A) 1.46

B) 1.47

C) 1.50

D) 1.13

E) 1.77

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

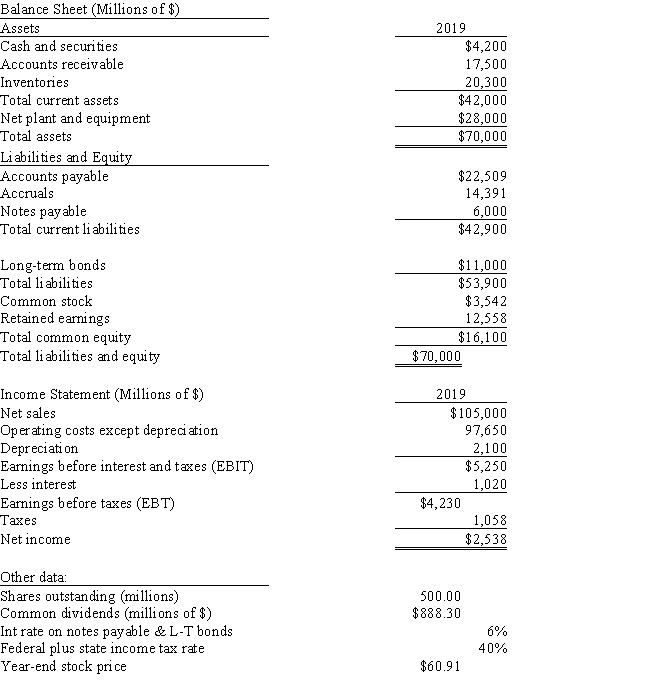

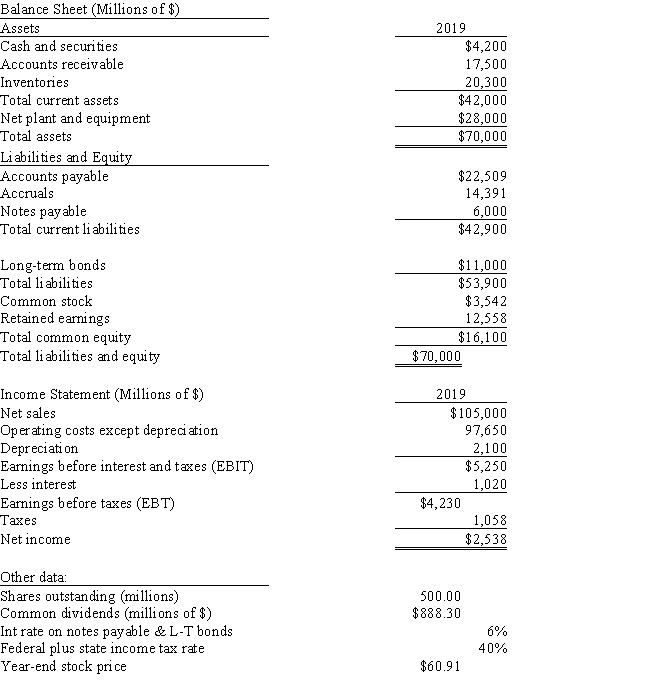

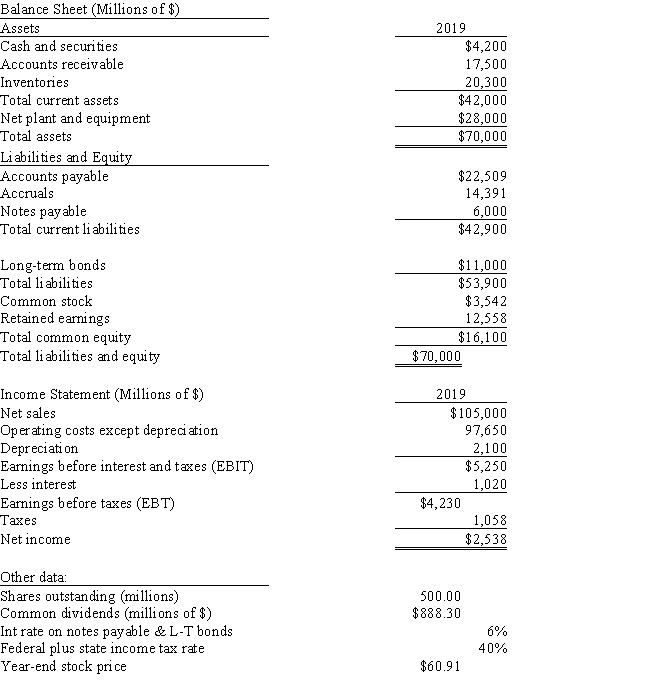

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's return on invested capital?

-Refer to Exhibit 4.1.What is the firm's return on invested capital?

A) 9.52%

B) 7.33%

C) 7.71%

D) 7.23%

E) 7.61%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Royce Corp's sales last year were $280,000,and its net income was $23,000.What was its profit margin?

A) 6.41%

B) 6.98%

C) 8.21%

D) 10.02%

E) 6.57%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Firms X and Y have the same P/E ratios,then their market-to-book ratios must also be equal.

B) If Firms X and Y have the same net income,number of shares outstanding,and price per share,then their P/E ratios must also be the same.

C) If Firms X and Y have the same earnings per share and market-to-book ratio,then they must have the same price/earnings ratio.

D) If Firm X's P/E ratio exceeds that of Firm Y,then Y is likely to be less risky and/or be expected to grow at a faster rate.

E) If Firms X and Y have the same net income,number of shares outstanding,and price per share,then their market-to-book ratios must also be the same.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's BEP? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's BEP? Do not round your intermediate calculations.

A) 7.20%

B) 6.45%

C) 7.50%

D) 9.30%

E) 7.58%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position,holding other things constant?

A) The inventory and total assets turnover ratios both decline.

B) The total debt to total capital ratio increases.

C) The profit margin declines.

D) The times-interest-earned ratio declines.

E) The current and quick ratios both increase.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brookman Inc's latest EPS was $2.75,its book value per share was $22.75,it had 300,000 shares outstanding,and its debt/total invested capital ratio was 44%.The firm finances using only debt and common equity,and its total assets equal total invested capital.How much debt was outstanding? Do not round your intermediate calculations.

A) $6,595,875

B) $5,469,750

C) $5,523,375

D) $5,094,375

E) $5,362,500

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amram Company's current ratio is 2.0.Considered alone,which of the following actions would lower the current ratio?

A) Borrow using short-term notes payable and use the proceeds to reduce accruals.

B) Borrow using short-term notes payable and use the proceeds to reduce long-term debt.

C) Use cash to reduce accruals.

D) Use cash to reduce short-term notes payable.

E) Use cash to reduce accounts payable.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The advantage of the basic earning power ratio (BEP)over the return on total assets for judging a company's operating efficiency is that the BEP does not reflect the effects of debt and taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm has high current and quick ratios,then it must be managing its liquidity position well.

B) If a firm sold some inventory for cash and left the funds in its bank account,then its current ratio would probably not change much,but its quick ratio would decline.

C) If a firm sold some inventory on credit,then its current ratio would probably not change much,but its quick ratio would decline.

D) If a firm sold some inventory on credit as opposed to cash,then there is no reason to think that either its current or quick ratio would change.

E) The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its current assets.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Firms A and B have the same amount of assets,total assets are equal to total invested capital,pay the same interest rate on their debt,have the same basic earning power (BEP),finance with only debt and common equity,and have the same tax rate.However,Firm A has a higher debt to capital ratio.If BEP is greater than the interest rate on debt,Firm A will have a higher ROE as a result of its higher debt ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A reduction in inventories will have no effect on the current ratio.

B) An increase in inventories will have no effect on the current ratio.

C) If a firm increases its sales while holding its inventories constant,then,other things held constant,its inventory turnover ratio will increase.

D) A reduction in the inventory turnover ratio will generally lead to an increase in the ROE.

E) If a firm increases its sales while holding its inventories constant,then,other things held constant,its fixed assets turnover ratio will decline.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ajax Corp's sales last year were $510,000,its operating costs were $362,500,and its interest charges were $12,500.What was the firm's times-interest-earned (TIE) ratio?

A) 11.80

B) 9.32

C) 10.50

D) 14.75

E) 9.56

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The return on invested capital measures the total return that a company has provided for its investors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its quick ratio?

A) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

B) Issue new common stock and use the proceeds to increase inventories.

C) Speed up the collection of receivables and use the cash generated to increase inventories.

D) Use some of its cash to purchase additional inventories.

E) Issue new common stock and use the proceeds to acquire additional fixed assets.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Jandik Corp.had $270,000 of assets (which is equal to its total invested capital) ,$18,750 of net income,and a debt-to-total-capital ratio of 37%.Now suppose the new CFO convinces the president to increase the debt-to-total-capital ratio to 48%.Sales,total assets and total invested capital will not be affected,but interest expenses would increase.However,the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged.By how much would the change in the capital structure improve the ROE? Do not round your intermediate calculations.

A) 2.77%

B) 2.15%

C) 1.87%

D) 2.33%

E) 2.75%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.These ratios include the Price/Earnings,the Market/Book,and Enterprise Value/EBITDA ratios.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's ROE is equal to 9% and its ROA is equal to 6%,its equity multiplier must be 1.5.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's book value per share? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's book value per share? Do not round your intermediate calculations.

A) $36.39

B) $36.71

C) $36.06

D) $32.20

E) $35.10

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duffert Industries has total assets of $1,040,000 and total current liabilities (consisting only of accounts payable and accruals) of $105,000.Duffert finances using only long-term debt and common equity.The interest rate on its debt is 8% and its tax rate is 25%.The firm's basic earning power ratio is 13% and its debt-to capital rate is 40%.What are Duffert's ROE and ROIC? Do not round your intermediate calculations.

A) 6.48%;9.11%

B) 8.37%;9.44%

C) 9.57%;10.52%

D) 9.97%;10.84%

E) 10.67%;12.04%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 133

Related Exams