the coming year change if HHW increased the payout from 10% to the new and higher level? All dollars are in millions.

A) $28.2

B) $33.6

C) $26.9

D) $30.9

E) $25.5

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company expects sales to increase during the coming year,and it is using the AFN equation to forecast the additional capital that it must raise.Which of the following conditions would cause the AFN to increase?

A) The company previously thought its fixed assets were being operated at full capacity,but now it learns that it actually has excess capacity.

B) The company increases its dividend payout ratio.

C) The company begins to pay employees monthly rather than weekly.

D) The company's profit margin increases.

E) The company decides to stop taking discounts on purchased materials.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fairchild Garden Supply expects $700 million of sales this year,and it forecasts a 15% increase for next year.The CFO uses this equation to forecast inventory requirements at different levels of sales: Inventories = $30.2 + 0.25(Sales) .All dollars are in millions.What is the projected inventory turnover ratio for the coming year?

A) 2.78 times

B) 2.82 times

C) 4.35 times

D) 3.79 times

E) 3.48 times

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A typical sales forecast,though concerned with future events,will usually be based on recent historical trends and events as well as on forecasts of economic prospects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital intensity ratio is generally defined as follows:

A) Sales divided by total assets,i.e. ,the total assets turnover ratio.

B) The percentage of liabilities that increase spontaneously as a percentage of sales.

C) The ratio of sales to current assets.

D) The ratio of current assets to sales.

E) The amount of assets required per dollar of sales,or A0*/S0.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Emery Industries had $450 million of sales and $225 million of fixed assets,so its Fixed Assets/Sales ratio was 50%.However,its fixed assets were used at only 65% of capacity.If the company had been able to sell off enough of its fixed assets at book value so that it was operating at full capacity,with sales held constant at $450 million,how much cash (in millions) would it have generated?

A) $66.94

B) $78.75

C) $63.00

D) $74.81

E) $75.60

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Once a firm has defined its purpose,scope,and objectives,it must develop a strategy or strategies for achieving its goals.The statement of corporate strategies sets forth detailed plans rather than broad approaches for achieving a firm's goals.

B) A firm's corporate purpose states the general philosophy of the business and provides managers with specific operational objectives.

C) Operating plans provide management with detailed implementation guidance,consistent with the corporate strategy,to help meet the corporate objectives.These operating plans can be developed for any time horizon,but many companies use a 5-year horizon.

D) A firm's mission statement defines its lines of business and geographic area of operations.

E) The corporate scope is a condensed version of the entire set of strategic plans.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When we use the AFN equation to forecast the additional funds needed (AFN),we are implicitly assuming that all financial ratios are constant.If financial ratios are not constant,regression techniques can be used to improve the financial forecast.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The term "spontaneously generated funds" generally refers to increases in the cash account that result from growth in sales,assuming the firm is operating with a positive profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Handorf-Zhu Inc.had $850 million of sales,and it had $425 million of fixed assets that were used at only 85% of capacity.What is the maximum sales growth rate the company could achieve before it had to increase its fixed assets?

A) 16.94%

B) 17.47%

C) 19.06%

D) 18.88%

E) 17.65%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 39

Related Exams