A) If Mutual Fund A held equal amounts of 100 stocks,each of which had a beta of 1.0,and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0,then the two mutual funds would both have betas of 1.0.Thus,they would be equally risky from an investor's standpoint,assuming the investor's only asset is one or the other of the mutual funds.

B) If investors become more risk averse but rRF does not change,then the required rate of return on high-beta stocks will rise and the required return on low-beta stocks will decline,but the required return on an average-risk stock will not change.

C) An investor who holds just one stock will generally be exposed to more risk than an investor who holds a portfolio of stocks,assuming the stocks are all equally risky.Since the holder of the 1-stock portfolio is exposed to more risk,he or she can expect to earn a higher rate of return to compensate for the greater risk.

D) There is no reason to think that the slope of the yield curve would have any effect on the slope of the SML.

E) Assume that the required rate of return on the market,rM,is given and fixed at 10%.If the yield curve were upward sloping,then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you manage a $10.00 million mutual fund that has a beta of 1.05 and a 9.50% required return.The risk-free rate is 2.20%.You now receive another $8.75 million,which you invest in stocks with an average beta of 0.65.What is the required rate of return on the new portfolio? (Hint: You must first find the market risk premium,then find the new portfolio beta. ) Do not round your intermediate calculations.

A) 7.13%

B) 8.12%

C) 9.59%

D) 7.30%

E) 8.20%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A's beta is 1.5 and Stock B's beta is 0.5.Which of the following statements must be true,assuming the CAPM is correct.

A) Stock A would be a more desirable addition to a portfolio then Stock B.

B) In equilibrium,the expected return on Stock B will be greater than that on Stock A.

C) When held in isolation,Stock A has more risk than Stock B.

D) Stock B would be a more desirable addition to a portfolio than A.

E) In equilibrium,the expected return on Stock A will be greater than that on B.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because of differences in the expected returns on different investments,the standard deviation is not always an adequate measure of risk.However,the coefficient of variation adjusts for differences in expected returns and thus allows investors to make better comparisons of investments' stand-alone risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8 and Stock B has a beta of 1.2.50% of Portfolio P is invested in Stock A and 50% is invested in Stock B.If the market risk premium (rM - rRF) were to increase but the risk-free rate (rRF) remained constant,which of the following would occur?

A) The required return would increase for both stocks but the increase would be greater for Stock B than for Stock A.

B) The required return would decrease by the same amount for both Stock A and Stock B.

C) The required return would increase for Stock A but decrease for Stock B.

D) The required return on Portfolio P would remain unchanged.

E) The required return would increase for Stock B but decrease for Stock A.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

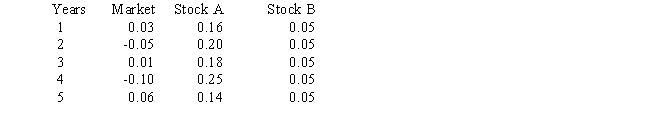

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B.Which of the possible answers best describes the historical betas for A and B?

A) bA > 0;bB = 1.

B) bA > +1;bB = 0.

C) bA = 0;bB = -1.

D) bA < 0;bB = 0.

E) bA < -1;bB = 1.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Most corporations earn returns for their stockholders by acquiring and operating tangible and intangible assets.The relevant risk of each asset should be measured in terms of its effect on the risk of the firm's stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the required rate of return for Climax Inc. ,assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.50,and (5) its realized rate of return has averaged 15.0% over the last 5 years.Do not round your intermediate calculations.

A) 16.77%

B) 20.09%

C) 21.65%

D) 15.80%

E) 19.50%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tom O'Brien has a 2-stock portfolio with a total value of $100,000.$65,000 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.42.What is his portfolio's beta? Do not round your intermediate calculations.Round your final answer to 2 decimal places.

A) 0.94

B) 0.98

C) 0.88

D) 0.90

E) 1.15

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you hold a well-diversified portfolio that has an expected return of 11.0% and a beta of 1.20.You are in the process of buying 1,000 shares of Alpha Corp at $10 a share and adding it to your portfolio.Alpha has an expected return of 22.5% and a beta of 1.20.The total value of your current portfolio is $90,000.What will the expected return and beta on the portfolio be after the purchase of the Alpha stock? Do not round your intermediate calculations.

A) 11.42%;1.04

B) 11.54%;1.26

C) 15.07%;1.33

D) 12.15%;1.20

E) 13.97%;0.97

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Since the market return represents the expected return on an average stock,the market return reflects a certain amount of risk.As a result,there exists a market risk premium,which is the amount over and above the risk-free rate,that is required to compensate stock investors for assuming an average amount of risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain,and most investors are risk averse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe the following information regarding Companies X and Y: -Company X has a higher expected return than Company Y. -Company X has a lower standard deviation of returns than Company Y. -Company X has a higher beta than Company Y. Given this information,which of the following statements is CORRECT?

A) Company X has more diversifiable risk than Company Y.

B) Company X has a lower coefficient of variation than Company Y.

C) Company X has less market risk than Company Y.

D) Company X's returns will be negative when Y's returns are positive.

E) Company X's stock is a better buy than Company Y's stock.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate is 6% and the market risk premium is 5%.Given this information,which of the following statements is CORRECT?

A) An index fund with beta = 1.0 should have a required return of 11%.

B) If a stock has a negative beta,its required return must also be negative.

C) An index fund with beta = 1.0 should have a required return less than 11%.

D) If a stock's beta doubles,its required return must also double.

E) An index fund with beta = 1.0 should have a required return greater than 11%.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In portfolio analysis,we often use ex post (historical)returns and standard deviations,despite the fact that we are really interested in ex ante (future)data.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The slope of the SML is determined by investors' aversion to risk.The greater the average investor's risk aversion,the steeper the SML.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a potential problem when estimating and using betas,i.e. ,which statement is FALSE?

A) The fact that a security or project may not have a past history that can be used as the basis for calculating beta.

B) Sometimes,during a period when the company is undergoing a change such as toward more leverage or riskier assets,the calculated beta will be drastically different from the "true" or "expected future" beta.

C) The beta of an "average stock," or "the market," can change over time,sometimes drastically.

D) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

E) The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns.This calculated historical beta may differ from the beta that exists in the future.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,if the expected inflation rate decreases and investors also become more risk averse,the Security Market Line would be affected as follows:

A) The y-axis intercept would decline,and the slope would increase.

B) The x-axis intercept would decline,and the slope would increase.

C) The y-axis intercept would increase,and the slope would decline.

D) The SML would be affected only if betas changed.

E) Both the y-axis intercept and the slope would increase,leading to higher required returns.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a company against those of the market and found that the slope of your line was negative,the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor,assuming that the observed relationship is expected to continue in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate remains constant,but the market risk premium declines.Which of the following is most likely to occur?

A) The required return on a stock with beta = 1.0 will not change.

B) The required return on a stock with beta > 1.0 will increase.

C) The return on "the market" will remain constant.

D) The return on "the market" will increase.

E) The required return on a stock with a positive beta < 1.0 will decline.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 147

Related Exams